Hard to believe that Silver hit $50 an ounce in 2011? Even though Silver is off to a good start in 2017 (up near 14%), it remains over 50% below the highs of 6-years ago.

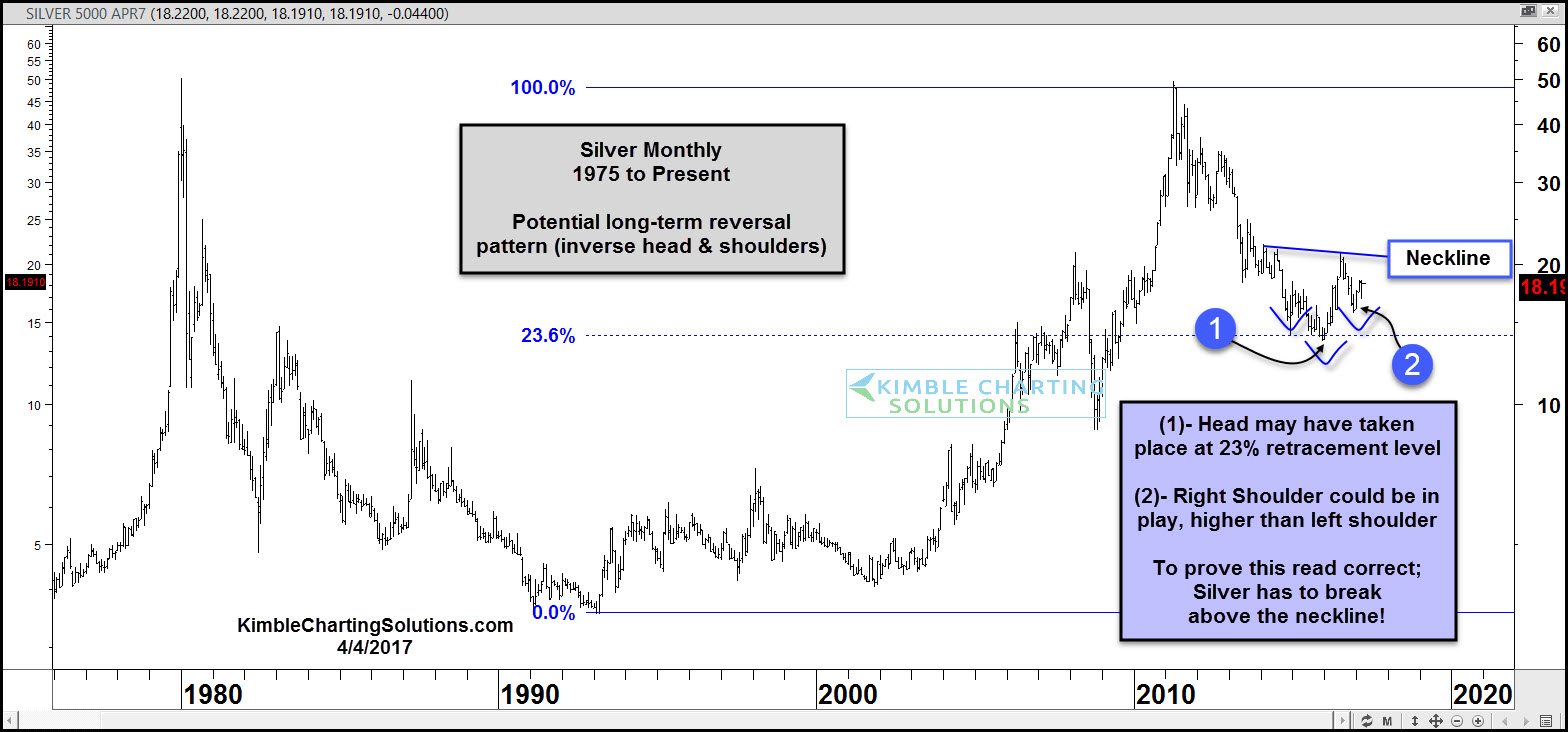

Below looks at Silver on a monthly basis, over the past 40-years.

CLICK ON CHART TO ENLARGE

Silver hit the 1979 highs in 2011 (Double Topped) and then proceed to create a series of lower highs and lower lows. The decline took Silver down to its 23% retracement level of the 1993 lows/2011 highs. It is possible that Silver created the “Head” of a multi-year reversal pattern (inverse head & shoulders) at (1).

If Silver is making a long-term bottoming pattern (inverse head & shoulders), the ideal price action would be; create a right shoulder above the left shoulder, where a rally takes off and breaks above the falling neckline, in the $20 zone. At this time the neckline comes into play as resistance. To prove the read correct, breaking above the neckline is a must!!!

Full Disclosure- Even though Silver has done well in 2017, Premium and Metals members have been playing this sector via GDX & GDXJ. If this read for Silver would happen to be correct, Gold, Silver and Miners should do well.

Not a subscriber to our research products yet? Email us for discount and trial offers to get started

Website: KIMBLECHARTINGSOLUTIONS.COM

Blog: KIMBLECHARTINGSOLUTIONS.COM/BLOG

Get our daily research posts delivered to your inbox here

Questions: Email services@kimblechartingsolutions.com or call us toll free 877-721-7217 international 714-941-9381

0 comments:

Post a Comment