Published here: http://redirect.viglink.com?u=http%3A%2F%2Fwww.zerohedge.com%2Fnews%2F2016-05-24%2Fprecious-metals-fake-rally-ends-hostage-markets-return&key=ddaed8f51db7bb1330a6f6de768a69b8

Written by Jeff Nielson

Back at the beginning of 2009, we had a real rally in the precious metals sector. The price of gold increased by roughly 2 ½ times. Silver led the way, rising more than double that amount. And the precious metals miners soared much higher, leveraging the gains in metals prices – as they must do, in any legitimate rally.

The rally occurred immediately after the Crash of ’08, the manufactured crash at the end of the Big Banks’ previous bubble-and-crash cycle. It occurred after a sharp, ruthless take-down of precious metals prices had established a clear “bottom” in those markets. That rally was terminated in 2011, by the Big Banks, in one of the most-obvious price-capping operations in the history of markets.

What has followed is 5+ years of what has previously been referred to as “Hostage Markets”: markets which were kept in a permanent choke-hold since that date, with prices grinding steadily lower and lower. This brings us to the beginning of 2016.

At the beginning of this year; the price of gold did something which we had not seen for several years: it went up. At the beginning of this year; the mainstream media did something which we had not seen for several years: it began praising gold as an asset class – and announced that “a new rally” had begun. The talking heads proclaimed that the “fundamentals” for gold were now bullish, and thus the price should start to steadily rise.

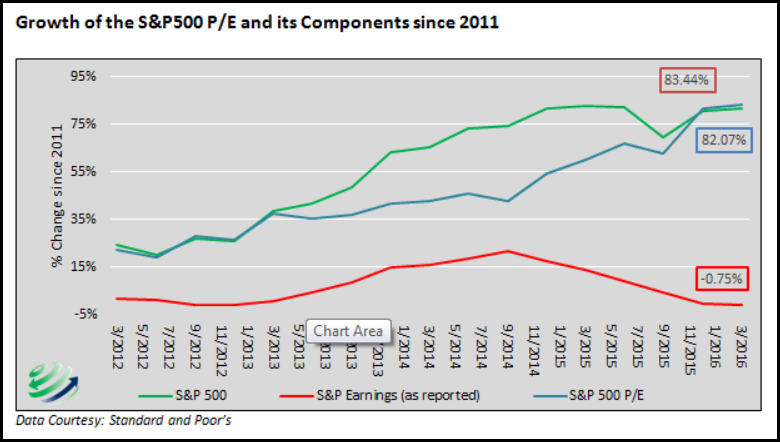

There was never any reason to consider this to be a real, spontaneous rally, and several strong arguments to conclude that this was an upward price-fixing operation of precious metals prices, to set the stage for a larger, general crash, at the end of the current eight-year, bubble-and-crash cycle from the Big Bank crime syndicate.

1) Nothing at all has changed in precious metals markets (except the rhetoric of the mainstream media) versus the last 5+ years.

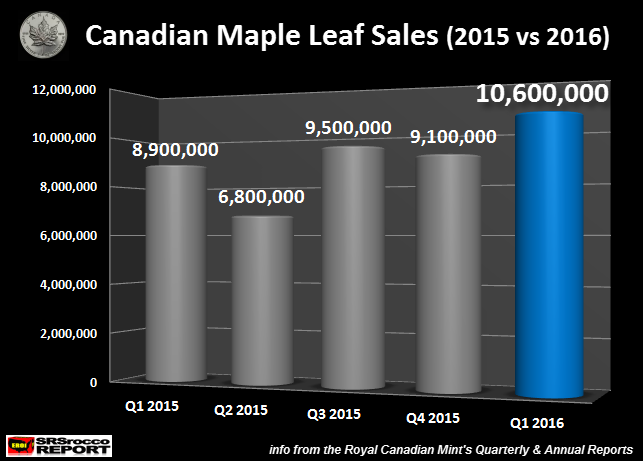

2) Silver has failed to “lead the way”, as it must in any/all legitimate rallies.

3) The Big Banks remain in complete control of all markets.

Taking these reasons in order, mainstream propagandists have proclaimed that precious metals markets are now supported by bullish fundamentals. However, the “fundamentals” for gold and silver have remained equally bullish throughout the 5+ years where we were forced to endure Hostage Markets. In other words, any “reason” that could be made for gold and silver prices to rise now was equally valid, at all times over the past 5+ years.

“Technical analysis” (a pseudo-science with little statistical validity) would argue that the reason we are supposedly seeing a rally in 2016 is because gold and silver have “built a base” over the past 5+ years, and thus are now “ready” for the next leg higher, in their long-term bull market. However, this argument only applies to asset classes which have already risen to fair-market value.

In 2011, even after the large 2+ year rally in these sectors, neither gold nor silver was even close to any fair-market price . As “monetary metals” the primary fundamental of gold and silver is that their prices mustreflect any/all increases in the supply of money (i.e. “inflation”).

When B.S. Bernanke perpetrated his infamous “helicopter drop”, printing U.S. funny-money at an astronomical rate, never before seen in any large economy in modern history, he ultimately quintupled the U.S. monetary base. The price of gold would have had to duplicate this quintupling, as a starting point, before one could even begin to consider this a fair-market price.

At the beginning of the Bernanke helicopter-drop, gold was priced at roughly $800/oz. This meant that the price of gold would have had to rise to at least $4,000/oz (at a minimum) before it would/could be necessary for the market to “build a base” (to support even higher prices).

While the price of silver did rise roughly proportionately in comparison to Federal Reserve funny-money creation, this was only because silver started the rally priced at roughly $8/oz – at a 100:1 price ratio versus gold. As educated readers are aware, the legitimate, long-term price ratio for gold and silver is 15:1, reflecting the natural occurrence of these metals in the Earth's crust. Thus the price of silver would have had to rise to over $50/oz (higher than its 2011 peak) just to be priced rationally versus gold at the start of 2009.

In other words, in order for silver to (rationally) reflect Federal Reserve money-printing and the long-term price ratio versus gold, first the price of silver would have had to rise by a factor of roughly seven (just to be rationally aligned versus the price of gold), and then it would have had to increase by an additional factor of five – to mirror the Federal Reserve's monetary insanity .

This means that the price of silver would have had to rise somewhere above $200/oz (in 2011), before there could be any rational argument that it was priced at fair-market value at that time. Thus, in 2011, when the prices of gold and silver were first capped, and then taken down, there was never any reason for that rally to have ended. The 5+ years of Hostage Markets which we saw with precious metals should have never occurred.

Similarly, at the start of this fake rally, the gold/silver price ratio was at an ultra-absurd level of roughly 80:1, with silver priced at roughly $13/oz (USD). Even if already priced at a correct price ratio, the price of silver would have to lead the price of gold in any legitimate rally because the silver market is much, much smaller. However, at the ultra-compressed price ratio which existed at the beginning of 2016, if a legitimate rally had begun in precious metals markets, the price of silver would have exploded out of the starting blocks – leaving gold well behind in its wake.

Instead, we saw the price of gold “rally” for the first two months of this year, while the price of silver lagged. Understand the arithmetic here. At an 80:1 price ratio, if only 1.5% of the money entering this sector went into silver, the price of silver would have had to rise at a faster rate than gold .

In the real world, the quantity of investment dollars going into silver is roughly parallel to the quantity of dollars going into gold. Had a similar ratio of investor dollars entered the bankers “paper bullion” markets the price of silver would have had to rise roughly 20 times faster/higher than the price of gold during this supposed rally.

The notion, in this “precious metals rally”, that no one was buying silver is patently absurd. The price of silver during most of this fake-rally wasn't merely improbable, it was impossible.

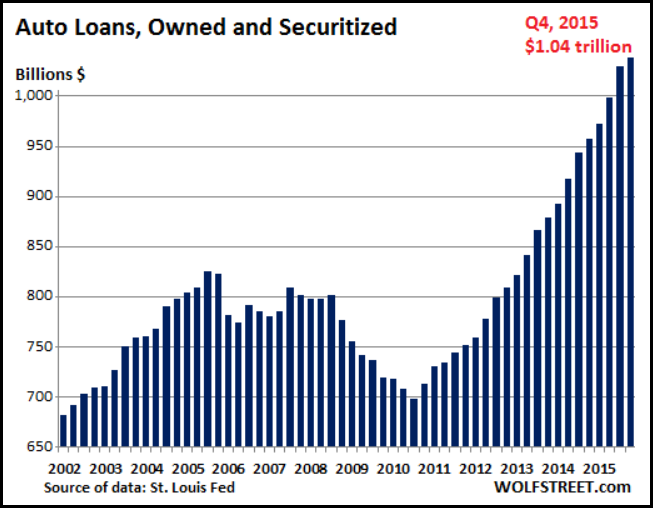

Lastly, the Big Bank crime syndicate remains totally in control of what we call our “markets” (for lack of a better word). Currency prices remain fixed (rigged). Equity market prices remain fixed (rigged). Bond market prices remain fixed (rigged). Are we to believe that the banksters simply 'forgot' to continue their precious metals price-fixing – even as the mainstream media was shouting the word “rally” at the top of its lungs?

Simply, the rise in the price of gold (and muted rise in silver) which has taken place this year could have only occurred with the tacit support – if not overt assistance – of the Big Bank crime syndicate. At the same time, it is common knowledge that the banksters are firmly committed to suppressing precious metals prices, at all times.

...central banks stand ready to lease gold in increasing quantities should the price rise.

– Testimony of Federal Reserve Chairman Alan Greenspan, July 24th 1998

The bankers “stand ready” to suppress the price of gold. Always. Eternally. Thus when we saw precious metals prices start to rise steadily/modestly at the beginning of this year, while the bankers remain in complete control of our markets, it could only have been because they wanted prices to rise.

Why? This question has already been answered . The current eight-year, bubble-and-crash cycle manufactured by the Big Banks is nearing its end. When this Next Crash is detonated, this crime syndicate obviously doesn't want precious metals to stand out as “safe havens” -- as all of their corrupt, paper assets are plunging in value.

The problem: with gold and silver already at rock-bottom prices at the beginning of 2016, it would have been very difficult to crash those markets (along with everything else). Thus the banksters need to march gold and silver prices higher, to some modest level, before they were set up to be crashed along with all other asset classes.

Now, the fake-rally appears to be at its end. This headline has been repeated again and again and again and again in the mainstream media over the past several days.

Gold in Longest Slump since November as Fed Signals Higher Rates

Translation: a Fed-head talked about raising interest rates, and the price of gold fell. It is a headline which could have been copied-and-pasted out of any mainstream publication, any week, during the 5+ years of Hostage Markets.

Now here is the important point. When precious metals began their real rally at the beginning of 2009, the Fed-heads were already promising to raise interest rates then, as well. In fact they were promising much more. The Federal Reserve solemnly promised to fully “normalize” interest rates – quickly and immediately – at the beginning of 2009. Not some token, 0.25% rate increase. Fully normalized interest rates: meaning a benchmark rate of at least 2 – 3%.

Precious metals markets ignored that talk. All through 2009; the Fed-heads “promised” to raise interest rates, and gold and silver prices rose. All through 2010; the Fed-heads “promised” to raise interest rates, and gold and silver prices rose. All through the first 4 months of 2011; the Fed-heads “promised” to raise interest rates, and gold and silver prices rose.

Then, suddenly, after 28 months of the Fed-heads “promising” to raise interest rates, never keeping their promises , and precious metals prices continuing to rise, we had this paradigm suddenly reverse, for no reason. After 28 months of consecutively telling the same lie; suddenly precious metals prices began falling steadily, via nothing more than the same Compulsive Liars telling the same lie – which had previously been completely ignored.

The precedent, over the past eight years, is unequivocal. In a real rally, precious metals prices are not deterred from rising via Compulsive Liars simply repeating the same lie, over and over and over. It is only in the realm of Hostage Markets where (supposedly) these markets “react” to the same lie (and same Liars) which they had previously ignored, for several years.

A Fed-head talks, and precious metals markets fall. Readers are invited to call this paradigm of fraud anything that they want. But the one thing they can't call this is “a rally”.

Please email with any questions about this article or precious metals HERE

Written by Jeff Nielson

This Could Send Silver Prices Soaring

This Could Send Silver Prices Soaring