Published here: http://www.zerohedge.com/news/2016-11-25/gold-down-135-13-days-%E2%80%93-trump-bearish-gold

- Gold down 13% in 13 trading days since Trump election

- Factors that have led to lower gold prices

- Trump bearish for gold in coming four years?

- 'Trumpflation' cometh

- Sharia gold - vaulted gold accessible to 110 million new investors

- What to do? Diversify and geometric price cost average

Donald Trump was elected President and the gold price surged 5%, over $60, from $1,271/oz to $1,336/oz. As many of us had suggested it would. And then something strange happened, something not expected by the majority of market participants - it started to fall, the dollar strengthened.

We now have a gold price that is down 13% since the US election result - from a high of $1,336/oz to a low of $1,177/oz this morning. This is a drop of 13% in just 13 trading days since the election.

Does this mean that Trump and his Presidency isn’t going to be very bullish for gold prices as so many of us predicted? Does this mean that gold is going to underperform or worse, enter a bear market in the next four years?

We don’t think so. Indeed, we see this as extremely unlikely. We outline below just some of the factors that have lead to the recent declines in the gold price, and outline why we don’t think this is a sign of things to come.

US dollar strengthens as Federal rate hike looms

For many in the gold space the miserable gold price is thanks to the expectations that Janet Yellen and co. will decide to hike rates thanks to some mixed data that suggestes a strengthening US jobs market. These were the noises emanating from the recent Federal Reserve Open Markets Committee meeting press release.

The US Dollar has rallied to its highest level since 2005 this week, largely on the back of these Fed expectations. Higher borrowing costs can hurt gold bullion as strategic buyers look at gold in the context of yields and interest payments. Although this is less the case now given ultra loose zero percent and negative interest rate monetary policies.

ETF support gone ... for now

In 2016 gold demand has been supported by stellar ETF demand as, according to the World Gold Council, the high gold price in Q3 had a negative impact on gold demand, elsewhere.

For the SPDR Gold Trust and the iShares Gold Trust combined inflows are worth around $13.6 billion for this year (a record).

Both jewellery and gold bars and coin sales have reached levels this year not seen since 2009. But physical demand has not reflected such levels in Q3. After very significant demand and the price surge in Q1 and Q2, Q3 saw a reduction in demand for jewellery and coins and bars.

Whilst central banks, which have been huge buyers (and therefore supporters) in the physical gold market, have reduced gold reserve diversification to 33% of that in 2015.

“ETPs were the only bright spot during the quarter, with 146t of inflows helping to counterbalance weak demand elsewhere, notably in jewellery (-21%), bars and coins (-36%) and purchases by central banks (-51%).”

But that bright spot has started to dim since the Trump’s victory:

According to ETF.com “in the week since the election, outflows from the SPDR Gold Trust and the iShares Gold Trust totalled $1.7 billion…the aftermath of the elections has clearly dampened enthusiasm for gold among ETF investors.”

Therefore it is unsurprising that a market that has been significantly supported by one investment product is now struggling as the outflows add up.

But the ETF argument raises an interesting point

As the World Gold Council stated in their recent report, much of the activity surrounding gold purchases this year (especially in the area of ETFs) shows strategic buying rather than investment buying.

This was no more clear than on the early hours of the election night on November 9th, as Jim Rickards recently outlined,

“Gold prices surged late on Nov. 8 and into the early morning hours of Nov. 9 as a Trump victory became clear. This was exactly in line with my expectations. Based on sentiment and momentum, gold should have held those gains.

Instead, one of the largest and most visible individual gold investors, Stan Druckenmiller, decided to liquidate his entire gold position in the middle of the night. Druckenmiller told CNBC: “I sold all my gold on the night of the election… All the reasons I have owned it for the last couple of years, it seems to me they may be ending. And by the way, they’re ending globally.”

The move by Druckenmiller saw gold continue to decline in the following days thanks to a change in sentiment. Many sheep like traders adopted a ‘me too’ attitude. Momentum is a powerful thing in markets.

Do the reasons to own gold no longer exist?

In short, no.

In lengthier words, still no. One of the main reasons for the dollar strength and uptick in industrial metals is because Trump is expected to spend, spend, spend his way back to making ‘America Great Again.’ The Donald in the White House means reduced regulation, a fall in corporate taxes and trillions of dollars of fiscal stimulus.

'Trumpflation' cometh.

All of this without any thought to the inflationary effects.

Jim Rickards, explains:

“If the Fed accommodates the deficit with “helicopter money,” inflation will surge. If the Fed leans against the big deficits with rate hikes, this will cause a stronger dollar and lead to a global liquidity crisis in emerging markets.

If bank regulation is eased, banks can be relied upon to leverage up with risky derivatives, which will make the next financial crisis more, not less, likely. Druckenmiller’s stated reasons for selling gold are equivalent to saying, 'I cancelled my fire insurance because now that Trump is president, we won’t have any more fires.' Don’t count on it.”

Druckenmiller is a great investor but like the majority of investors simply does not understand gold's role as a hedging instrument and financial insurance - either through choosing not to or through lack of knowledge.

Both Brexit and the Trump victory have wrong footed the financial markets and we are heading into unchartered territory both politically and economically. Unchartered territory means complex decisions are needed to be made by both governments and investors in order to navigate their way through over the coming years.

Uncertainty will lead to bargain hunting

A lot of uncertainty remains in both the geopolitical and economic arenas.

Conventional wisdom told us that gold would benefit from a Trump win, and in truth we haven’t seen the results of Trump win. This will play out over the next four years, and this is where we expect the precious metal to benefit.

Aside from Trump’s disastrous spending policies and strategic gold buyers dumping the metal for equities, there are some highlights to consider in the next few months.

With each Republican nomination contest we see at least one candidate mention the role of gold in the monetary system. In this recent one, we had a couple and one of them was Donald Trump.

It’s highly unlikely Trump is going to be forcing Janet Yellen to announce a return to the gold standard, but we may well see more discussion about gold’s monetary role.

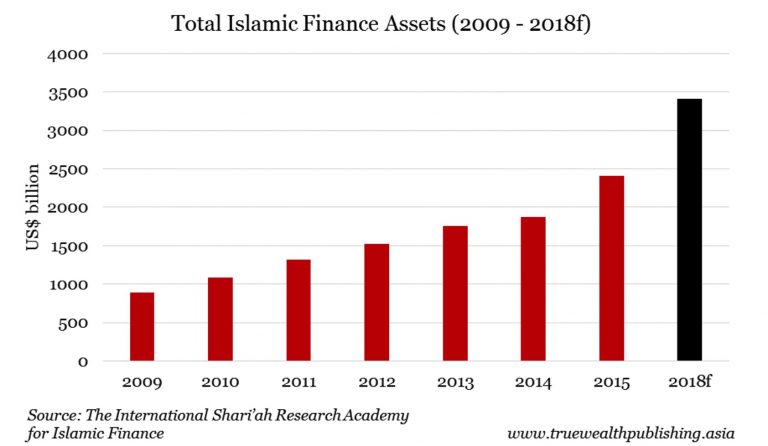

In addition to Trump taking a shine to gold, the gold market is soon to see a significant increase in investors when vaulted gold coins and bars become accessible to over 110 million Muslim investors in Turkey, Pakistan, Malaysia, Indonesia, Bahrain, Qatar, Saudi Arabia and the United Arab Emirates

As we outlined last week, the Sharia Gold Standard or Islamic Gold Standard is set to be announced, this will allow Muslims around the world to invest in physical gold.

The reasons to own gold have not disappeared in the dawn-of Trump. As Rickards says:

“The reasons to own gold are insurance against extreme risk, as a hedge against inflation, and as a sound form of money in a world where central banks are losing control. All of those reasons still apply”

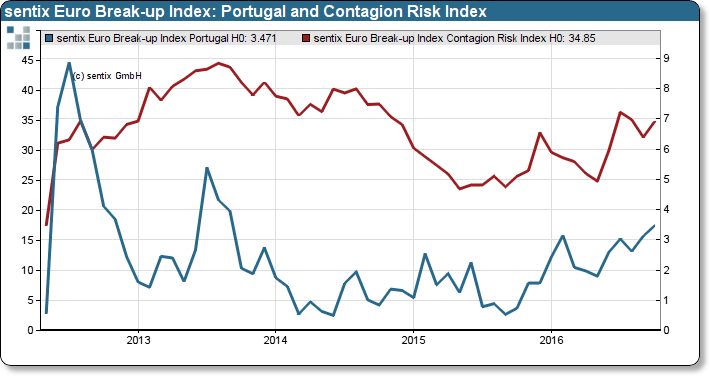

There are also the not inconsiderable risks posed by the Italian referendum on Sunday week, December 4th, and the French general election on April 23, 2017. Both of which have the potential to plunge the Eurozone into a new crisis - a potentially existential one.

Medium and Long Term (2017-2025) 'MSGM' Fundamentals

The long term case for having an allocation to precious metals is due to the still positive fundamentals:

- Macroeconomic risk is high as there is a serious risk of recessions in major industrial nations with negative data emanating from the debt laden Eurozone, Japan and China. Even the recoveries in the UK and the U.S. are tentative at best. Issues with banks, a la Lehman or Deutsche, or a major terrorist incident or another war could badly impact fragile consumer and investor sentiment.

- Systemic risk remains high as little of the problems in the banking system have been addressed. There remains the risk of another ‘Lehman Brothers’ moment or a new ‘Grexit’ moment and seizing up of the global financial system. The massive risk from the unregulated “shadow banking system” continues to be significantly underappreciated. There are many potential Lehman Brothers out there both in the Eurozone with Deutsche Bank looking very vulnerable.

- Geopolitical risk remains elevated – and Trump's election seems likely to exacerbate these risks. This is seen in the continuing significant tensions in Lebanon, Syria etc and between Iran and Israel. There is the real risk of conflict and the consequent effect on oil prices and the global economy. While tensions with Russia may subside with the Trump election, tensions with Iran and other Muslim nations look set to worsen.Indeed Trump's trade and economic policies have the potential to create significant tensions even with major trading partners in the EU and with China.

- Monetary risk is high as the policy response of the Federal Reserve, the ECB, the Bank of England, the BOJ and the majority of central banks to the risks mentioned above continues to be ultra-loose monetary policies, zero interest rate policies (ZIRP), negative interest rate policies (NIRP), the printing and electronic creation of a tsunami of currency and the debasement of paper and electronic currencies.Should the macroeconomic, systemic and geopolitical risks increase even further in the coming months, then the central banks’ response will likely again be more cheap money policies. This will lead to further currency debasement and there is a risk of currency wars deepening.

Given these real risks, investors should use this latest correction to diversify into physical gold.

There is a strong case for having higher allocations to physical gold today, of as much as 25% of a portfolio, given the risks above. We advise owning physical gold as gold ETFs have significant levels of legal indemnifications and various forms of force majeures that exposes investors to unnecessary risks with little recourse.

Hence the importance of physical, allocated and segregated gold “outside the banking system.”

Those seeking to allocate funds to precious metals should geometrically price cost average into position by front loading their initial allocation and allocating as much of 50% of their allocation to gold on the first transaction.

This latest bout of weakness will allow value buyers to accumulate physical on the dip.

Gold and Silver Bullion - News and Commentary

Gold hits 9-1/2-month low on firm dollar; set for third weekly loss (Reuters.com)

Gold futures fall further below $1,200 mark (MarketWatch.com)

Gold edges lower on dollar and U.S. rate prospects (Reuters.com)

Potential gold-import ban by India could be biggest bombshell since Nixon (MarketWatch.com)

Mastercard, Visa Set to Reap Spoils of India’s War on Cash (Bloomberg.com)

- $6 billion 'puke' sends gold plunging below $1200. Source Zero Hedge

Trump's Victory: What Does it Mean for Gold? (TocqueVille.com)

ECB Warns There Is "Significant Risk Of Abrupt Market Reversal" (ZeroHedge.com)

$6 Billion Puke Sends Gold Plunging Below $1200 As Dollar Index, Bond Yields Spike (ZeroHedge.com)

Chart of the week: “shrinkflation” hits the chocolate market (MoneyWeek.com)

Gold: valuable reserve amid unprecedented policy environment (Gold.org)

Gold Prices (LBMA AM)

25 Nov: USD 1,187.50, GBP 995.33 & EUR 1,121.83 per ounce

24 Nov: USD 1,187.25, GBP 995.36 & EUR 1,125.04 per ounce

23 Nov: USD 1,213.25, GBP 998.00 & EUR 1,143.00 per ounce

22 Nov: USD 1,217.55, GBP 997.89 & EUR 1,144.98 per ounce

21 Nov: USD 1,214.95, GBP 984.72 & EUR 1,143.39 per ounce

18 Nov: USD 1,206.10, GBP 971.15 & EUR 1,135.54 per ounce

17 Nov: USD 1,232.00, GBP 988.19 & EUR 1,148.10 per ounce

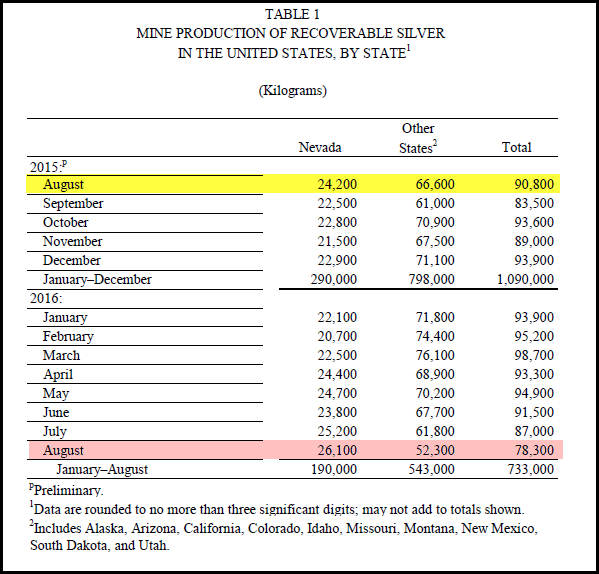

Silver Prices (LBMA)

25 Nov: USD 16.47, GBP 13.21 & EUR 15.55 per ounce

24 Nov: USD 16.31, GBP 13.09 & EUR 15.43 per ounce

23 Nov: USD 16.56, GBP 13.36 & EUR 15.59 per ounce

22 Nov: USD 16.76, GBP 13.46 & EUR 15.77 per ounce

21 Nov: USD 16.68, GBP 13.47 & EUR 15.69 per ounce

18 Nov: USD 16.51, GBP 13.30 & EUR 15.54 per ounce

17 Nov: USD 17.04, GBP 13.65 & EUR 15.87 per ounce

Recent Market Updates

- War On Cash Just Got Real – India and Citibank In Australia

- Russia Gold Buying In October Is Biggest Monthly Allocation Since 1998

- Stocks, Bonds, Pension Funds “Will Be Wiped Out…” – Rickards

- Physical Gold Is A “Long-Term Position” as “Hedge Against Governments”

- Gold Sell Off On Fed Noise – “Interesting Times” To “Support Gold”

- Islamic Gold – Vital New Dynamic In Physical Gold Market

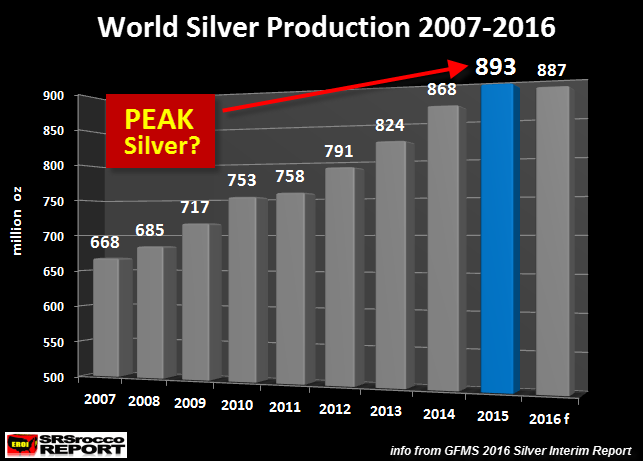

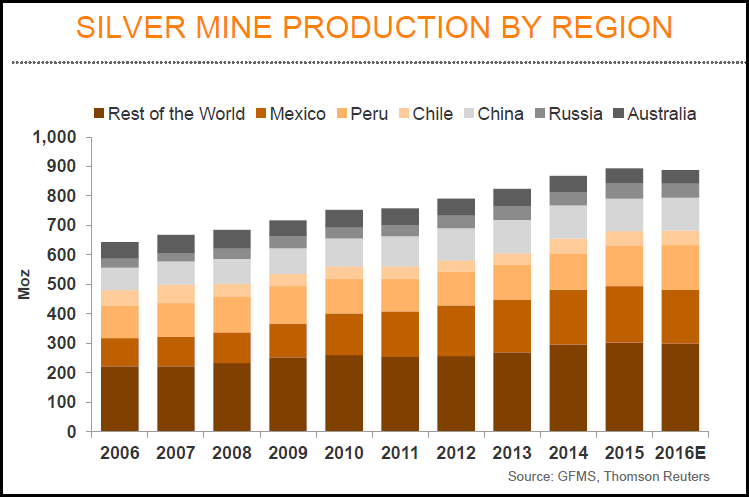

- Peak Gold Globally – “Bullish For Gold”

- Gold Price Should Go Higher On Global Risks and Trump – Capital Economics

- President Trump – Why Market Loves Him and Experts Wrong

- ‘Helicopter Money President’ Trump To Create Inflation and Gold Will Rise

- Central Bank Gold Demand continues in Q3

- Trump Victory Sends Gold Surging 5%

- An uncertain election outcome looks good for gold

Bail-ins can now be used in the UK, EU, U.S. and G20 countries. Banks internationally and especially in Europe remain vulnerable.

Bail-ins can now be used in the UK, EU, U.S. and G20 countries. Banks internationally and especially in Europe remain vulnerable.

Silver Maples 2016 (1 oz)

Silver Maples 2016 (1 oz)

(Copyright The Financial Times Limited 2016)

(Copyright The Financial Times Limited 2016)