Pensions Timebomb - Pensions "Are Going To Be A National Crisis"

- America’s underfunded pension system is “not a distant concern but a system already in crisis”...

- Tax may explode as governments seek to bail out insolvent pension plans

- Illinois, California, New Jersey, Connecticut, Massachusetts, Kentucky and eight other states vulnerable

- The simple mathematical mismatch at the heart of the pension crisis...

- Why the pension crisis really is “America’s silent crisis”...

- Pensions timebomb confronts Ireland, UK and most EU countries

By Brian Maher, Managing editor, The Daily Reckoning

"This is going to be a national crisis..."

“This” being America’s woefully underfunded pension liabilities, according to Karen Friedman. She’s the executive vice president of the Pension Rights Center.

(A place called the Pension Rights Center does in fact exist. We checked.)

MarketWatch columnist Jeff Reeves howls in confirmation that “collapsing pensions will fuel America’s next financial crisis.”

“This is not a distant concern,” warns he, “but a system already in crisis.”

According to data supplied by the Federal Reserve, pensions — public and private combined — were roughly 27% underfunded at the end of last year.

By some estimates, America’s public pensions alone are sunk in a $6 trillion abyss.

The issue, approached from any direction, is an impossible knot… a tar pit… a minotaur’s maze of blind alleys and dead ends.

How has the American pension come to such an estate?

Most public pension systems were built upon the sunny assumption that their investments will yield a handsome 7.5% annual return.

But consider…

The average public pension plan returned just 1.5% last year.

Last year marked the second consecutive year that plans undershot the 7.5% return rate, according to Governing magazine.

The same plans worked an average gain of 2–4% in 2015.

A highly technical term describes the foregoing if it goes on long enough... and we apologize if it sends you to the dictionary:

Insolvency.

Briefly turn your attention to the Golden State, for example. California.

State pensions are only in funds to meet 65% of their promised benefits.

And California pins its hopes on that golden annual 7.5% return to make the shortage good.

But it’s in a devil of a fine fix if the average public pension plan only returns 1.5%.

The math is the math.

California essentially depends on returns 400% above the norm, according to financial analyst Larry Edelson.

But California is by no means alone.

We won’t run the entire roll call of shame.

But the great state of Illinois, for one, risks sinking into a $130 billion "death spiral" from its unfunded pension liabilities, as Ted Dabrowski of the Illinois Policy Institute described it.

S&P Global Ratings has even threatened to downgrade the state's credit score to "junk" status.

New Jersey, Connecticut, Massachusetts and Kentucky are also among the worst deadbeats.

But the problems run from ocean to ocean and south to north.

A report from Moody’s reads thus:

For many states and municipalities, exposure to unfunded pension liabilities is already at or near all-time highs. Since cost burdens are already expected to further increase, pension fund investment performance is critical for the credit quality of many governments.

Not even a "best case" cumulative 25% investment return on public pension plans would stanch the blood flow, according to Moody’s.

They say that best-case 25% would merely reduce pension liabilities a slender 1% through 2019 due to weak contributions and poor past investment returns.

“But I don’t have a pension,” comes your response. “This doesn’t concern me.”

Ah, but have another guess — at least if you swear off your taxes in these United States.

Is it your belief that governments will let their prized public pension plans flop?

There are votes to consider, after all.

Jilted pensioners are capable of generating a good deal of hullabaloo, hullabaloo to which the official ear is exquisitely attuned.

Besides, do you think kind Uncle Samuel will turn the politically strategic states of California and Illinois out on their ears?

As our resident income specialist Zach Scheidt argues:

Your tax bill could explode as governments around the country seek to bail out insolvent pension plans. And you know how much politicians like to use your tax money to bail out some constituent. They like to prove their “compassion” with your money!

“Expect to pay higher state and local taxes for fewer services in the years to come,” adds Larry Edelson, before mentioned.

And:

“Don’t be surprised if authorities of all shapes and sizes — from local governments to national agencies — up the ante to get ahold of your assets any way they can.”

We would have to agree. You shouldn’t be surprised in the least.

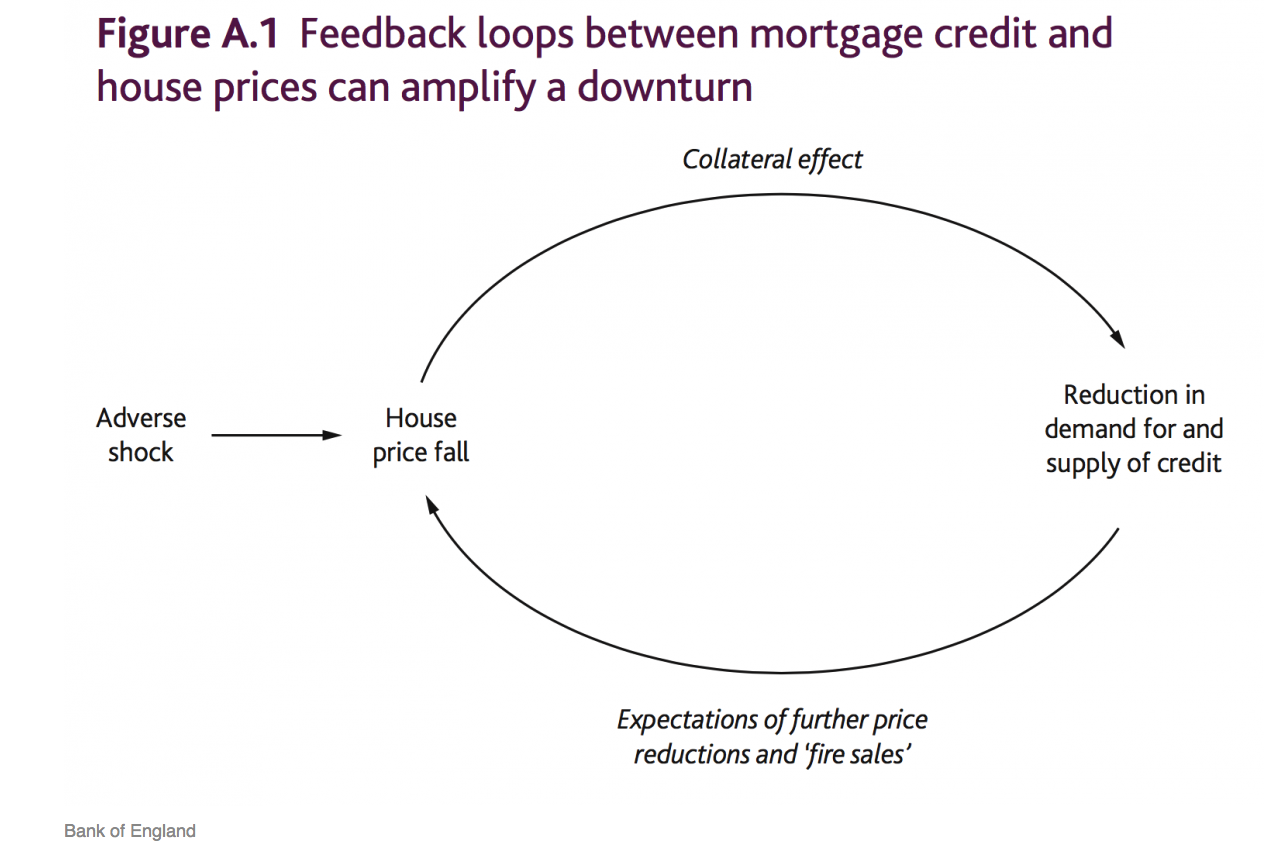

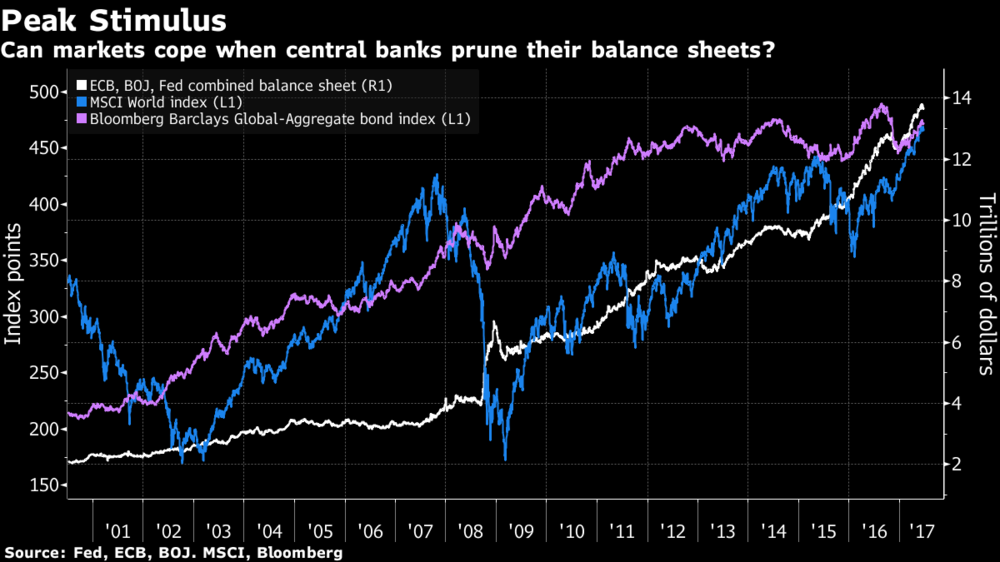

And we can scarcely imagine the holy hell that would follow another financial crisis.

Illinois Gov. Bruce Rauner warns the state’s pension crisis is driving his beloved Land of Lincoln into "banana republic" territory.

But we suspect the good governor’s mouth ran away with him here...

Can you imagine comparing the venerable, eminently worthy banana republic... to Illinois?

The pension crisis is truly “America’s silent crisis” and indeed the world's silent crisis.

From The Daily Reckoning newsletter

85% of Pension Funds Will Go Bust Within 30 Years

Pensions Timebomb in “Slow Motion Detonation” In U.S., EU and Internationally

Investing in Gold In Your Individual Retirement Account (IRA)

News and Commentary

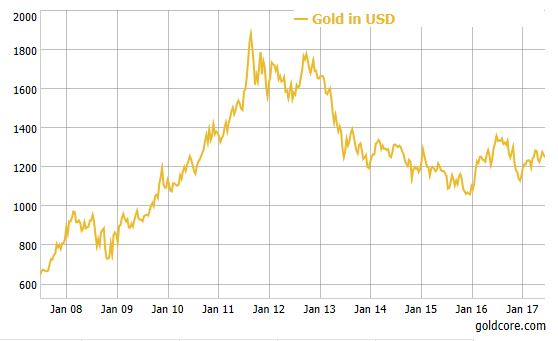

Gold steady on easing dollar, stocks amid hawkish central banks (Reuters)

Technology Shares Lead Stock Rebound; Oil Gains: Markets Wrap (Bloomberg)

Nikkei dives under 20,000 as Asian markets sharply pull back (Marketwatch)

Tech Spoils Bank Party as Stocks, Dollar Slide: Markets Wrap (Bloomberg)

The Yellowstone Supervolcano Has Just Seen 878 Earthquakes in Two Weeks (Science Alert)

Source: Cape Shiller via ZeroHedge

Robert Shiller: "The Index I Invented Is At Levels Last Seen In 1929 And 2000" (Zerohedge)

How owning a home in Britain became a luxury (Moneyweek)

Petrodollar wars - Gold in your custody cannot be hacked, erased, or frozen (Zerohedge)

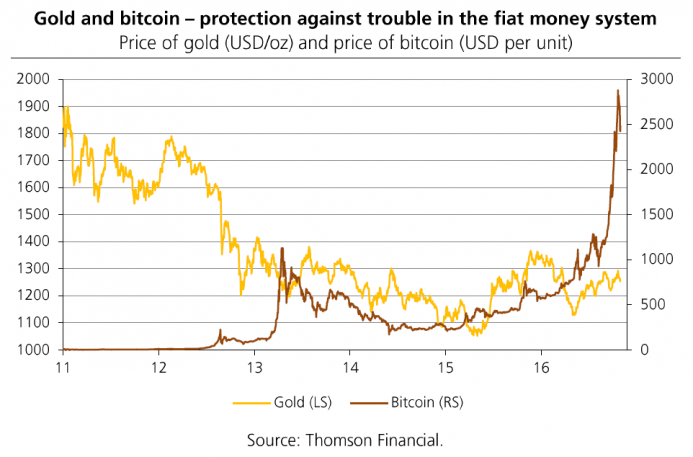

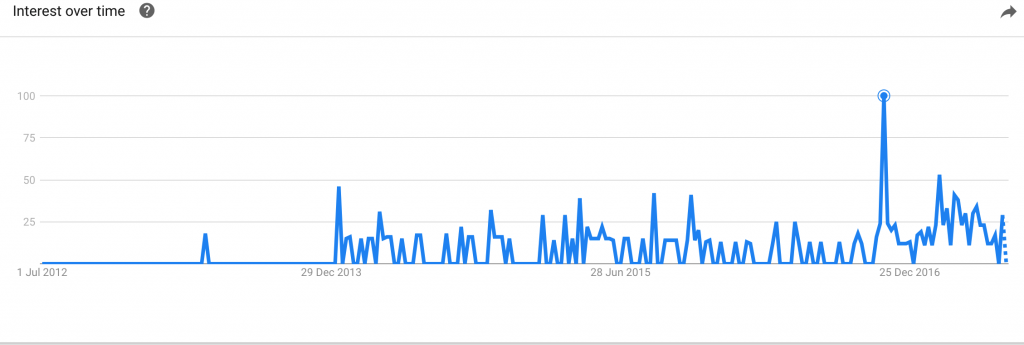

Should you own bitcoin or gold? That’s easy (SCH)

Lessons from ten of the greatest trades of all time (Moneyweek)

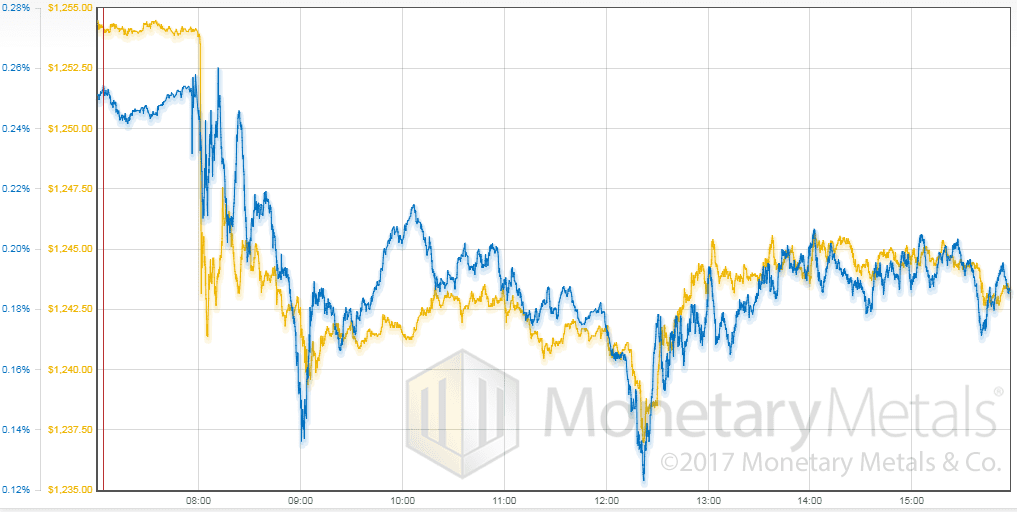

Gold Prices (LBMA AM)

30 Jun: USD 1,243.25, GBP 957.43 & EUR 1,090.83 per ounce

29 Jun: USD 1,246.60, GBP 959.88 & EUR 1,093.14 per ounce

28 Jun: USD 1,251.60, GBP 976.25 & EUR 1,101.91 per ounce

27 Jun: USD 1,250.40, GBP 980.31 & EUR 1,111.36 per ounce

26 Jun: USD 1,240.85, GBP 975.56 & EUR 1,109.32 per ounce

23 Jun: USD 1,256.30, GBP 987.70 & EUR 1,125.27 per ounce

22 Jun: USD 1,251.40, GBP 988.36 & EUR 1,120.13 per ounce

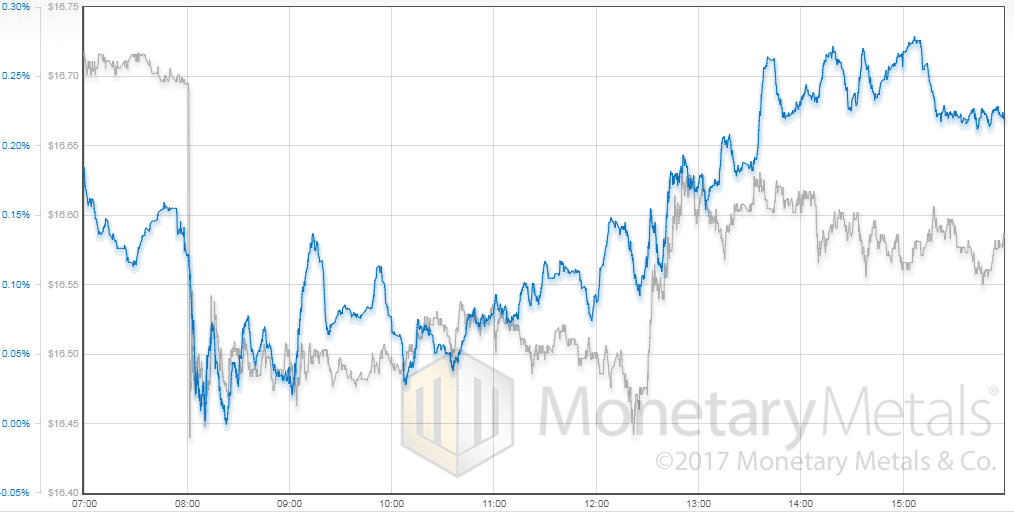

Silver Prices (LBMA)

Silver Prices (LBMA)

30 Jun: USD 16.47, GBP 12.69 & EUR 14.44 per ounce

29 Jun: USD 16.83, GBP 12.98 & EUR 14.76 per ounce

28 Jun: USD 16.78, GBP 13.08 & EUR 14.78 per ounce

27 Jun: USD 16.66, GBP 13.07 & EUR 14.79 per ounce

26 Jun: USD 16.53, GBP 12.98 & EUR 14.79 per ounce

23 Jun: USD 16.71, GBP 13.12 & EUR 14.97 per ounce

22 Jun: USD 16.58, GBP 13.09 & EUR 14.85 per ounce

Recent Market Updates

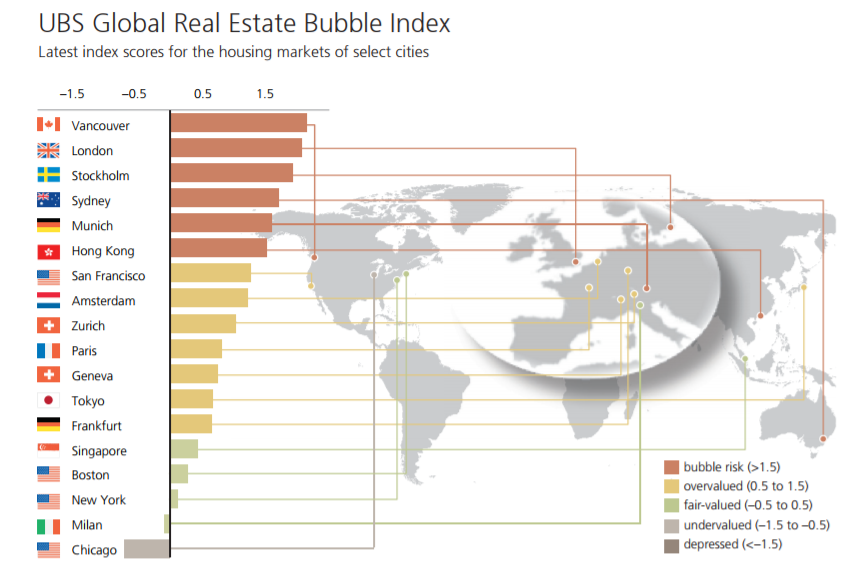

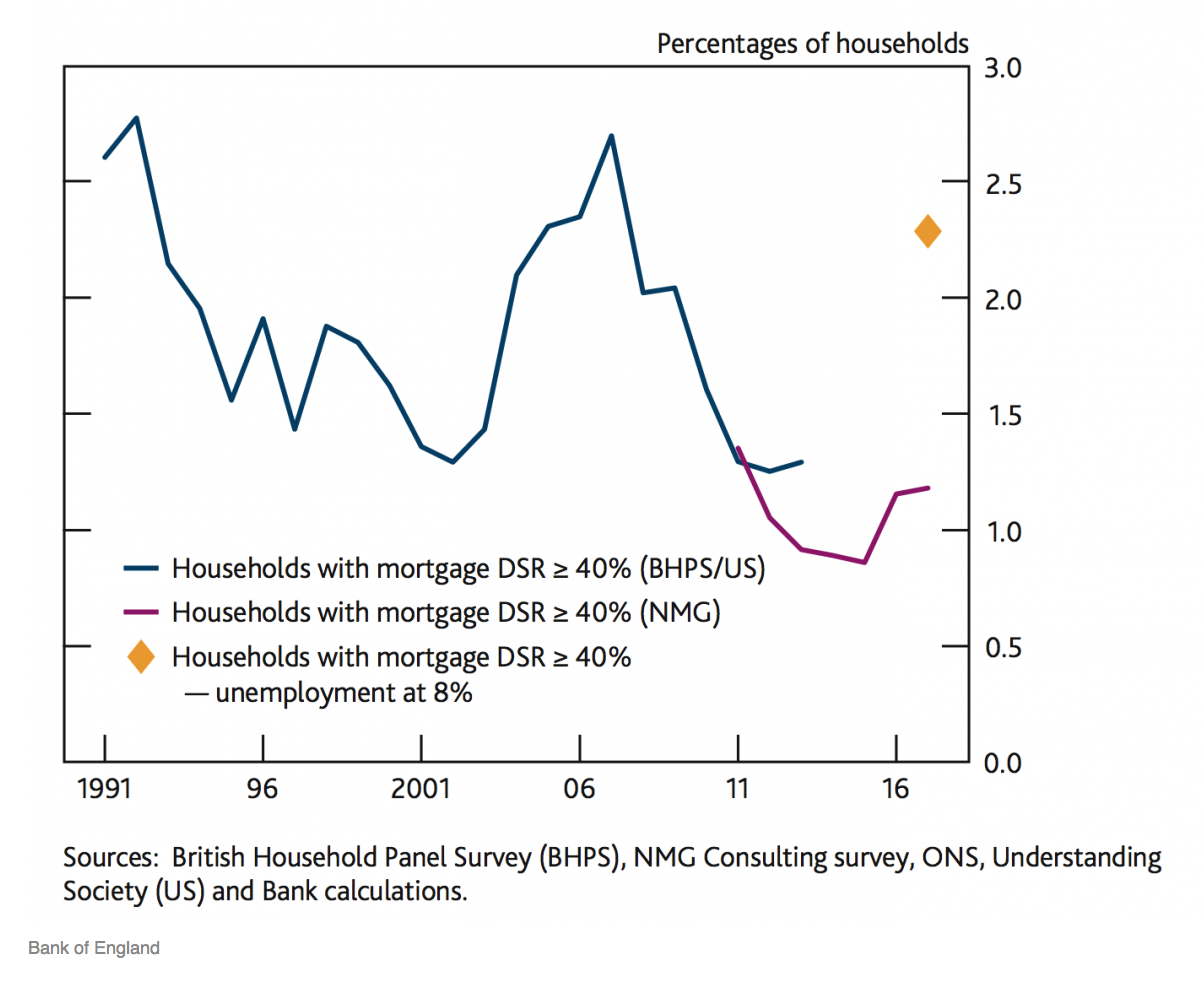

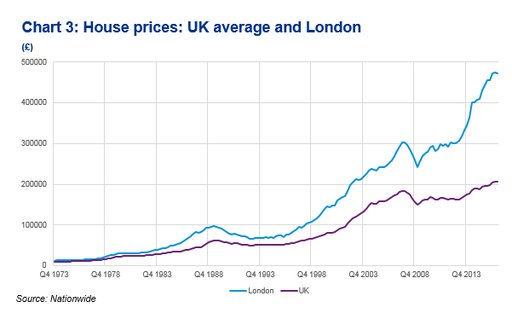

- London Property Bubble Bursting? UK In Unchartered Territory On Brexit and Election Mess

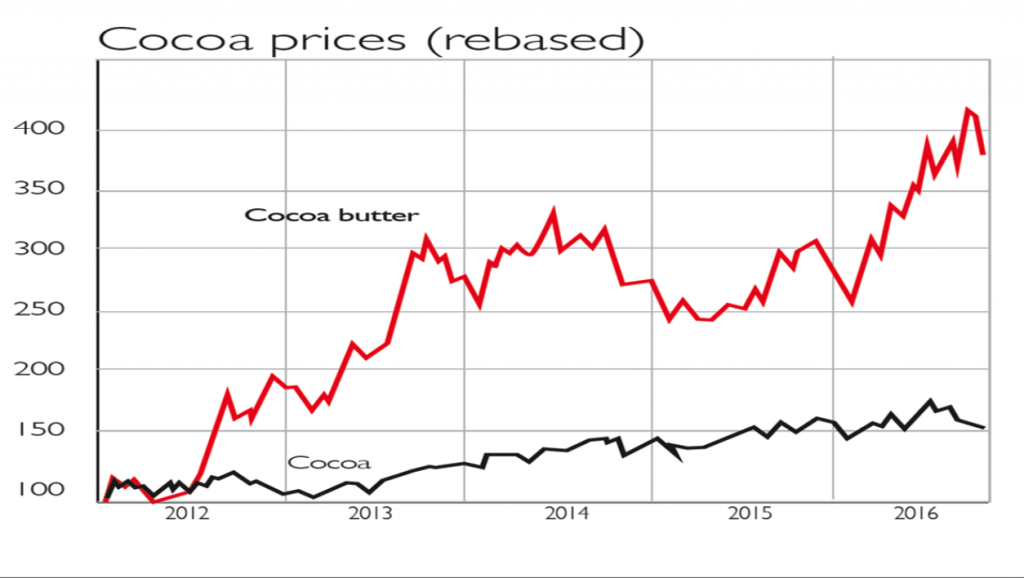

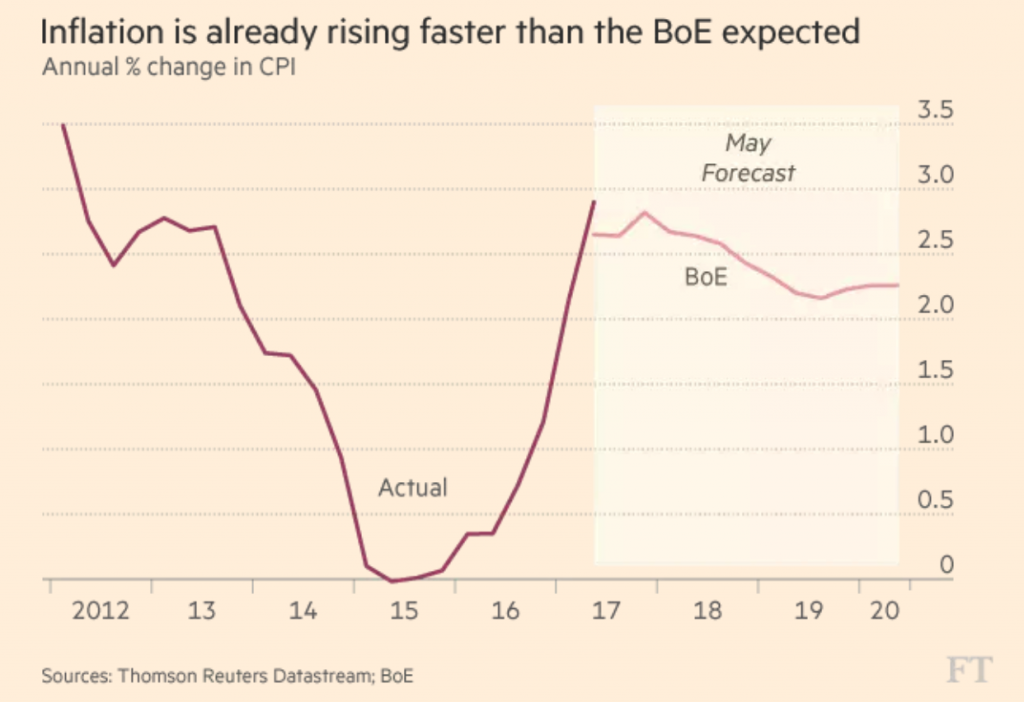

- Shrinkflation – Real Inflation Much Higher Than Reported

- Goldman, Citi Turn Positive On Gold – Despite “Mysterious” Flash Crash

- Worst Crash In Our Lifetime Coming – Jim Rogers

- Go for Gold – Win a beautiful Gold Sovereign coin

- Only Gold Lasts Forever

- Your Future Wealth Depends on what You Decide to Keep and Invest in Now

- Inflation is no longer in stealth mode

- James Rickards: Gold Will Start Heading Higher On “Dwindling” Supply

- Billionaires Invest In Gold

- Brexit and UK election impact UK housing

- In Gold we Trust: Must See Gold Charts and Research

- Pension Funds, Sovereign Wealth Funds, Central Banks “Stock Up” on Gold “Amid Uncertainty”

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.