This article by David Haggith completes a series first pubished on The Great Recession Blog.

In the first debate, Hillary Clinton called Trump’s tax plan “trumped-up, trickle-down” economics. It’s the one thing that came out of her mouth that I had to entirely agree with. Many others are saying it, too:

New analysis from a nonpartisan group finds that Donald Trump’s latest tax proposals would increase the federal debt by $5.3 trillion over the next decade, compared with $200 billion if Hillary Clinton’s ideas were enacted. The Committee for a Responsible Federal Budget looked at Trump’s newly revised tax plan as well as other proposals…. Trump has also proposed a sharp increase in spending on the military and veterans. He has proposed some spending cuts, but the committee calculated they wouldn’t come close to balancing the budget. (Newsmax)

In the Tax Policy Center’s analysis of the Republican candidate’s proposal, the institute said that Trump’s plan would reduce federal revenues by $9.5 trillion over its first decade, and an additional $15.0 trillion over the next 10 years. Including interest costs, the Center said, the proposal would add $11.2 trillion to the national debt by 2026…. While the plan cuts taxes for all income levels, the biggest cuts involve the highest-income level, both in dollar terms and as a percentage of income. By 2017, the highest-income 1% of taxpayers would receive a tax cut of 17.5% of after-tax income, and the top 0.1% — those with incomes of over $3.7 million in current dollars — would experience an average tax cut of more than $1.3 million, nearly 19% of after-tax income…. In contrast, the lowest-income households would receive an average tax cut of $128, or 1% of after-tax income, in Trump’s plan. (Fortune)

Pass-through entities don’t pay the corporate rate, which currently tops out at 35 percent. Instead, their profits are distributed directly to their owners, who then pay taxes on them as normal income. A lot of truly small businesses are set up this way. But so are hedge funds, private equity firms, real estate developers, and major law firms, whose partners would often pay a top rate of 39.6 percent on their earnings. Trump was essentially offering to cut their top tax rate by more than half…. Perhaps not coincidentally, the Trump Organization LLC is a pass-through entity. It is hard to overstate what a truly terrible policy idea this is. You know how people complain about the carried interest rule that gives hedge fund and private equity guys a tax break? This is that on performance-enhancing drugs…. When Trump announced his tax plan Thursday, it appeared he had experienced a momentary bout of sense and had nixed the 15 percent rate for pass-through businesses. Or so he told the conservative Tax Foundation…. But then … his campaign “privately reassured” the National Federation of Independent Business that it was still on board with the cut. (Slate)

It’s not just the establishment publication Fortune that says Trump’s tax plan is a gift to the one-percenters or the more balanced Newsmax or the liberal Slate; Reagan’s own fiscally conservative budget director, David Stockman, says essentially the same thing as reported in my earlier article in this series.

Trump’s plan continues to stomp down the road of massive debt accumulation we are already on. It takes us further down this path than we’ve ever gone before and does it for all the foreseeable years to come. It gives the biggest tax breaks in history to the wealthiest people and only the tiniest crumb to the middle class on the belief that they’re so desperate that any tax cut will look good and get their approval.

Trump’s plan perpetuates the trickle-down theory that the best and only way to help the poor and the middle class do better is to make the rich richer. Larry Kudlow and Stephen Moore have seen to that. Let’s all genuflect one more time to the rich to hope they save us from themselves.

Running down the road to our own destruction

After Trump’s first rendition of this trickle-down plan was resoundingly criticized (hence the current major revision), Trump said this in his defense:

In May, [Trump] was asked about analyses that found most of the tax cuts went to the richest 1 percent of Americans. “I will say this, and I’m not necessarily a huge fan of that,” he responded. “I’m so much more into the middle class who have just been absolutely forgotten in our country.” (Think Progress)

Apparently not! Here we are (again!) with the top tax breaks going to the top 1% while 99% of tax payers get about a 1% improvement in their take-home pay. Trump cannot get his head around the idea that there is any way to help the economy other than helping the rich. Trump knows he can sell this plan to most of his supporters who will say that any tax break is good (even though the Bush Tax breaks — bigger than the Reagan tax breaks — so completely failed to stimulate the economy that the economy plunged into the Great Recession).

Trump promises smaller government, a huge cutback in regulations, continuance of massive military spending coupled with equally massive tax cuts for the rich that are made palatable by modest tax cuts for the poor and middle class. And he promises that all of that will pay for itself. Been there. Done that. Didn’t work. But we won’t learn from the past. People will vote for Trump because they like how he verbally attacks the establishment, and they don’t see through smoke screen of middle-class tax cuts to see how much Trump’s actual plan gives away the nation to the establishment — the biggest gift they’ve ever received.

Oh, but Trump is going to pay for this by rolling back government spending … down the road. He promises to eventually cut back one penny on every dollar spent over the years ahead. (Have you ever noticed how major spending cuts are always set a few years down the road when future congresses will simply overrule them anyway? Thus, they never materialize unless done now. In Trump’s plan even minor spending cuts are kicked down the road.)

These kinds of future cost cuts are like Lucy pulling the football away from Charlie Brown. Fool me once, shame on you. Fool me twice, shame on me. But fool me four, five or six times, and I must be an idiot. I say, “Big deal” to a penny saved at some far future date when we’re drowning in twenty trillion dollars of debt now, almost all of which was created from Reagan forward. Wow! A penny! That’ll save us!

Since Trump also vows not to cut one penny for military spending, Social Security or Medicare or Medicaid — and since these programs make up two-thirds of the national budget — there is not going to be a lot of pennies saved by cutting the remaining third. At the same time, Trump is vowing to increase spending on the Border Patrol and Department of Veterans Affairs, which are part of the remaining third. So, that leaves even less than a third from which all the penny cuts can happen in order to balance the budget.

And that is why it is voodoo economics. If you think that is actually going to play out, you live in denial — deep denial because you’ve already seen similar but smaller plans under Reagan and Bush that took us much deeper into debt. Trump will take us there with our foot flat down on the accelerator. The plans of the filthy rich, like Trump, are exactly what has made this a great recession … for a few — the top one-percenters.

Trump’s plan is a typical politician’s wish-list of promises in order to get elected

Trump is also going to create six months of federally paid maternity leave and pay for that by cutting waste in unemployment programs. It’s always nice to think you will pay for the candy you want to offer by trimming unspecified fat elsewhere down the road. We need to trim the fat in every program without adding anything to the program just to lower the deficit into a sub-orbital trajectory.

The candy diet plan for trimming fat rarely works. It’s mostly fantasy, but it is the kind of fantasy that tax payers are almost always receptive to, and that’s why our deficits keep getting bigger as do our bellies as we continue to believe we can have it all.

The candy diet is tempting, but the only way to really cut taxes is to cut programs first and NOW when you have the power to do so then match your tax cuts to what you have already cut. You have to do the hard work first to prove the cuts are not a fantasy because the cuts you promise down the road will never be approved by the people you are speaking for. These spending cuts fail to materialize because they are always in areas that the other party hates to cut and, therefore, successfully fights. Like a mirage, spending cuts that are planned for down the road always remain down the road.

Earlier in his campaign, Trump proposed a $10 trillion tax cut over 10 years that was so large and costly that several Republican economists laughed when asked about it. He later tacked on a series of spending proposals that promised even larger deficits, including a push against illegal immigration that analysts estimated could cost up to $600 billion, a $500 billion investment in the nation’s infrastructure and a vow to restore $450 billion of existing cuts in military spending….

Marc Goldwein, the senior policy director of the nonpartisan Committee for a Responsible Federal Budget, said Trump is “relying on very rosy economic assumptions that I don’t think are going to come to fruition.” The economy is currently expected to grow by roughly 2 percent a year, and economists say Trump’s proposed restrictions on immigration would be among the many things hampering his ability to double that rate of expansion. (Newsmax)

Trump promises to make sure no child is left behind by allowing child-care expenses to be deducted from what one pays in FICA taxes and Medicare taxes. Since he also promises he will allow no cuts to these entitlement programs, how will he pay for the childcare deductions unless the childless pay more into those already underfunded, overburdened programs, to make up for the deductions? More candy to be paid for by unspecified trimming of fat down the road, I suppose.

Trump will also eliminate the estate tax, which already applies only to very large estates (those worth more than the $5.45 million current exemption). This is a gift to his own children to boost their inheritance. No wonder they are stumping for his campaign, as that success alone could put billions of dollars in their own pockets. (Yet another gift that goes entirely to the rich … in this case the silver-spooned children of the rich.)

Trump also plans to stimulate the economy with massive new infrastructure programs — building new tunnels, better roads, maintaining bridges, etc. That is all stuff we should have jumped on eight years ago because it is the one form of deficit spending that, at least, gives the next generation something before you hand them the bill. However, Republicans under the obstructionist policies of John Boehner staunchly opposed it because they didn’t want Obama to get the credit. Now we’ve already piled up twenty trillion dollars of debt, using up much of our debt capacity.

Some say, the sky is the limit on how much debt the government can afford because it controls the money. It’s easy to prove how blatantly stupid that is in one sentence: In that case, let’s abolish all taxes forever and have the government always buy everything with debt. Heck, if twenty trillion dollars isn’t too much, why not double down on that in a decade. Anyone for Double in a Decade? That sounds pretty close to the Trump plan.

The Trump plan also promises to roll back regulations, including those on the energy industry and protections on the food you eat. What is there that an establishment Republican wouldn’t love in that? There is, as far as I can see, nothing in Trump’s economic-recovery plan that the Republican establishment doesn’t love because Trump turned to the establishment to engineer the plan in order to make peace with his party.

In the final analysis

Thus, the Trump plan looks to me like one last hurrah for the trickle-down crowd and the ultimate Trojan Horse of the Wall Street Establishment. The trump years will be the greatest block party ever because we get to hand the bill and the clean-up afterward to our kids and their kids. If you tell yourself otherwise, you’re just kidding yourself as we’ve done for the past thirty-plus years of trickle-down deficits because that, in the end, is the only thing that has trickled down: the debt has trickled on down the road to our progeny.

Although it appears Trump has caved in completely to the establishment, Larry Kudlow points out that the Donald still needs to be schooled in a few things where he hasn’t yet drunk the establishment’s Kool-Aid®:

That said, Trump’s view of monetary policy, especially the dollar, needs to be resolved. At the Economic Club of New York, he charged that the Fed is being “totally controlled politically.” Elsewhere he has stated that Fed chair Janet Yellen is keeping interest rates ultra-low in a political effort to boost Democratic fortunes. I disagree.

But don’t worry. After Trump spends several more months with the likes of Larry, Kudlow & Company will get him to suck up the rest of the establishment’s dogma and become as much a friend of the Fed as he has always been a friend of the one percent. According to Kudlow, Trump just needs a little more learning, and then he’ll know that the Fed is really a balanced organization, chartered to seek the greater public good.

TheRump will soon give up his paranoid idea that he needs to fire Janet Yellen. He’ll learn that the Fed is not just a bunch of banking cronies seeking to make themselves vastly richer at the rest of the world’s expense, even though that is the only thing that has happened inside the Eccles building since Alan Greenspan took office there.

It sounds like TheRump has mostly gotten “on message” as establishment pundits said he needed to do if he intended to win this race. He has fully adopted the ultimate Reaganomics deficit-based, trickle-down tax plan as his own. TheRump is still half baked in Larry’s point of view, but the establishment has tenderized him, and he’s coming around nicely. He has even softened his immigration stance.

Who would have thought you could so easily win a self-interested, self-aggrandizing, blustering, boisterous, rich buffoon over to a plan that serves all of his own personal interests? The two-party system is working is magic to give the Donald a comb over, grooming him into their candidate who will, once again, make certain the one percenters continue to prosper ahead of everyone else with the promise of nutritious crumbs below for the middle class voters. (It goes without saying that you’re not going to get anything anti-establishment out of Hillary, so I don’t even need to make that argument. The Democrats already solved that concern for their corporate cronies by cheating Bernie out of a fair race; but what else is new?)

Make America great again

One thing is certain to anyone who is capable of learning from thirty-five years of history: the debt under Trump will be great … really great. It’ll be a great debt like you’ve never seen before, and the Fed will be great, too. It’ll all be great again once TheRump finishes his schooling under Kudlow and Moore and other Republican apperatchiks who have been given the task of tutoring him in the Established Dogma.

It may take them another year to file off the Donald’s remaining edges and get him to realize that cheap foreign labor is good for American businesses, too, and to knock off his opposition to free trade, which is also good for American business stockholders and CEOs (though not at all good for American workers and average citizens). The rich are going to love Trump’s plan — really love it! Just wait. You’ll see.

The Rate Coalition, which lists Boeing Co., Ford Motor Co. and Wal-Mart Stores Inc. among corporate supporters, said it won’t endorse all aspects of Trump’s plan but that the tax proposal is a “huge step in the right direction and we urge other candidates in the race to follow his lead.” (Newsmax)

See. They are starting to fall in love with it already.

Trump is pushing a plan squarely in the GOP tradition of sharp tax cuts for individuals and businesses, which most analyses conclude would largely benefit wealthier Americans. That’s in contrast with other issues such as international trade, where he has jettisoned decades of GOP orthodoxy and taken a more populist stance. (Newsmax)

Don’t worry. He’ll likely come around on the latter just as much as he did on the former. The establishment is already absorbing the anti-establishment candidate into the corporate collective. Trump’s tax plan is now in its third iteration, and each move has shifted more benefits toward the rich.

In its original form, the Republican presidential nominee’s plan was set to exempt about 70 million lower-income Americans from paying any taxes at all — and offer cuts to middle-income taxpayers, who are most likely to use the standard deduction. When that provision didn’t make it into Trump’s speech on economic policy Monday, observers were left to wonder just how much his revamped proposals will benefit lower- and middle-income Americans…. Moore and economist Lawrence Kudlow have been working with the Trump campaign to try to lower the cost of his original tax proposal…. Trump’s new plan would provide more modest cuts in individual tax rates. (Newsmax)

Now that Trump has been drinking the Kudlow Kul-Aid, the cuts have become particularly more modest for the middle class (while greater for the upper class). That was back in August with the first shift in his tax plan. His shift in September toward corporate interests and the top one-percenters was even greater.

It doesn’t matter anyway

The game should soon be over anyway. The one-percenters have so successfully rerouted all advantages to the top and throttled the middle class that they have killed their own marketplace while heaping vast debts upon the nation to make themselves richer. The imminent implosion is only being held off by an all-stops-out Federal Reserve that now buys up any market it needs to — stocks, bonds, oil, you name it — to stave off mass revolt until after the election. Trump’s gifts to the rich along with his mirage of spending cuts simply puts that gold-plated Trump finish to America’s bankruptcy.

The last squeezing of wealth toward the top one percent is likely to burst America’s already smoldering social fabric into widespread flames once American citizens find they have been trumped once again by the rich. You can only squeeze the lemon so tight before it has nothing left to give. I doubt — having predicted epocalypse this year — that the Fed can even hold things off until the election; but if they do manage to postpone America’s eruption, the nation is only going to be that much more enraged.

There is nothing in any of Trump’s plans that will reinstate Glass-Steagall, break up major conglomerates (especially banks so they are no longer too big to fail), eliminate all the practices of Wall Street that make it mostly a speculative casino for the megarich, force the rich to pay an equal percentage of their wealth in taxes as those beneath them, or to replace an extremely complex, politically manipulated income tax entirely with a simple, progressive sales tax, or to stop the US from being the global cop so that we can reduce military spending nor in any way to begin to live within our means by paying entirely for our warfare and welfare as we go. There is, in short, nothing here that will make America great again!

There is also nothing in his Trump-America-Again plan that eliminates, curbs or even attempts to reform the Fed’s control over all the money in the world. It’s all fantasy economics. He even wants an ex-Goldman-Sachs banker to run the Treasury! (Let’s put the Cobra in the chicken’s nest to guard the eggs!)

Yes, the establishment has hated the original Donald Trump, but the newly combed-over Trump (and the make-over came easily because Trump in his heart serves only himself anyway) is looking more like an establishment puppet everyday. He’s just a yappy puppet with a sharp mouth that voices what the public wants to hear. He’s entertainment in the colosseum for the Romans.

That kind of makeover of a candidate tends to happen when someone has no true ideas of his own and only knows what makes everyone else angry and how to tap into that anger. Trump made himself a lightning rod, and the neocons are figuring out how to use it since they are stuck with it. Now that TheRump has chosen his advisors, he’s looking more like them every day.

I’d like to hope that an enraged response by the electorate before the elections could jar him back on track before his conversion is complete. However, it could be that the anti-establishment rhetoric was all a ruse to begin with. Maybe he always intended to serve himself the biggest tax breaks in history (before that audit catches up with him and he has to start actually paying taxes), or maybe he’s actually a decoy for Hillary, caving into the establishment right in the final leg of the race so that the growing anti-establishment vote winds up with nowhere to turn on election day.

Thumbs up, I guess, to TheRump for pulling that one off. “We gotcha one more time.”

Source

Source

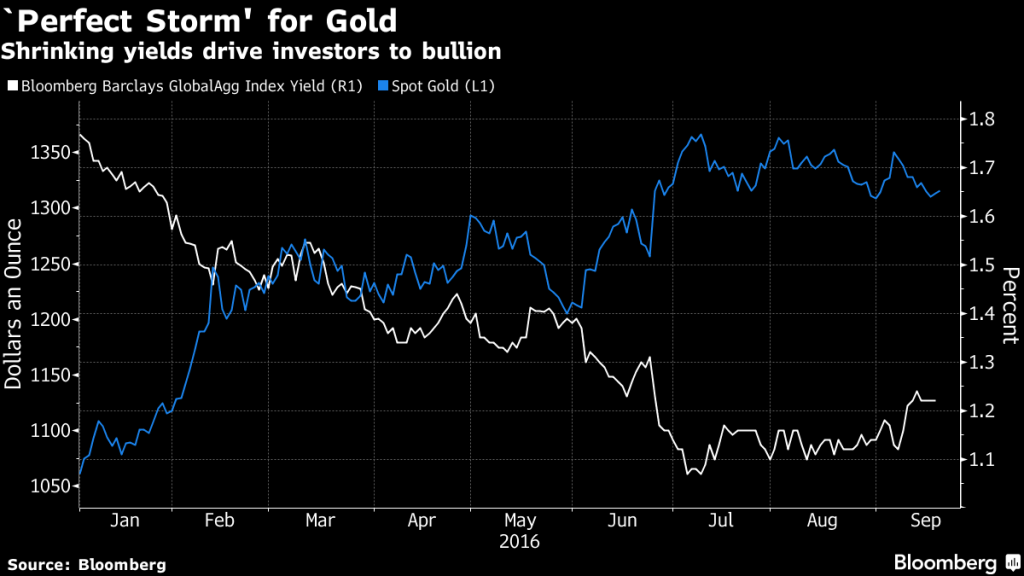

In all probability, December 2015 marked the bottom of the cyclical gold and silver bear market – a bear cycle that had been in play since silver topped in May 2011 and gold in September of the same year.

In all probability, December 2015 marked the bottom of the cyclical gold and silver bear market – a bear cycle that had been in play since silver topped in May 2011 and gold in September of the same year.

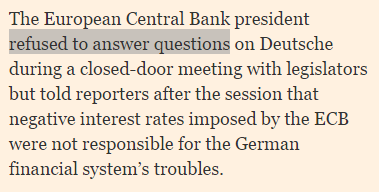

Deutsche Bank, Germany’s (and Europe’s) largest – otherwise in very poor financial shape – is said to be holding no less than 50 mining sector stocks, with a total market value of over $2 billion. The Swiss National Bank holds 25 stocks at a $1 billion market value. Now Norway’s Central Bank (Norges Bank) has filed notice with U.S. regulators that it too holds securities in 23 mining stocks to the tune of just under $1billion.

Deutsche Bank, Germany’s (and Europe’s) largest – otherwise in very poor financial shape – is said to be holding no less than 50 mining sector stocks, with a total market value of over $2 billion. The Swiss National Bank holds 25 stocks at a $1 billion market value. Now Norway’s Central Bank (Norges Bank) has filed notice with U.S. regulators that it too holds securities in 23 mining stocks to the tune of just under $1billion. David Smith is Senior Analyst for

David Smith is Senior Analyst for

There have been many other threats to the confidence that underpins the dollar. Among them were straight-forward and widely publicized assaults; trillion dollar federal deficits, metastasizing debt and an explosion in the supply of U.S. dollars. If years of Quantitative Easing – the Fed’s program to gin up trillions in new dollars with which to buy Treasury Bonds and garbage mortgage securities – didn’t torpedo confidence, a far more obscure institution like the IMF may not do it either when it changes the composition of their arcane supranational currency.

There have been many other threats to the confidence that underpins the dollar. Among them were straight-forward and widely publicized assaults; trillion dollar federal deficits, metastasizing debt and an explosion in the supply of U.S. dollars. If years of Quantitative Easing – the Fed’s program to gin up trillions in new dollars with which to buy Treasury Bonds and garbage mortgage securities – didn’t torpedo confidence, a far more obscure institution like the IMF may not do it either when it changes the composition of their arcane supranational currency. Clint Siegner is a Director at

Clint Siegner is a Director at