Published here: http://www.zerohedge.com/news/2017-09-28/gold-standard-resulted-%E2%80%9Cfewer-catastrophes%E2%80%9D-%E2%80%93-ft

Gold Standard Resulted In “Fewer Catastrophes” – FT

- "Going off gold did the opposite of what many people think" - FT Alphaville

- "Surprising" findings show benefits of Gold Standard

- Study by former Obama advisor in 1999 and speech by Bank of England economist in 2017 make case for gold

- UK economy was 'much less prone to extremes' under than the gold standard - research shows

- 'Gold standard seems to have produced fewer catastrophes for Britain' - data shows

- FT still wary of gold standard arguing 'stability can be overrated and growth is worth having'

- Finding is not surprising and joins a wealth of evidence and research that shows gold's importance as money, a store of value and safe haven asset

300 years ago last week on the 21st September, 1717 Sir Isaac Newton, Master of the Royal Mint of Great Britain, accidentally invented the gold standard.

Last month it was the 46th anniversary of President Nixon ending the gold standard. Since then the world has existed on a system of fiat paper and digital currency. It works so badly that it has lead to the global financial crisis, unending debt issues and a dramatic devaluation in sovereign currencies.

Despite this, much of the media and central banking system remain supporters of the current financial and monetary status quo.

They are so convinced that the time before fiat money was a disaster that anyone who suggests otherwise is labelled a gold-bug and told to move along.

Last week, there was a glimmer of light when the Financial Times' Matthew C. Klein uncovered some 18-year old research into the gold standard and a recent speech by a Bank of England economist.

Mr Klein although a young man has quite an impressive journalistic c.v. He writes for FT Alphaville and Bloomberg View about the economy and financial markets.

He previously wrote for the Economist magazine and before that, Klein was a research associate at the Council on Foreign Relations (CFR), where he spent more than two years studying the history of the Federal Reserve and the intellectual history of monetary economics.

Going off gold did the opposite of what many people think

Klein writing in FT Alphaville draws on research from former economics advisor to President Obama, Christina Romer:

Imagine you can choose between living in two kinds of societies:

- Dynamic world prone to wild swings and big crashes, but ultimately more growth in the long run

- Safe and stable world with greater consistency, less volatility, and much lower risk of catastrophe

You might think that Americans and Europeans effectively decided to move from option 1 to option 2 between the late 19th and mid-20th centuries. Depending on your politics, you might attribute this to the stultification of modernity, or the triumph of the enlightened welfare state.

Regardless, you would be wrong.

The growth of government as a service provider and guarantor of financial security — backed by fiat money — has actually coincided with faster trend growth and greatervariance around that trend line. Moreover, the likelihood of particularly bad events has increased since the escape from the “golden fetters”.

Klein refers to this and subsequent information from Romer as 'surprising findings'. They are not likely suprising to Klein but would be too many FT readers given its generally negative stance towards gold in recent years.

The gold standard: Reduced volatility

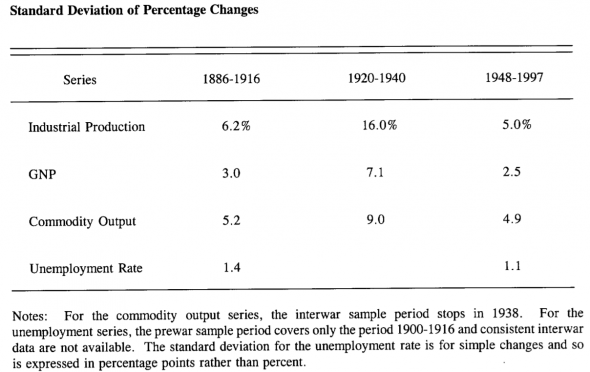

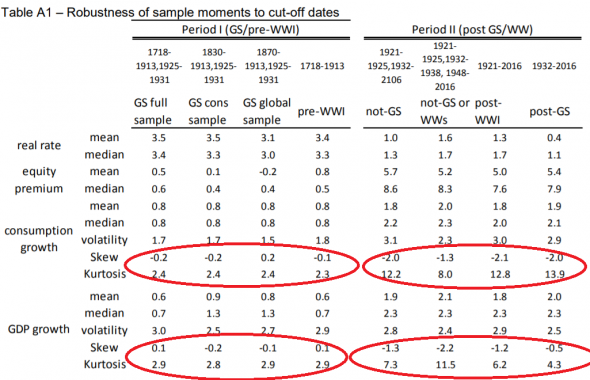

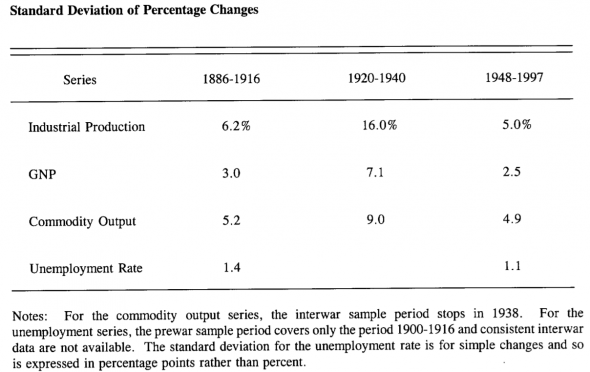

Klein reports that in 1999, Romer made some interesting findings regarding the stability and volatility of various business cycles in the 20h century.

The findings initially suggest results that would make modern bankers rest on their laurels in terms of how they manage things today, but dig deeper and things don't look so straight forward.

He reports that Romer concluded:

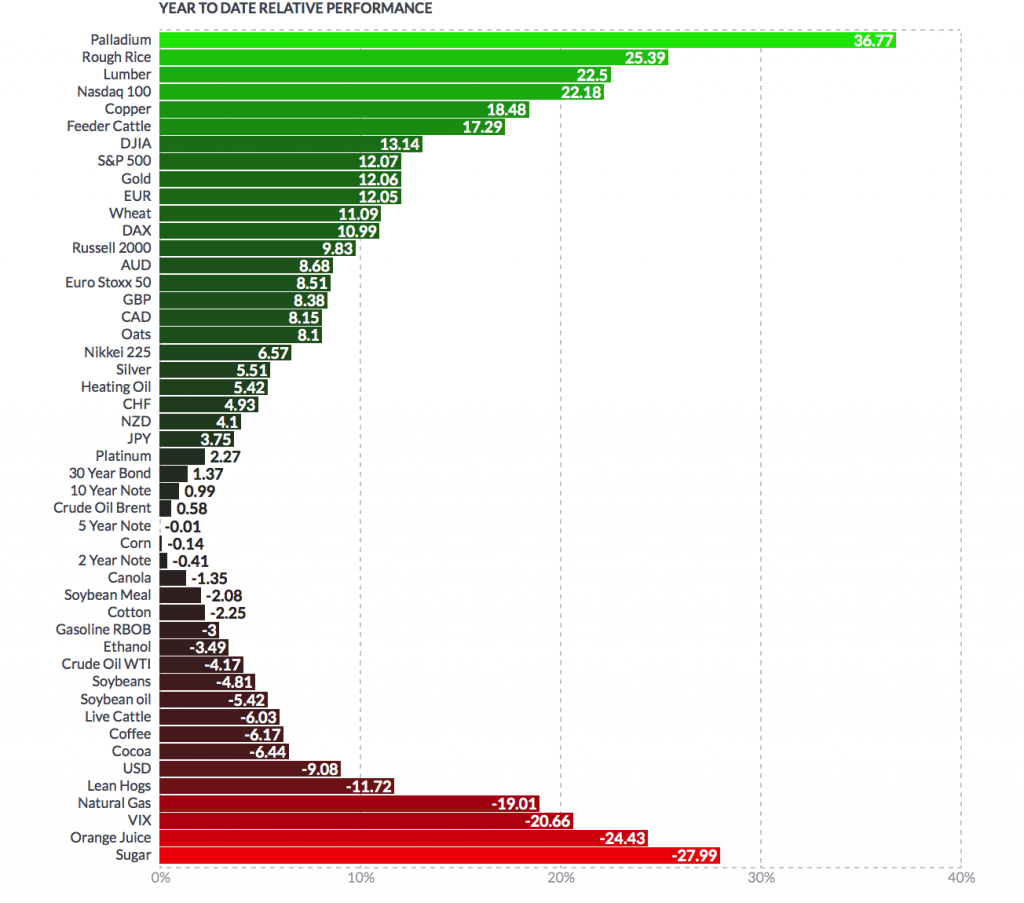

that business cycles had roughly the same amplitude both before WWI and after WWII. Volatility was slightly lower in the modern period:

- Credit: FT, Romer

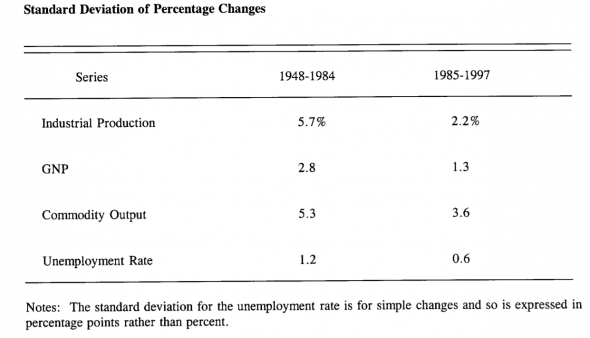

But this was entirely attributable to the unusual calm of 1985-1997:

- Credit: FT, Romer

Given what’s happened since then, the pre-WWI period might look more stable than the era of the “countercylical” Federal Reserve. Romer measured the severity of a downturn by looking at how far industrial production fell from its peak and how long it took to return to its old level. Using her method, the financial crisis was about as painful as the depression of 1920 and the contraction of 1937 — and about 2.5 times as bad as any post-WWII downturn.

Bank of England's economist makes case for gold

Gertjan Vlieghe, an economist and former economic assistant to Lord Mervyn King at the Bank of England, gave a speech last week entitled 'Real Interest Rates and Risk'.

The speech presented research on and linked the history of interest rates, economic volatility, and stock market returns.

As Klein points out in the FT the most important part of the speech is most likely to the be most underreported.

Vlieghe's research finds that whilst the UK economy off the gold standard was better at allocating resources, the dangers it brought to the financial system made it "more fragile" and "lead to a financial crisis".

Vlieghe at the Bank of England says:

I suspect the increase in the importance of private sector debt and financial intermediation plays an important role, which in turn was facilitated by moving off the gold standard. An economy where debt and financial intermediation play a more important role can allocate resources more efficiently and achieve a higher growth rate, but also becomes more fragile. Small set-backs can have amplified downside effects and even lead to a financial crisis

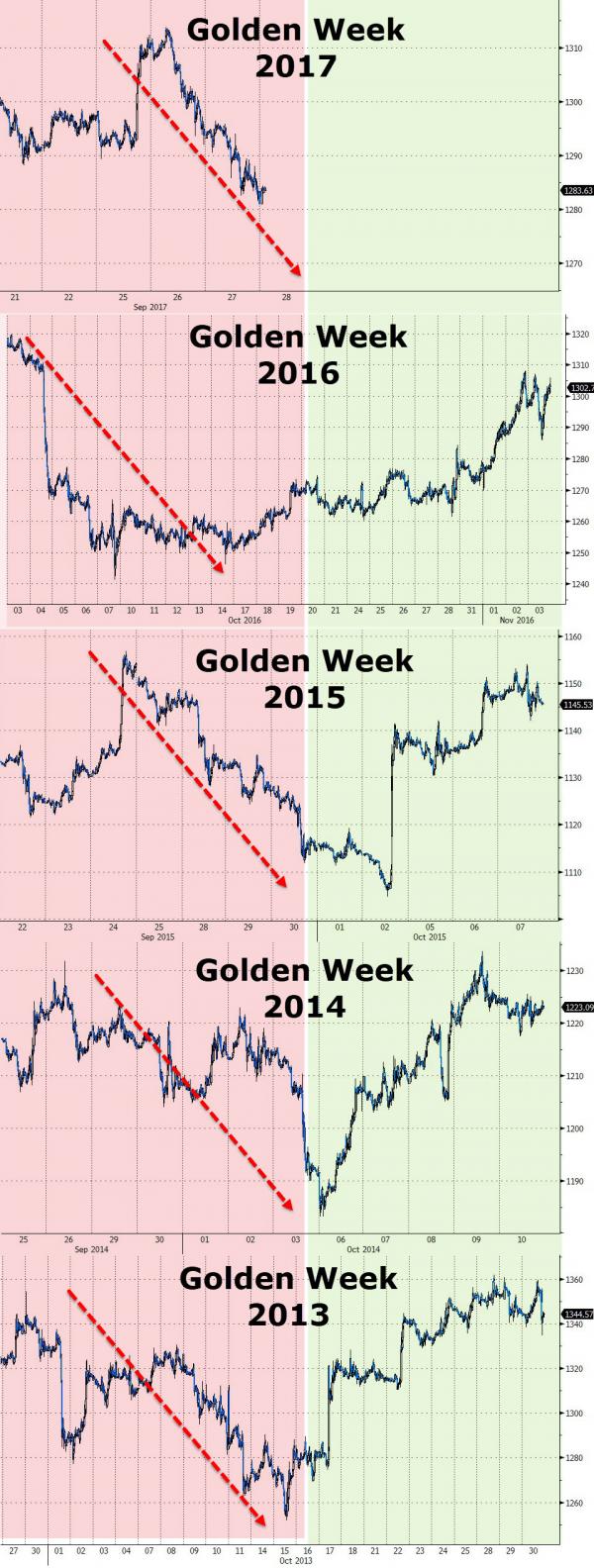

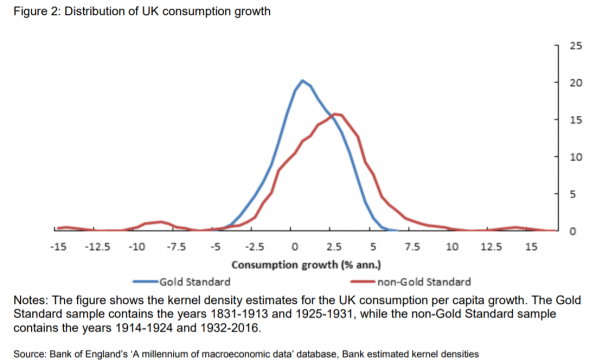

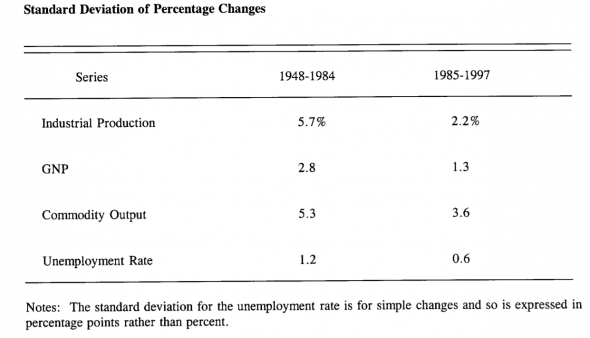

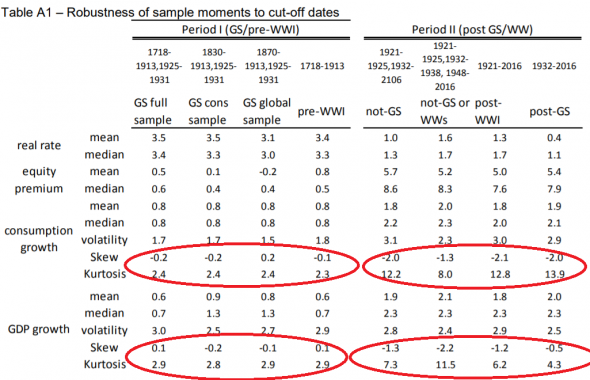

Klein draws our attention to an interesting chart presented as part of Vlieghe's speech.

- Credit: FT, Vlieghe

Klein explains:

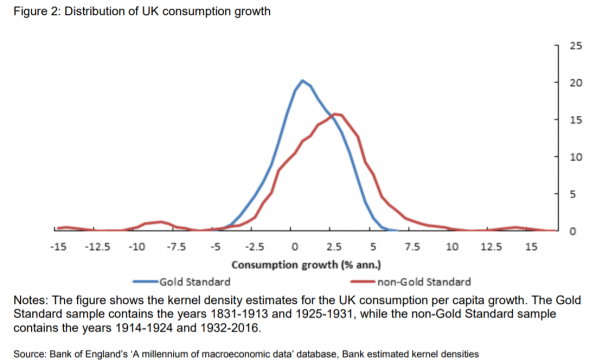

The table, based on nearly three centuries of UK data, shows that the economy grew much less (in per person terms) under the gold standard than in the period of fiat money, but was also much less prone to extremes.

The distribution of growth performance during the gold standard era was much more tightly concentrated around the average than the distribution in the epoch of fiat money. The comparison is even more stark when comparing average consumption, which is the best single measure of living standards. (That’s what the kurtosis numbers show.)

- Credit: FT, Vlieghe

Klein clearly recognises that this shows the gold standard for what it is: a monetary system which brings far fewer disasters to an economy than one easily manipulated by central bankers and governments.

This, says Klein, requires some serious consideration.

the gold standard seems to have produced fewer catastrophes for Britain. There is no negative (or positive) skew in the distribution, unlike in the modern period, which has been blighted by several profoundly unpleasant downturns.

...the standard arguments in favour of the flexible and “counter-cyclical” state we have today, need serious revision.

Very little desire for serious revision

Throughout history, the majority of fiat currencies have met a miserable end, succumbing to hyperinflation after just a few decades.

So far the current global fiat monetary system has survived just over 45 years. Few can seriously look at it and argue that it is healthy. It is increasingly unstable and is in terminal decline.

It is not unfathomable to expect it to fail in the coming financial crisis. Unfortunately bankers and governments have not woken up to this thought yet.

Ignorance is apparently bliss when it comes to believing a decade of money printing can be unwound without serious consequence.

Whilst it is refreshing to see the Financial Times take a positive look at the gold standard, it is unfortunate that they have failed to recognise this simple fact from looking at monetary history and at the wealth of research out there which makes very similar arguments.

One of the world's most famous bankers, Alan Greenspan, recognised the destructive nature of the fiat system:

‘In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value ...’ (Greenspan, 1967)

In a study which used data from 15 countries from as early as 1820 to as late as 1994, Rolnick and Weber (1997) found ‘money growth and inflation are higher’ under fiat standards than those seen in gold and silver standards. They found during the fiat standard the average inflation rate was 9.17% per year compared to 1.75% per-cent found in gold standards.

The result of the FT's approach is their readers (you, I, central bankers, finance ministers) are easily swayed into believing that a system of debt, volatility, high returns and high risk is preferable to the gold standard. We come to believe it is 'the norm'.

But a system which repeatedly fails cannot be 'the norm.' Surely the one that we ultimately return to after each failure should be 'the norm'?

Did we learn anything about money?

Following the financial crisis, a 2009 UN report concluded that the disaster was not a result of failures, instead the result of bad political choices:

‘...our multiple crises are not the result of a failure or failures of the system. Rather, the system itself – its organization and principles, and its distorted and flawed institutional mechanisms – is the cause of many these failures... our global economy is but one of many possible economies, and, unlike the laws of physics, we have a political choice to determine when, where, and to what degree the so- called laws of economic behaviour should be allowed to hold sway.’

Luckily gold’s role as a store of value and important monetary asset is being increasingly appreciated. This is happening both on the part of governments and individuals alike.

Major holders and buyers of gold include the world's largest central banks, the largest global banks, the largest insurance companies in the world, the largest hedge funds in the world, the largest pension funds in the world and of course many wealthy and prudent investors.

The idea of returning gold to the monetary system is clearly not a crazy one - it is already slowly happening and the Chinese look set to take the lead in this regard.

The mainstream media should not be surprised by this. After all, the evidence shows gold's ability to protect wealth, reduce volatility and protect us from the policies of central banks and increasingly populist governments.

Klein's article can be read in full here Going off gold did the opposite of what many people think - FT Alphaville

News and Commentary

Gold rises from 1-mth lows; palladium at discount to platinum (Reuters.com)

Ex-UBS metals trader indicted over alleged metals price rigging (Reuters.com)

Bonds Slide as Dollar Climbs on Tax Plan, Economy (Bloomberg.com)

Trump proposal slashes taxes on businesses, the rich amid deficit worries (Reuters.com)

Billionaire Paulson Targets CEOs Of Poorly Performing Gold Miners (Bloomberg.com)

Source: City AM

Source: City AM

London house prices to fall this year and next on Brexit - Experts (CityAM.com)

This Is Not A Time To Buy Anything - Zell Warns Retail Real Estate Market Is A "Falling Knife" (ZeroHedge.com)

A Real Republic of Opportunity would Tax Land and Property to the Hilt (DavidMCWilliams.ie)

You're Likely A Lot Less Prepared For Crisis Than You Realize (PeakProsperity.com)

Jim Rogers on why you should get “less passive” today (StansBerryChurcHouse.com)

Gold Prices (LBMA AM)

28 Sep: USD 1,284.30, GBP 961.04 & EUR 1,091.40 per ounce

27 Sep: USD 1,291.30, GBP 963.83 & EUR 1,099.54 per ounce

26 Sep: USD 1,306.90, GBP 969.59 & EUR 1,105.38 per ounce

25 Sep: USD 1,295.50, GBP 957.89 & EUR 1,089.26 per ounce

22 Sep: USD 1,297.00, GBP 956.15 & EUR 1,082.09 per ounce

21 Sep: USD 1,297.35, GBP 960.56 & EUR 1,089.00 per ounce

20 Sep: USD 1,314.90, GBP 970.53 & EUR 1,094.79 per ounce

Silver Prices (LBMA)

28 Sep: USD 16.82, GBP 12.53 & EUR 14.28 per ounce

27 Sep: USD 16.89, GBP 12.58 & EUR 14.38 per ounce

26 Sep: USD 17.01, GBP 12.67 & EUR 14.43 per ounce

25 Sep: USD 16.95, GBP 12.57 & EUR 14.27 per ounce

22 Sep: USD 16.97, GBP 12.52 & EUR 14.18 per ounce

21 Sep: USD 16.95, GBP 12.58 & EUR 14.24 per ounce

20 Sep: USD 17.38, GBP 12.84 & EUR 14.48 per ounce

Recent Market Updates

- Financial Advice From Man Who Made $1+ Billion in 1929 – Importance Of Being Patient and “Sitting”

- “Gold prices to reach $1,400 before the end of the year” – GoldCore

- Commodities King Gartman Says Gold Soon Reach $1,400 As Drums of War Grow Louder

- Bitcoin “Is A Bubble” but Gold Is Money Says World’s Biggest Hedge Fund Manager

- Pensions and Debt Time Bomb In UK: £1 Trillion Crisis Looms

- Gold Investment “Compelling” As Fed May “Kill The Business Cycle”

- “This Is Where The Next Financial Crisis Will Come From” – Deutsche Bank

- Global Debt Bubble Understated By $13 Trillion Warn BIS

- Bitcoin Price Falls 40% In 3 Days Underlining Gold’s Safe Haven Credentials

- Gold Up, Markets Fatigued As War Talk Boils Over

- Oil Rich Venezuela Stops Accepting Dollars

- Massive Equifax Hack Shows Cyber Risk to Deposits and Investments Today

- British People Suddenly Stopped Buying Cars

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.