Gold Reset To $10,000/oz Coming "By January 1, 2018" - Rickards

- Trump could be planning a radical “reboot” of the U.S. dollar

- Currency reboot will see leading nations devalue their currencies against gold

- New gold price would be nearly 8 times higher at $10,000/oz

- Price based on mass exit of foreign governments and investors from the US Dollar

- US total debt now over $80 Trillion - $20T national debt and $60T consumer debt

- Monetary reboot or currency devaluation seen frequently - even modern history

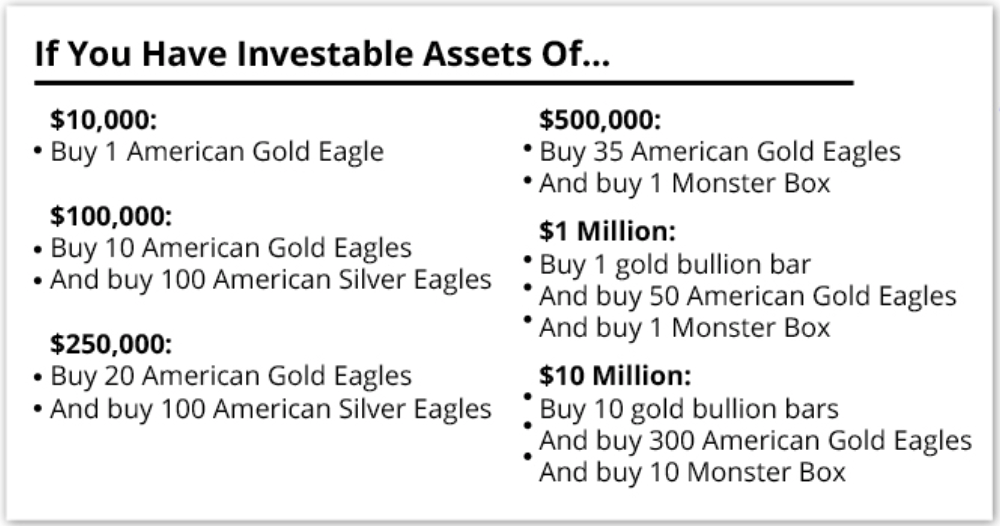

- Buy gold eagles, silver eagles including monster boxes and gold bars

- Have a 10% allocation to gold, smaller allocation to silver

Editor: Mark O'Byrne

A new monetary standard which will see the dollar "reboot" and gold be revalued to $10,000/oz according to best-selling author and Pentagon insider Jim Rickards.

A monetary 'reboot' is not unprecedented

Articles about an imminent return to the gold standard are not exactly infrequent in the gold world and it can be easy to become immune to them and dismiss them without considering the facts and case being made.

Many of the articles are not just based one ever-wishful daydreams. Much of it comes from information that is true about today and is then applied to situations that we have seen in the past.

Rickards makes this point himself. A monetary reset is not unheard of. Since the Genoa Accord in 1922 there have been a further eight reboots. The most recent was in 2016 in what Rickards refers to as the Shanghai Accord which purportedly saw deals done that would allow China to ease without leading to a sharp correction in the US stock market.

Rickards isn't the only one who is speculating that there could be some big monetary changes on the horizon. In March intelligence service Stratfor wrote:

Trump may consider unilateral or, failing that, multilateral currency interventions to bring it back down...Negotiating a new coordinated monetary intervention

Stratfor's analysis was considering the threat of a strong dollar on Trump's plans to reduce the trade deficit. We have recently discussed the danger of political deadlock and uncertainty on the US Dollar and how this will benefit gold.

Rickards' comments come from a similar viewpoint in that there is decreasing faith in the US dollar. This lack of trust is mainly driven by the more than $100 trillion debt ($20 trillion national debt and another $100 trillion in off 'balance sheet' liabilities) in the country and the ongoing dedollarisation by major economies.

Should Trump continue to stumble, disappoint and provoke then we will no doubt see this issue snowball even faster.

No longer banking on debt

The Federal Reserve — America’s central bank — has lowered interest rates and printed nearly 4 trillion new dollars out of thin air since the economic crisis in 2008.

That’s equivalent to nearly one quarter the size of the entire U.S. economy.

The number one consequence of all of this money printing so far hasn’t been inflation at all…

It’s been debt.

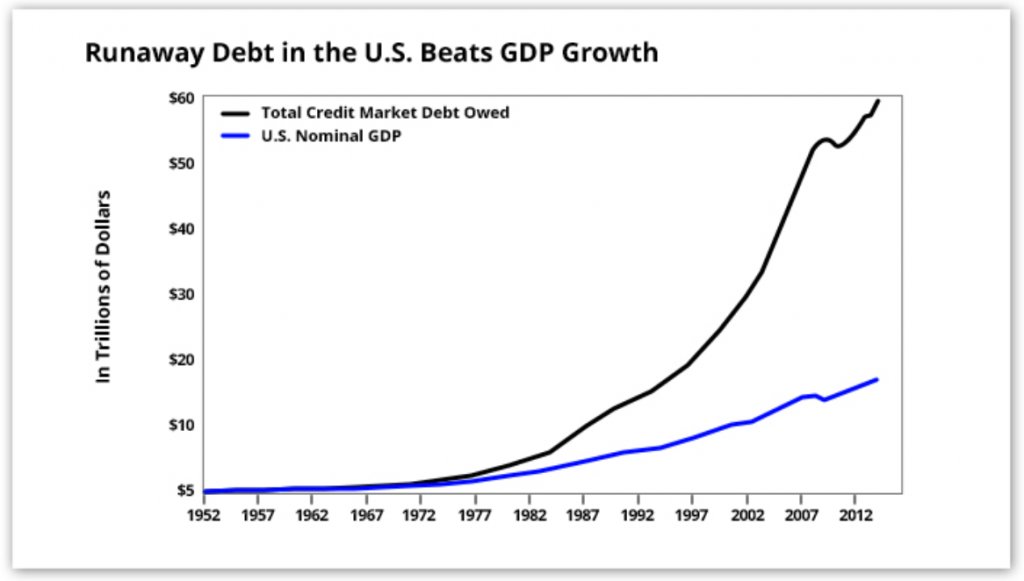

Total U.S. debt — across all private sectors — has risen to nearly $60 TRILLION…

That’s over three times as big as the entire U.S. economy.

If you add the federal debt to that number, you get $80 trillion! That’s more than four times the size of the U.S. economy.

In fact, the Government Accountability Office just reported this year that the U.S. is at risk of “fiscal failure.”

And Harvard Economics Professor Kenneth Rogoff says, “There’s no question that the most significant vulnerability… is the soaring government debt. It’s very likely that will trigger the next crisis as governments have been stretched so wide.”

And Investor’s Business Daily reports that: “Current total debt, at roughly 105% of GDP, is already in the danger zone — and based on historical economic studies, this is where nasty things can happen.”

All of this is the result of too much debt… too many Obama policies… and too much meddling by the Federal Reserve.

But what happens when there is too much debt? The dollar is still relatively strong so does it matter? Yes, says Rickards, 'many countries are relentlessly abandoning the dollar.'

Too much debt to make America Great Again

Countries aren’t sticking around to figure out whether the U.S. can really pay back its debt or wait to see if their dollar reserves are going to keep losing their value…

Like billionaire investor Warren Buffett said

“People are right to fear paper money… it’s only going to be worth less and less over time…”

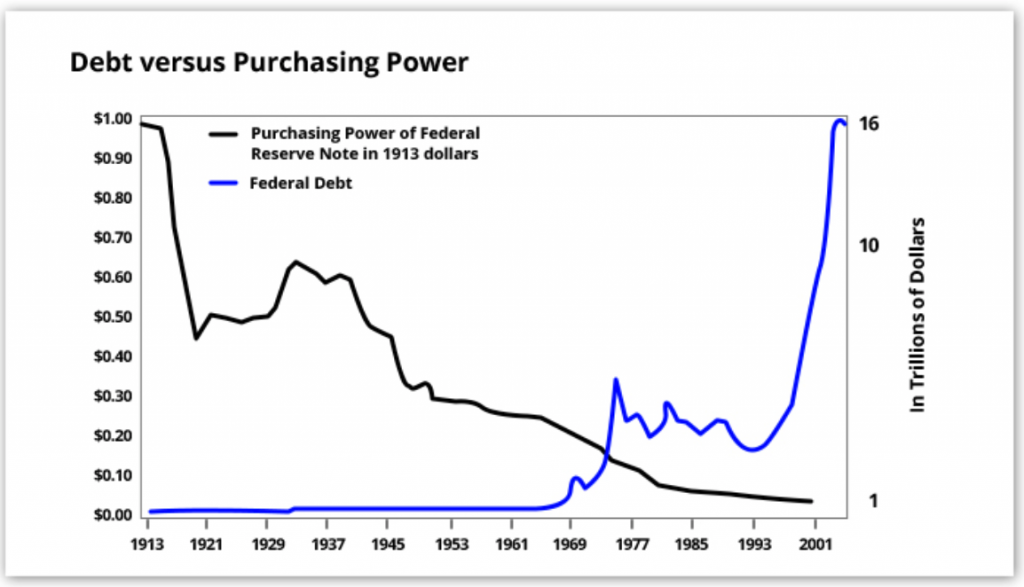

And he’s right. The U.S. dollar has lost 96% of its value since the Federal Reserve was created in 1913. Meanwhile the national debt has skyrocketed!

The dollar and debt are two sides of the same coin:

That’s why many countries are relentlessly abandoning the dollar.

Typically most foreign governments invest their surplus or savings in U.S. financial assets.

Global trade is typically conducted in U.S. dollars, too.

The dollar is what’s called the “world’s reserve currency.”

As one Forbes columnist put it, “ There is a global currency. It’s called the ‘U.S. dollar.’”

But all of that is about to change if the dollar is not rebooted.

The dollar is getting dumped around the globe because of our debt, spending and money printing.

The total amount of “de-dollarization” is at least: $1.14 TRILLION…

But it’s not just the “de-dollarization” of the world that’s making this so urgent. You see, countries have not only stopped buying U.S. Treasuries… but they're selling them at a record clip.

Bloomberg reports, “ America’s Biggest Creditors Dump Treasuries in Warning to Trump .”

The Economist says, “As America’s economic supremacy fades, the primacy of the dollar looks unsustainable.”

Trump to call global summit and take control

Rickards believes that the situation of dedollarization will get so bad that the US President will be forced to call a summit of world leaders and monetary authorities.

Using his stature as leader of the free world, he’ll bring the financial leaders of the globe together.

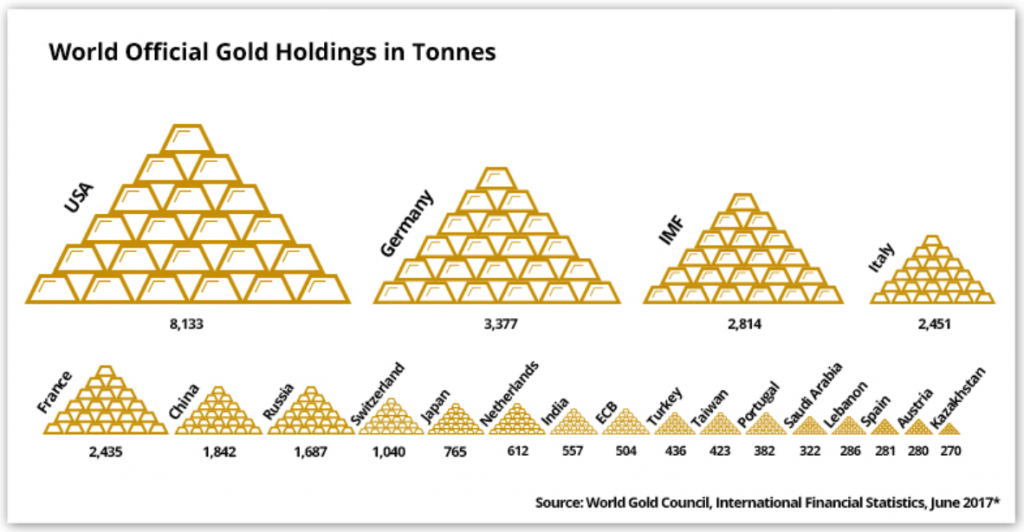

This would include delegates from the U.S., China, Japan, Germany, Italy, France, the UK and the International Monetary Fund.

Then, they’ll agree to simultaneously revalue all of their currencies against gold until the price reached $10,000 per ounce.

Will Trump really call a global summit? Who knows. His own team probably won't know until he tweets about it.

But you should consider one element that Rickards mentions. Aside from a new monetary order, Trump is about to become the most powerful US president when it comes to looking after the US Dollar.

You see, there are seven total seats on the Board of Governors of the Federal Reserve. That’s the group that makes our central bank’s decisions.

The president appoints each governor.

That means Trump could be able to appoint five governors in the coming months, including a chair and two vice chairs.

Trump will have six out of seven board seats in Republican hands.

In effect, Trump will own the Fed!

The Republicans will also have the White House…

And a majority in the House of Representatives and Senate…

Conservatives will soon be a majority on the Supreme Court, too.

And there are more Republican state legislatures and governors in the state mansions than at any time since Civil War reconstruction.

This means President Trump could have zero resistance to changing the debt-dollar system we have.

Whether Trump 'owning' the Fed means he would seek to upend the international monetary order is one thing. But, even if he doesn't do that, investors would be wise to consider what impact a Trump-controlled Federal Reserve would have on the world.

Why $10,000 per ounce?

It’s the gold price Donald Trump will need to use to “reboot” the U.S. dollar and the world’s international monetary system.

This isn’t a far-fetched concept, by the way…

Since the world financial crisis in 2008, many of the world’s governments have been buying physical gold in record amounts.

In fact, according to a recent report by the Official Monetary and Financial Institutions Forum (OMFIF), world central banks have been buying gold at a rate of 385 tons per year since the 2008 crisis.

Those are levels last seen when the world was on the gold standard pre-1971.

Why are they buying so much gold?

Because they know gold is going to be money again…

And the more gold they own, the more leverage they'll have when Trump calls the world’s financial powers together to reform the monetary system at his Mar-a-Lago resort.

As with chat surrounding soon-to-be gold standard, calls for $10,000/oz gold (or more) are also not uncommon in precious metal spheres. Since I began in the gold industry I have been reading about the imminent rise of the gold price to $30,000 even $40,000.

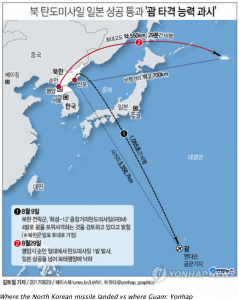

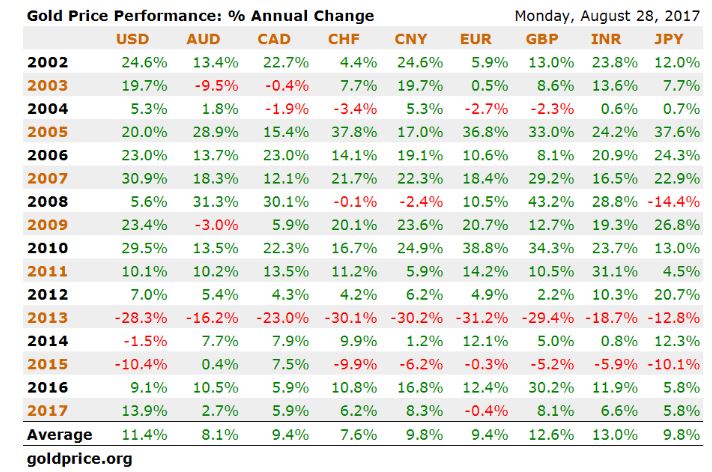

In truth, I believe such outlandish predictions are damaging for the long-term reputation of the gold and silver investment community. Regardless of where you think the gold price and gold standard could head to, it is all relative to your own situation, your own portfolio and the currencies you buy it in.

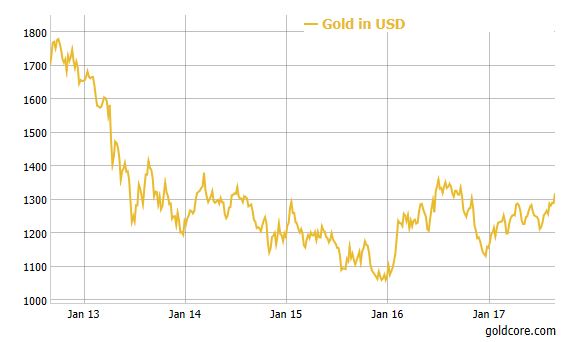

At the same time, while gold at $10,000 per ounce seems outlandish now, it is not impossible and indeed the scale of the levels of debt in the U.S. and internationally make it quite possible. When gold was trading at $250/oz in 2002, a rise of more than seven times and gold at $1,900 seemed outlandish to most.

Whether or not you believe Trump will ever achieve a new gold standard in a currency reset, it is vital to consider the point that central banks have been net buyers of gold for some time. A lesson for all investors.

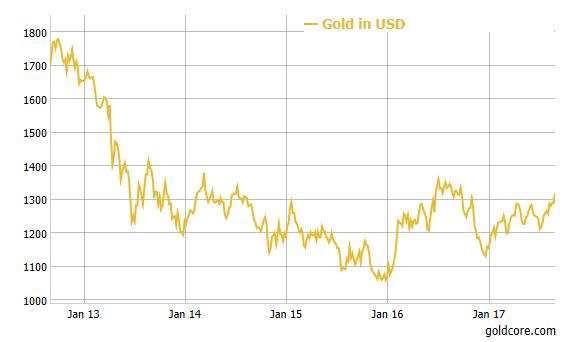

And the most important nugget to takeaway from pieces such as this is that governments are in a completely unsustainable, debt-laden position. The current state of the global economy is unprecedented. We are also in unknown times when it comes to technology, cyber threats and nuclear sabre rattling. Governments buying gold is sensible portfolio diversification.

Buying gold coins and bars a prudent way to hedge coming currency devaluations

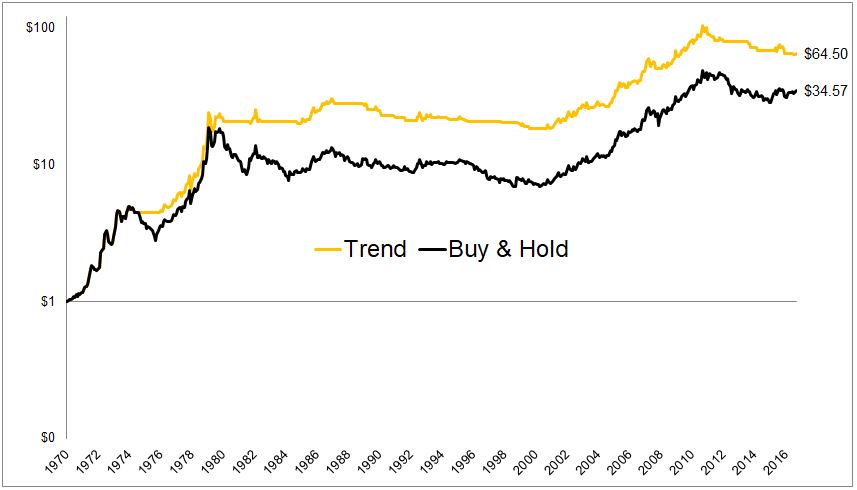

Rickards, Stratfor and even us here at GoldCore cannot predict what will happen in terms of the gold price. What we do know is that gold has played a very important role throughout history - especially as a hedge against currency devaluation.

Currency devaluations are coming and currencies are set to fall in value against gold as they have done throughout history. The only question is how much fiat currencies will fall versus gold and silver.

History has taught us that governments rarely know what they are doing when it comes to financial and monetary planning. It has also taught us that when times are tough countries turn on one another and war becomes common. Trade wars lead to currency wars lead to real wars. We are seeing that today.

Investors and savers are wise to think small. They should consider their own form of gold standard and how they can protect themselves. Buying gold bars, gold eagles and silver eagles including monster boxes is a prudent way to hedge the real risk of global currency debasement today.

The extracts are taken from an article which originally appeared on Agora Financial.

Gold eagles can currently be acquired from GoldCore at record low premiums of 3%.

Please call to secure coins as this is a phone call offer only and not available online.

Gold and Silver Bullion - News and Commentary

Gold slips on stronger dollar; geopolitical risks support (Reuters.com)

Asian markets rebound, shrugging off North Korea tensions (Marketwatch.com)

Crude slips, gasoline jumps as storm shuts a fifth of U.S. fuel output (Reuters.com)

ICE to take over London silver benchmark on Sept. 25 (Reuters.com)

Wall Street insiders sell bank shares as Trump rally reverses (Irish Times)

Gold to surge to $1,400 by early 2018 as rates stay low - BoA (Gulf News)

The Battle for India's $45 Billion Gold Industry Has Begun (Bloomberg)

Stevenson-Yang Warns "China Is About To Hit A Wall" (Zerohedge)

U.S. may revalue gold if debt ceiling isn't raised - Rickards (Daily Reckoning)

Gold Prices (LBMA AM)

30 Aug: USD 1,310.60, GBP 1,014.93 & EUR 1,096.71 per ounce

29 Aug: USD 1,323.40, GBP 1,020.34 & EUR 1,097.36 per ounce

25 Aug: USD 1,287.05, GBP 1,003.90 & EUR 1,090.90 per ounce

24 Aug: USD 1,285.90, GBP 1,003.26 & EUR 1,090.44 per ounce

23 Aug: USD 1,286.45, GBP 1,004.33 & EUR 1,091.68 per ounce

22 Aug: USD 1,285.10, GBP 1,000.71 & EUR 1,091.95 per ounce

21 Aug: USD 1,287.60, GBP 999.82 & EUR 1,096.52 per ounce

Silver Prices (LBMA)

30 Aug: USD 17.44, GBP 13.49 & EUR 14.60 per ounce

29 Aug: USD 17.60, GBP 13.59 & EUR 14.62 per ounce

25 Aug: USD 17.02, GBP 13.26 & EUR 14.40 per ounce

24 Aug: USD 16.93, GBP 13.20 & EUR 14.36 per ounce

23 Aug: USD 17.06, GBP 13.32 & EUR 14.48 per ounce

22 Aug: USD 17.02, GBP 13.27 & EUR 14.48 per ounce

21 Aug: USD 17.02, GBP 13.20 & EUR 14.48 per ounce

Recent Market Updates

- Gold Surges 2.6% After Jackson Hole and N. Korean Missile

- Diversify Into Gold On U.S. “Political Instability” Advise Blackrock

- Trump Presidency Is Over – Bannon Is Right

- The Truth About Bundesbank Repatriation of Gold From U.S.

- Cyberwar Risk – Was U.S. Navy Victim Of Hacking?

- Global Financial Crisis 10 Years On: Gold Rises 100% from $650 to $1,300

- Mnuchin: I Assume Fort Knox Gold Is Still There

- Buffett Sees Market Crash Coming? His Cash Speaks Louder Than Words

- Gold, Silver Consolidate On Last Weeks Gains, Palladium Surges 36% YTD To 16 Year High

- Must See Charts – Gold Hedges USD Devaluation, Rise in Oil, Food and Cost of Living Since Nixon Ended Gold Standard

- World’s Largest Hedge Fund Bridgewater Buys $68 Million of Gold ETF In Q2

- Diversify Into Gold Urges Dalio on Linkedin – “Militaristic Leaders Playing Chicken Risks Hellacious War”

- Gold Has Yet Another Purpose – Help Fight Cancer

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Gold’s naysayers and doubters came out in full force earlier this summer as sentiment reached its nadir. The mid-year pullback in prices did, too.

Gold’s naysayers and doubters came out in full force earlier this summer as sentiment reached its nadir. The mid-year pullback in prices did, too. Assuming the breakout holds, the next upside target is $1,375/oz, the high point for 2016.

Assuming the breakout holds, the next upside target is $1,375/oz, the high point for 2016. President Donald Trump so far hasn’t backed off his vow to pursue border wall funding even if Congress refuses and a government shutdown occurs. But a government shutdown in the aftermath of a major natural disaster could be a political disaster for whoever gets blamed for it.

President Donald Trump so far hasn’t backed off his vow to pursue border wall funding even if Congress refuses and a government shutdown occurs. But a government shutdown in the aftermath of a major natural disaster could be a political disaster for whoever gets blamed for it. Stefan Gleason is President of

Stefan Gleason is President of  Money Metals readers may remember my

Money Metals readers may remember my  In January, 2015, I penned an essay titled

In January, 2015, I penned an essay titled

David Smith is Senior Analyst for

David Smith is Senior Analyst for

The Gold/Dollar chart below reflects that Gold was much stronger than the U.S. Dollar (US$) from 2001 until 2011. Since 2011, the US$ has been stronger than Gold, as the ratio has declined for 6-years. Is it time for the worm to turn (Gold stronger than US$)? The ratio below reflects a big test is in play, that could answer this very important question.

The Gold/Dollar chart below reflects that Gold was much stronger than the U.S. Dollar (US$) from 2001 until 2011. Since 2011, the US$ has been stronger than Gold, as the ratio has declined for 6-years. Is it time for the worm to turn (Gold stronger than US$)? The ratio below reflects a big test is in play, that could answer this very important question.