Published here: http://redirect.viglink.com?u=http%3A%2F%2Fwww.zerohedge.com%2Fnews%2F2016-06-25%2Fhistoric-mind-boggling-rise-gold-open-interest-friday&key=ddaed8f51db7bb1330a6f6de768a69b8

June 25 - Gold $1315.60 - Silver $17.72

"There are no markets anymore, just interventions." … Chris Powell, April 2008

GO GATA!

Friday was a historic one for a number of reasons. One of them leaps off the charts this morning in our gold/silver sector world.

Due to the unexpected and stunning Brexit vote, the price of gold began to take off like a cat on a hot tin roof, as you know. At one point gold shot up just pennies shy of $100 an ounce … a price move that my friend John Embry has long said is needed to show The Gold Cartel is in the biggest of trouble. How close that came. Course, the real deal $100 up day has to be on a closing basis.

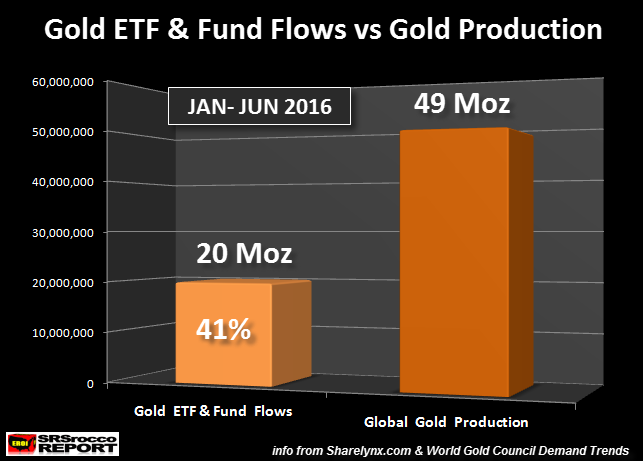

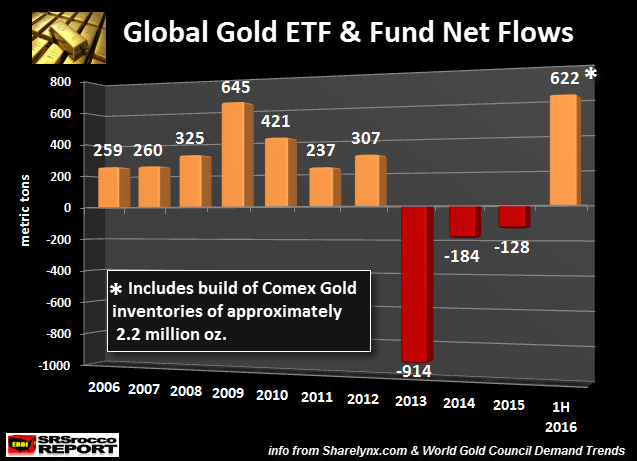

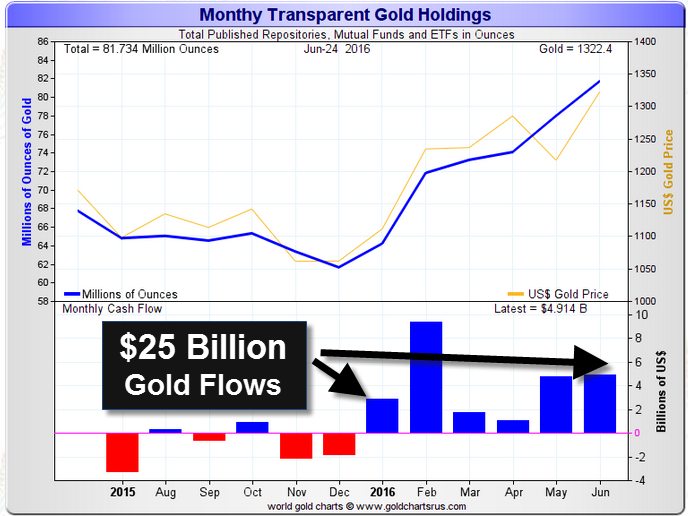

The jolting uncertainty over how that vote, and developing ramifications, will affect the world economic scene created a surge of interest in gold as the go-to fallout investment play. Zero Hedge reported that on Friday Google showed something like five times the normal hits on gold as a subject matter.

It seems that interest also reverberated into the investment arena.

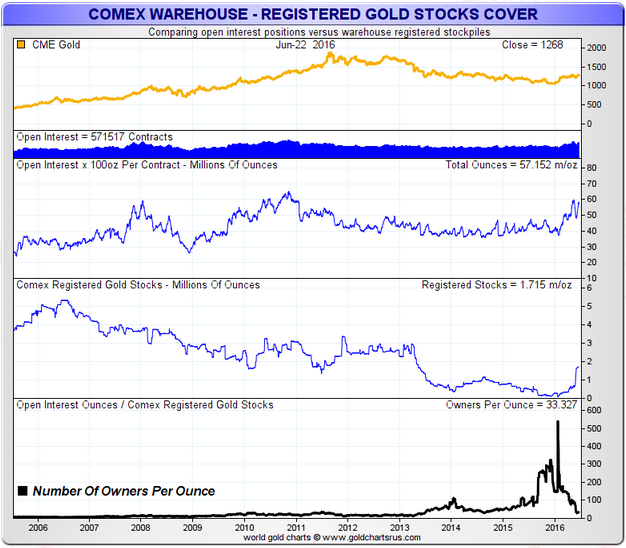

The gold and silver open interests are tallied on a daily basis. A "Preliminary" tabulation of their changes is usually posted late in the evening with a "Final" number posted mid-morning the following business day. At times the two numbers can be noticeably different, but for the most part, they are in decent sync.

Well, the "Preliminary" gold open interest just released revealed a mind boggling rise of 59,379 contracts to 628,885. The August contract alone was up 49,124 contracts. Throw out the window any over the top adjective you want to describe that number, and what took place on Friday, and it would not do it justice.

A big increase in the gold open interest would be in the 10,000 to 20,000 contract range with a 25,000 increase really registering on the radar screen. For that number to go up nearly 60,000 contracts puts it into seismic earthquake category.

Overnight the gold open interest shot up into multi-year high territory by a huge margin, the latest high being around 608,000. Gold’s all-time high number is around 650,000 when prices were FAR higher than they are at the moment.

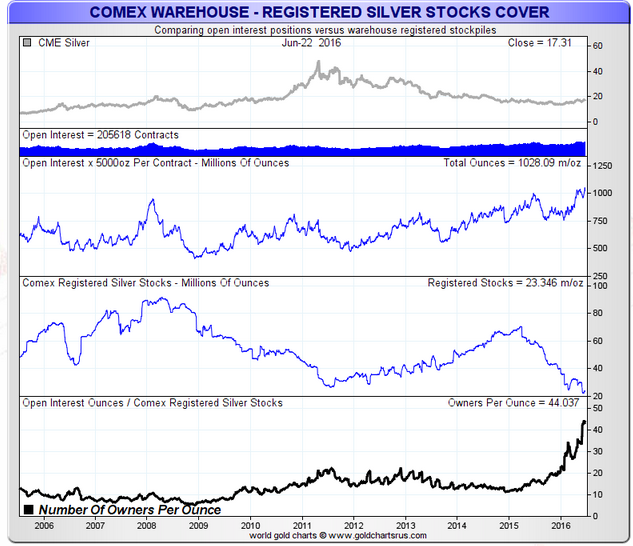

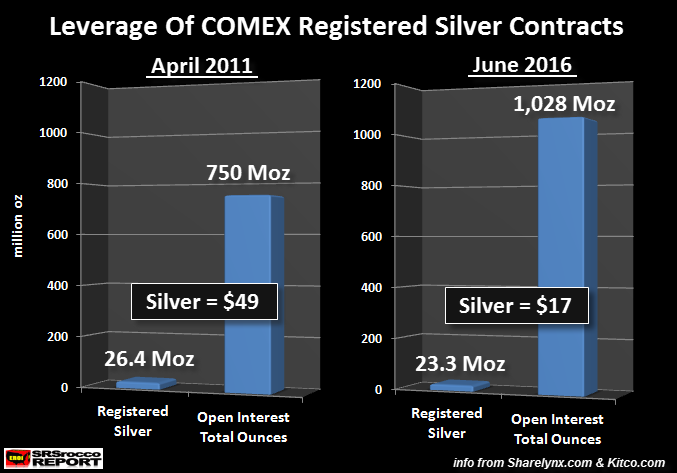

Meanwhile, to add to the drama the silver open interest, after soaring into its own all-time high territory by a SIGNIFICANT amount this week, went surprisingly down 636 contracts to 218,343. My expectation was that it would have gone up sharply once again. Scratching head time on that score. However, it is important to keep in mind the silver open interest was already 10% over its latest all-time high number and 15% over its older all-time high set a few years ago. And that is with silver prices in the DUMPSTER!

An explanation perhaps. Thursday is First Notice Day for the July silver contract. The July OI went down 3603 contracts with some spec longs deciding to take some profits ahead of exit time … especially considering the way the silver price was under such obvious JPM/Gold Cartel control on Friday, with the price of gold going bonkers at the same time.

The bottom line: the silver open interest is in all-time high territory, and gold is on its way there, with the prices of both precious metals artificially suppressed to very LOW levels. Simplistically, the gold price is less than half of what it would be if it had kept up with inflation in the U.S. and silver is nearly 1/3 of a price it was able to reach 36 years ago.

The current gold/silver prices of $1315.60 and $17.72 respectively are only that low because of the relentless efforts of The Gold Cartel forces. That their open interest numbers are skyrocketing with prices so low strongly points out the increasingly desperate situation THEY find themselves in.

More simplicity…

*The world financial situation is in a precarious state.

*Quantitative Easing and low/negative interest rates have been undertaken by the world powers to stimulate world economic sluggishness.

*Those efforts have really become stale in the tooth.

*Gold is a barometer of U.S., and world, economic health. Down is good, up is bad. Way up is terrible. Thus the gold price is suppressed over and over again thanks to the elitist/establishment world.

*Silver is allied with gold. It has been put in the penalty box along with gold because a noticeable price dichotomy between the two would attract too much attention to what and why The Gold Cartel is doing to the price of gold.

There have been signs all year that this Gold Cartel is reaching a Tipping Point in which they will be unable to carry on and be effective at the current artificially low gold/silver prices … that they are going to be forced to retreat to MUCH higher price levels to continue their operations … operations which might even not be viable in the years ahead.

As you know, the mantra here this year is that gold and silver will never go up again from current price levels until we get a Commercial Signal Failure … which means The Gold Cartel forces short positions are routed by price explosions … with the weakest cabal members, and followers, forced to cover because the financial pain is too great.

The incredibly high gold/silver open interest numbers strongly suggest that Commercial Signal Failures are getting closer and closer at hand. As those failures manifest themselves, the prices of both precious metals will soar. For if a number of THEM are buying, who in the heck is going to be selling? It certainly won’t be the specs, who based on all of history, will be adding to their positions, like they are doing now.

POINT: the jolting Brexit vote is VERY likely to be the catalyst which finally causes Commercial Signal Failures because of the whopping new interest to buy gold (and silver) all over the world. It is going to be just TOO MUCH for the bums to deal with.

So, no matter what sort of counterattack The Gold Cartel feels compelled to launch in the days ahead, it is going to be overrun and fail. As time goes by these last gasp efforts to keep the gold and silver prices artficially submerged will look both pitiful and pathetic.

The price of gold is going to soar this year.

As for silver, been pounding my thoughts on the table all week. What THEY have done to the silver price is probably unprecedented. As a result, it is a coiled spring that is about to be sprung. Once silver is able to penetrate $18.50 on the upside, it will open Pandora’s Box. The price action at times will be similar to what we saw in gold on Thursday with its $10 higher upticks. Stay tuned!

The price action of the gold/silver shares have been screaming all year that mega upside price moves are in the works for the precious metals prices. The correction in the shares have been few and far between. Big Money (perhaps some of the in-the-know bad guy’s own money) keeps piling in. These savvy investors know what is coming down the pike and many certainly have a clear idea that The Gold Cartel’s jig is soon to be up.

If there ever was a time to be all over the precious metals sector, this is it!

So rule, Britannia -- Britannia, rule thyself

Submitted by cpowell on 02:21PM ET Friday, June 24, 2016. Section: Daily Dispatches

By Chris Powell

Journal Inquirer, Manchester, Connecticut

Friday, June 24, 2016

http://www.journalinquirer.com/opinion/chris_powell/rule- britannia----br...

Recognizing that the objective of the European project, ever-closer political and economic union, meant the destruction of democracy, sovereignty, and the country's very culture, Britain has voted in a great referendum to withdraw from the European Union.

The majority arose from a remarkable combination of the free-market, limited-government political right, the core of the Conservative Party, with the working-class political left, the core of the Labor Party, both party cores repudiating their leaderships as well as the national elites.

The result has enormous implications for the United Kingdom, starting with whether it can remain united, since Scotland - - formerly the most industrious and inventive province in the world, now perhaps the most welfare-addled -- probably will make a second attempt to secede, figuring that free stuff is more likely to flow through continued association with the EU than with England, which is growing resentful of the freeloaders up north.

But there are enormous implications for the world as well. The EU project never has won forthright ratification by the people of its member states and indeed has sometimes refused to accept rejection by them. Indeed, the whole EU government is largely unaccountable. So the British vote quickly prompted demands for similar referendums in France and the Netherlands, where conservative populist movements have been gaining strength.

The politically correct elites are portraying the British vote as a "xenophobic" response to free movement of labor across the EU and particularly as opposition to the vast recent immigration into Europe from the Middle East and Africa. This immigration is widely misunderstood as being mainly a matter of refugees from civil war. In fact this immigration has been mainly economic and it has driven wages down in less-skilled jobs while increasing welfare costs throughout Europe, which explains the British Laborite support for leaving the EU.

But it is not "xenophobic" to oppose the uncontrolled and indeed anarchic immigration the European Union has countenanced. For any nation that cannot control immigration isnt a nation at all or wont be one for long. Since most immigration into Europe lately has come from a medieval and essentially fascist culture and involves people who have little interest in assimilating into a democratic and secular society, this immigration has threatened to destroy Europe as it has understood itself. Britain has been lucky to be at the far end of this immigration, but voters there saw the mess it has been making on the other side of the Channel. They wisely opted to reassert control of their borders.

Their example should be appreciated in the United States, which for decades has failed to enforce its own immigration law and as a result hosts more than 10 million people living in the country illegally and unscreened. Fortunately few of this country's illegal immigrants come from a culture that believes in murdering homosexuals, oppressing women, and monopolizing religion. But the negative economic and social effects here are similar to those in Europe and properly have become political issues.

The main lesson of Britain's decision may be an old one - - that nations have to develop organically, arising from the consent of the governed and a common culture, and that they can't be manufactured by elites. Having defended its sovereignty and indeed liberty itself against Napoleon and Hitler, Britain now has set out to defend them again. So rule, Britannia -- Britannia, rule thyself.

The nations not so blest as thee

Must in their turn to tyrants fall,

While thou shalt flourish great and free,

The dread and envy of them all.

-----

Chris Powell is managing editor of the Journal Inquirer.

GATA BE IN IT TO WIN IT!

MIDAS

I explain this phenomenon in more detail in my Bullet Report:

I explain this phenomenon in more detail in my Bullet Report:

“Look at that screen,” exclaimed Fox Business Network’s Stuart Varney, referring to the television graphic showing markets crashing across the globe. “The only thing going up is the price of gold!”

“Look at that screen,” exclaimed Fox Business Network’s Stuart Varney, referring to the television graphic showing markets crashing across the globe. “The only thing going up is the price of gold!”  Spanish Catalonia was all set for independence from Spain in 2014, until stopped in its tracks by Spanish courts. Scotland the same year managed to muster 45% of three million votes in a losing bid to leave the UK. Quebec voted down independence from Canada in 1995, but has never stopped talking about it.

Spanish Catalonia was all set for independence from Spain in 2014, until stopped in its tracks by Spanish courts. Scotland the same year managed to muster 45% of three million votes in a losing bid to leave the UK. Quebec voted down independence from Canada in 1995, but has never stopped talking about it. Here at home, the current and former governors of the always revolution-ready Texas have suggested secession from the United States. A move to include secession as a plank in the

Here at home, the current and former governors of the always revolution-ready Texas have suggested secession from the United States. A move to include secession as a plank in the