'Three wise men' are warning that the next financial crash is coming and that one of the ways to protect and grow wealth in the coming crash will be to own gold.

The men who have recently warned are Jim Rogers (video below), Martin Armstrong (blog below) and Tony Robbins (video below). Each come from somewhat different backgrounds and are respected experts in their respective fields.

Each has different views in terms of asset allocation and how best to weather the coming financial storm but all are united in believing that gold will act as a wealth preservation tool and will likely rise in value when other assets fall.

Jim Rogers is a world renowned investor who co-founded the Quantum Fund with fellow investor George Soros. He is an investor, traveler, financial commentator and author who believes that this will be the 'Asian Century.'

In his usual plain speaking, honest manner, Jim Rogers warned on Bloomberg TV that

"the Federal Reserve... has no clue what they are doing. They are going to ruin us all."

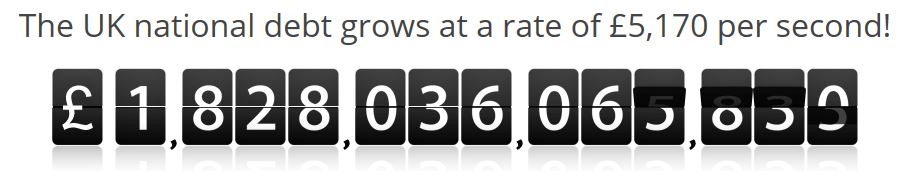

Central banks have driven rates to all time record lows and in the process, debt has "sky-rocketed."

Rogers slams the 'counterfactual' arguments that things would have been a lot worse if the Fed had not done all this, "propping up zombie banks and dead companies is not the way the world is supposed to work. ... It's been nine years and we have nothing to show for it [economically] except staggering amounts of debt."

Rogers is pessimistic about the outlook for America and thinks that Donald Trump will see the US continue on the path to bankruptcy - a path set by Bush and Obama before him.

He concludes the Bloomberg interview ominously by saying that "this is all going to end very, very, very badly."

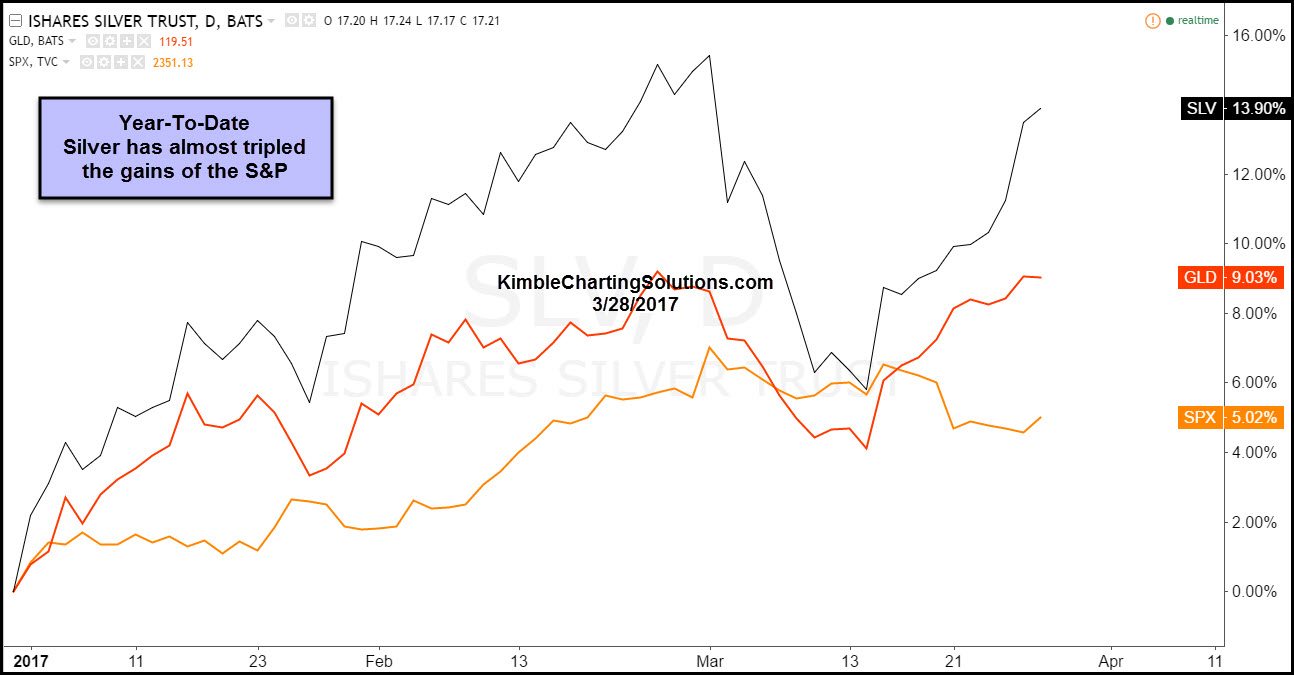

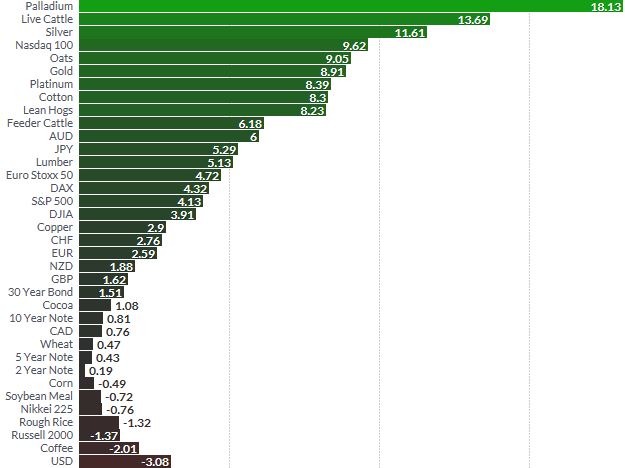

In recent years, Rogers has consistently said that he wants to own more gold and silver and will continue to accumulate the precious metals on any price dips.

Watch Rogers on Bloomberg TV here

Financial analyst and trends forecaster, Martin Armstrong warned on his Armstrong Economics blog this week that governments are in increasing trouble and people will start to lose confidence in their governments:

"Gold and the stock market will take off when people realize that government is in trouble. When they lose confidence, that is when they will start to pour into tangible assets."

Armstrong is nervous about gold in the short term and thinks it could fall as low as $1,000 per ounce prior to surging to as high as $5,000 per ounce in the coming years.

Tony Robbins, performance coach and self help guru has warned that "The Crash is Coming."

Robbins, who is focusing more on finances and wealth in recent years and in his latest book, 'Money: Master The Game', says plan now for what's to come. Things may be looking rosy on Wall Street as of late, but the crash will come.

"We are in a really artificial situation. There is a new high, on average, every month. Feds around the world have been printing money," said Robbins in a tv interview.

Robbins has long advocated owning gold as part of a diversified portfolio and has cited Kyle Bass, Marc Faber and more recently Ray Dalio as his financial gurus. In his recent book, Robbins cited Dalio and recommended an asset allocation strategy that involves a 7.5% allocation to gold.

Given the increasing risks of another financial crash, the warnings from these very different three men should be taken heed of. They underline the importance of being prudent, of real diversification and of owning gold.

The smart money sees what is coming and is once again preparing.

Gold and Silver Bullion - News and Commentary

Gold to edge up in 2017 as risk-averse buying offsets oversupply - GFMS (Finance.Yahoo.com)

Gold firm despite dollar strength; political uncertainty supports (IndiaTimes.com)

Massive debt increase forecast by Congressional Budget Office (CBSNews.com)

EU to Trump: Mess With Brexit and We’ll Mess With Texas (Bloomberg.com)

The Fed Is Bedeviled by Keynes's Paradox (Bloomberg.com)

- 'The Frame' - 150 Metre High Gold Plated Towers in Dubai

Low interest rates are likely to drive fresh investment in gold (Reuters.com)

Jim Rogers Says Fed Has No Clue, Will 'Ruin Us All' (Bloomberg.com)

Savers and Retirees "Impossible" Financial Choices To Make (Bloomberg.com)

CBO Warns Of Fiscal Catastrophe As A Result Of Exponential Debt Growth In The U.S. (ZeroHedge.com)

Why Brexit Makes Gold A Buy (Nasdaq.com)

Gold Prices (LBMA AM)

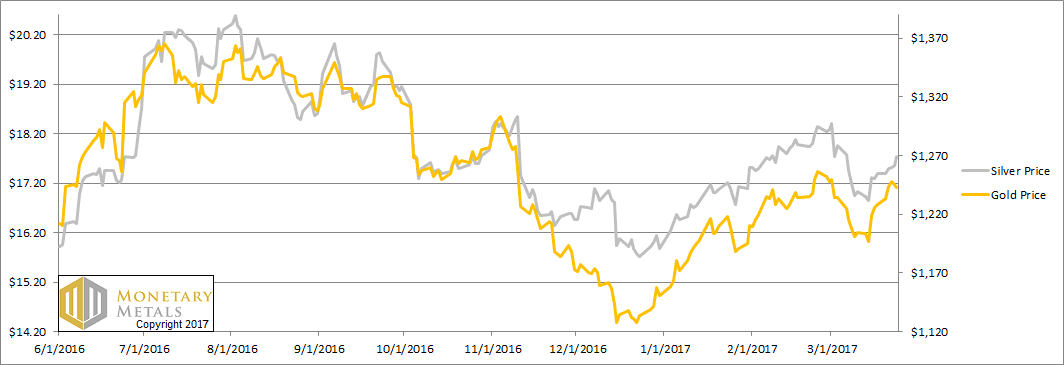

31 Mar: USD 1,241.70, GBP 9,996.46 & EUR 1,161.98 per ounce

30 Mar: USD 1,250.90, GBP 1,005.72 & EUR 1,165.34 per ounce

29 Mar: USD 1,252.90, GBP 1,007.71 & EUR 1,161.19 per ounce

28 Mar: USD 1,253.65, GBP 996.15 & EUR 1,154.49 per ounce

27 Mar: USD 1,256.90, GBP 1,000.49 & EUR 1,157.86 per ounce

24 Mar: USD 1,244.00, GBP 996.20 & EUR 1,150.82 per ounce

23 Mar: USD 1,247.90, GBP 997.95 & EUR 1,157.93 per ounce

Silver Prices (LBMA)

31 Mar: USD 18.06, GBP 14.50 & EUR 16.91 per ounce

30 Mar: USD 18.10, GBP 14.53 & EUR 16.85 per ounce

29 Mar: USD 18.13, GBP 14.58 & EUR 16.81 per ounce

28 Mar: USD 17.94, GBP 14.29 & EUR 16.53 per ounce

27 Mar: USD 17.94, GBP 14.25 & EUR 16.51 per ounce

24 Mar: USD 17.63, GBP 14.11 & EUR 16.31 per ounce

23 Mar: USD 17.55, GBP 14.04 & EUR 16.27 per ounce

Recent Market Updates

- Brexit Gold Buying – UK Demand for Gold Bars Surges 39%

- ‘Most Secure Coin In the World’ ?

- Gold Bullion Coin Worth $4 Million, Stolen in Berlin Museum Heist

- Gold, Silver Rise 2.5% and 3.2% As ‘Trump Trade’ Fades

- Gold ETFs or Physical Gold? Hidden Dangers In GLD

- Gold Prices See Seventh Day Of Gains After Terrorist Attack In London

- Peak Gold – Biggest Gold Story Not Being Reported

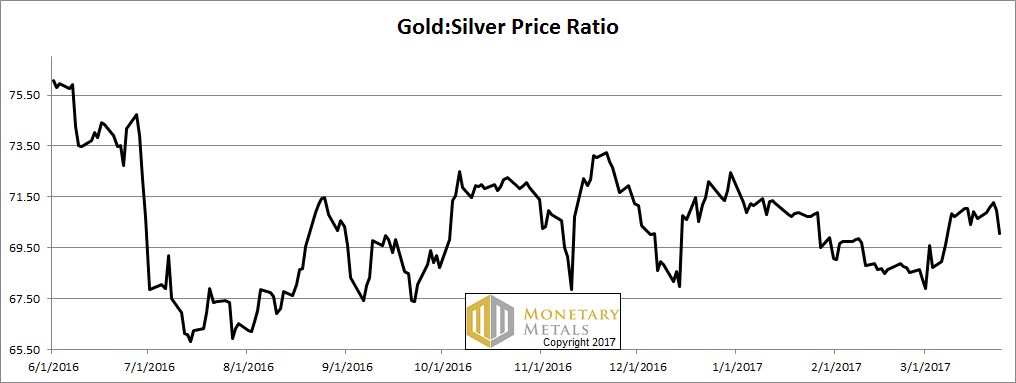

- Silver 1/ 70th The Price of Gold – Silver Eagles Sales Jump

- The Best Ways to Invest in Gold Today

- Gold Cup – Horse Racing’s Greatest Show, Gambling and ‘Going for Gold’

- Gold Up 1.8%, Silver Up 2.6% After Dovish Fed Signals Slow Rate Rises

- Most Overvalued Stock Market On Record — Worse Than 1929?

- EU Crisis Is Existential – Importance of Tomorrow’s Vote

Access Daily and Weekly Updates Here

Interested in learning more about physical gold and silver?

Call GoldCore and speak with a gold and silver specialist today