Published here: http://redirect.viglink.com?u=http%3A%2F%2Fgoldsilverworlds.com%2Fgold-silver-price-news%2Fchris-martenson-underpriced-silver-is-the-rip-van-winkle-metal%2F&key=ddaed8f51db7bb1330a6f6de768a69b8

Listen to the Podcast Audio: Click Here

Mike Gleason: It is my privilege now to be joined by Dr. Chris Martenson of PeakProsperity.com and author of the book, Prosper: How to Prepare for the Future and Create a World Worth Inheriting.

Mike Gleason: It is my privilege now to be joined by Dr. Chris Martenson of PeakProsperity.com and author of the book, Prosper: How to Prepare for the Future and Create a World Worth Inheriting.

Chris is a commentator on a range of important topics such as global economics, financial markets, governmental policy, precious metals, and the importance of preparedness, among other things. It’s great, as always, to have him with us. Chris, welcome back, and thanks for joining us again.

Chris Martenson: Mike, it’s a real pleasure to be here with you and your listeners.

Mike Gleason: Well it’s been a number of months since we’ve had you on last, far too long by the way, and there has been a ton of things going on in the financial world of late. I’ll get right to it here. For starters, what did you make of the Brexit decision last month? Is this potentially the beginning of some meaningful opposition to the ongoing drive for a world government? Or was this just a one-off event?

Chris Martenson: No, this was not a one-off event, this was a continuation of a pattern that we’ve been talking about at Peak Prosperity for a while. We thought that there were three scenarios for the future. One of them we called fragmentation. I think this is the beginning of it, and fragmentation has its roots in a growing wealth gap. It happens when you have a stagnant to shrinking economic pie that is increasingly seized by the elites who are tone deaf.

And when they do that, people get cranky, and this is the first form of crankiness we’ve seen break out. Austria is next, we are going to see the sweep across Europe, I believe. People have seen that austerity is just a punishment by the bankers upon the average people for the sins of the banker. It feels unfair because it is.

I think Brexit as a political statement is just the beginning, and of course the powers that be are going to do everything they can to paint this as a mistake and punish the wrong people again.

Mike Gleason: What about the banking system, despite some recovery in the past week or two, the European bank stocks have been getting hit hard. We’re seeing that Italian banks need to bailout, and the share price of Deutsche Bank is signaling that the firm is in real trouble. The IMF just named them the riskiest financial institution in the world.

There is a rally here in share prices, Brexit appears largely forgotten, and Wall Street certainly isn’t acting too worried. Is the concern over European banks overdone? Or might we see a firm like Deutsche Bank actually collapse. And what do you see as the ramifications here in the U.S.?

Chris Martenson: The European banks are absolutely in trouble. I think they are insolvent, that is the step that precedes bankruptcy which is a legal action. Insolvency is just when your assets and your liabilities have a big mismatch. We know that’s the case for the European banking shares. It also explains, Mike, why we are seeing this rally, we call it on Wall Street, but it’s global.

We saw two things. First, we saw a big decline, a scary decline in January, and then this miracle, nipple bottom vault back up to the highs that came out of nowhere. To me, that was a liquification event. Somebody put a lot of liquidity into the system. We know that the central banks are coordinating on this because they are scared of the Franken-markets they’ve created. They cannot even tolerate a few percent decline without freaking out. That should freak ordinary people out, because if they are scared, you should be too.

So they re-liquefied like crazy, and then we had just another post Brexit re-liquification. My evidence, stocks at all-time highs, bonds at all-time highs. Listen, you cannot have that unless there is a lot of liquidity coming from somewhere. People cannot be panicking both into negative interest yielding bonds and stocks at the same time for this to make sense through any other lens than the central banks are absolutely pouring money into these markets.

Mike Gleason: Yeah, it’s certainly been a head scratcher to watch these equities markets, the DOW and the S&P making these all-time highs in the wake of what we’ve seen here recently. That’s a good explanation and I don’t see any other potential for why that’s happened. That’s not sustainable forever, they cannot get away with that forever before without the bubble finally bursting, is that fair to say?

Chris Martenson: That is fair to say. And just for your listeners, I just got back from a major wealth conference. These are people, families, institutions that are managing enormous money… they’re all scratching their heads. I watched these poor fund managers and CIOs, that’s investment officers, attempt to explain all of this. They contorted themselves into pretzels. I got up there and just said, “Look, somebody is dumping money in this market.” A lot of heads started nodding. First wealth conference I’ve been to, Mike, in many years where I was no longer the contrarian in the crowd. That makes me nervous.

Mike Gleason: Switching gears here a little bit, what do you make of all of the recent social unrest here in the U.S., Chris? We’ve seen police shootings followed by protests and revenge killings of police officers in a number of cities around the country. Then we’ve got probably the two most polarizing figures ever running for president. The months between now and the November election are sure to be interesting. But there is at least the potential that they could also be very dangerous. What does the recent unrest signal here Chris?

Chris Martenson: I think this is connected to the same factors that I talked about with Brexit. Look, Mike, what’s happening here is that people are getting squeezed. If you believe the inflation numbers go get your head checked or study up on it, because we know we are getting inflation. It’s at least twice as high, maybe three times as high as officially announced. And that’s really hurting people, savers just getting crushed.

We are watching banks get bailed out, we are watching Hillary skate on what are obvious transgressions of the law as it’s written and it’s not a complicated law to understand about mishandling of classified information. She got a pass on that amongst other things. So listen, we’re primates. Fairness and justice are hard wired into us, that’s a thing. People are feeling and seeing the unfairness of this all.

What it comes down to, really, for me, Mike at this stage, is they ran these really interesting experiments back in the 40’s and 50’s. Where they would take a rat and put it in the cage, make it so there is nothing in the cage so it cannot escape, and they shock the floor. The rat hates it but ultimately they figure out how to tolerate it. They curl up in a ball, they’re miserable.

If you put two rats in the cage, what happens is that all of a sudden they are both getting shocked, they are both hated, it’s painful, but now they have somebody to look at and go, “Oh, it’s you.” And they fight. And if they leave them in there long enough, they fight to the death.

What that experiment shows us is that when people – and rats and people are the same this way – if you don’t know where the shocks are coming from, you go to the blame game. That’s what we are starting to see. I believe that police and the people they are policing are actually on the same side of the story, but they don’t know it, so they are looking at each other, they are blaming the wrong parties in the state. The pie is no longer expanding. In fact, the piece of the pie that used to belong to even the upper middle class on down is being rapidly vacuumed out.

All that oxygen is being sucked out of the room by a financial system, not just bankers but a complete financial system that just doesn’t know how to say enough. And it’s vacuuming more and more for itself at ever increasing rates. That’s leaving less and less for everybody else. Guess what? Along comes polarizing figures. One who is representing the status quo, and allows people to default into the denial of saying, “Well, if we just get back to pretending that everything is okay and we shoot for the middle zone and don’t see anything too troubling, things will be okay.” Spoiler alert, they won’t.

And then another guy that’s saying, “Hey, I got an answer for this, and this is troubling and we need to start getting angry about this.” So he’s tapped into the anger side, and I think both of them are missing the mark on this, which is that we have to have a more fundamental substantive discussion about what’s really happening in this country, which is that we have some systems that are run amok and they are going to take us into a really dark territory if we don’t stop them now.

Mike Gleason: For the people who live in these urban areas where there is maybe a little bit more danger in being in an environment where there is a lot of animosity towards police officers. I know you’ve organized your affairs, so you are no longer living in a major metropolitan area, do you have advice for people to maybe consider that type of move given the fact that there could be some real instability in some of these major city centers with all of this violence?

Chris Martenson: Short answer, move. Longer answer, be prepared to move. I do work with people who live in urban areas that they are there for a variety of reasons, they’re not ready to make the move, but they are increasingly having plans for how they would get out of there. Listen, the difficulty of this Mike is this idea of shifting baselines, where if you are a person and you took a person today from my town and you dropped them into Oakland, California they would leave so quickly because it would be like dropping a frog in boiling water. They would jump right out of that.

But for people living there, it’s a little bit violent, but it’s four blocks away, and somebody got shot six blocks away. A month later, it’s two blocks away, but that’s okay, the police responded quickly. Over time, people lose their sense of perspective over what’s happening. So my invitation to people is to really look around and actually see what’s happening, ask yourself if the trend is getting better or worse.

And regardless of whether it’s getting better or worse, is that really where you want to live? A lot of people say the answer is no, but they don’t know what to do next. My invitation is, well, start figuring out what that plan is because there really is no time like the present to begin figuring these things out. It takes time, it just takes time.

Mike Gleason: Changing gears again here. I want to get your thoughts on the Fed. The FMOC meets again next week, they have been punching on interest rate increases. We’ve had mixed economic data, growth below expectations and central bankers everywhere are ramping up stimulus. Janet Yellen and company are finding it exceedingly difficult to tighten. Throw into that that this is an election year. What do you see the FMOC doing between now and the election? Could we see some kind of surprise to the dovish side to help boost the markets and keep the status quo going this November? What are your thoughts there?

Chris Martenson: Yeah, that’s the 85% probability. I’m on record as saying that I thought it was more likely that they were going to lower rates instead of raise rates on their next move, whenever that comes. I said that back in December after that first tiny little wiggle hike. And the reason I said that is because look, you can’t have the United States raising rates while the rest of the world’s rates are going down. That just doesn’t make sense from a variety of logical standpoints. But let’s be clear, the Fed follow, it doesn’t lead.

This is not an aggressive, assertive organization ever since Paul Volcker left. These are not people who have the moxie to run against what the markets want. They’re totally captive to the markets, the markets are clearly saying rates are going down. I don’t think this fed has it in them to do anything other than follow the markets. So since the markets are going down, the best the Fed can do is hold pat. But at some point, honestly, I would put a little bit more money on the wager that said the next surprise would be to the downside not the upside. Especially in an election year.

Mike Gleason: Speaking of following and not leading, I don’t know if you have been following Alan Greenspan and his comments, but now all of a sudden late in life after leaving his Fed chairman post, he is now advocating for a gold standard. It’s quite amazing to hear that come out of that man’s mouth after all these years. Maybe it just goes to the fact that when you are in that position, you’re just following and you’re not making any real leading decisions. What have you made of what Alan Greenspan has had to say in these recent days?

Chris Martenson: Yet another extremely disappointing CYA retirement circuit lap. We’ve seen this a lot, Senators who finally on their retirement day say, “Oh, by the way, Washington is really broken, here is all the ways they are.” Eisenhower on the way out, “Hey, watch out for this military industrial complex.” Yeah thank you, would love to have had those insights while you still could have made some decisions that would have shown that you had the personal fortitude and internal authenticity to have stood up and done what was right.

So for Alan to come out afterwards, I agree with a lot of what he is saying, it’s too little, it’s too late. It doesn’t do anything to resurrect or buff his reputation in my eyes. I think he was the architect that will ultimately end so badly, that his name will be mud if you follow the historical reference, for a long time coming.

Mike Gleason: What is your best guess for what to expect in the markets between now and the election… particularly for the metals? We’ve had an excellent first half of the year in gold and silver, although they have struggled a bit here in the last week or two. So do you see this as maybe a short term pause before the next leg higher? Basically can the metals match the performance in the second half of the year that they had in the first half?

Chris Martenson: Well I still think metals of course, particularly gold given the monetary shenanigans, that’s something that has to be in everybody’s portfolio. It’s your insurance policy, get it there. I really thought that Grant Williams about a year ago had just to me the quintessential, best gold exposition where his summary was, “nobody cares”.

And his thought was that the west is perfectly happy to sell gold, we’re perfectly happy to sell our paper gold on the COMEX. We’re perfectly happy to see about 1,000 to 1,500 tons a year leave western vaults just for Shanghai alone. So we were okay with that because nobody cared. The Treasury didn’t care. He was talking with fed officials, like, “Yeah, if we lose gold, it’s fine.”

The west is starting to care. This hearkens back again to this wealth conference I was at, big money people, of course I’m always testing the gold waters with them. And more and more people are saying, “Yeah, I’m thinking about gold now.” So we’re starting to see this really show up on the western radars. I think that if I was going to mend Grant’s title, it moves from “nobody cares”, to “some are starting to care.” And that’s a very constructive environment for gold, just from that standpoint.

And the other part, of course, has to be how can gold not be constructive in a negative interest rate environment? People used to always say, “Chris, gold doesn’t yield anything.” And now I get to say, “Well at least it doesn’t yield negative something.” So this is a really positive environment for gold. It’s clear somebody has an interest in not allowing gold to go up. We saw that on Friday late night post Brexit. Somebody put 50,000 new open interest contracts to contain gold at the $1,360 mark. And we don’t know who that was, but we can all guess.

Mike Gleason: At some point you have to think that more and more people will recognize it as a safe haven. You talk about the wealth conference you just went to, about how maybe more and more people are starting to wake up to the idea of owning precious metals as a way to hedge against what may come. Obviously, and I’m talking about physical bullion now, there is not a tremendous amount of it. There’s been so much of it going to the east, and the west does not have a whole lot of precious metal left at this point.

If we did see an increase from say 1% of the general public and going to 3% or 5% of the general public, I have to think there is going to be a difficulty getting your hands on the metal if you wait too long. Is that fair to say?

Chris Martenson: That is fair to say, particularly at the retail level. I think the people who have the big, big money, they have access to vaults that you and I don’t normally have access to. There’s a very different structure for the big 400 ounce and 1,000 ounce bars for gold and silver respectively. But for people who want to buy coins, we saw this in ’08, we saw it in 2011 again when there were big price moves, particularly to the down side in silver where people started to want to get into that market.

And those were almost exclusively people who had already bought silver. This wasn’t new people coming into the market, just people looking for better deals. That alone swamped the retail supply chain, the refineries were maxed out, the mints were maxed out, supplies were tight, and the wait times ballooned out to six and eight weeks in some cases.

So that’s our learning which is that when the metals really do begin to move, your chance as a retail investor to get into that are going to be very, very limited if you wait or the percentages move from whatever it happens to be, 1% or 2%, to 3% or 5%. I think that that will swamp the retail availability for quite a while.

And then, you know what, people are going to be stuck with, and they’re going to say, “Oh there’s a six week wait.” When six weeks comes by, they discover that the price has moved a lot at that point in time. So either you put a lot of money on the line in the hopes of being in line somewhere, or you wait and discover that both the prices and availability have scurried away from you in the meantime. It’ll be hard I think psychologically if not practically for people to acquire what they want. So my motto always is I’d rather be a year early than a day late.

Mike Gleason: Very good advice. In terms of gold versus silver, obviously gold is really just monetary demand that drives that market, but silver is both pushed and pulled from both the industrial demand and the monetary demand. Generally speaking, when we see the metals rising, we’ll see silver outperform, but if we have an economic slowdown, perhaps that could hold silver back a little bit as it gets maybe lumped in with copper and oil and other industrial types of commodities. What are your thoughts there on the potential for silver versus gold going forward?

Chris Martenson: They’re very different words to me. A lot of people say, “Gold and silver” like it’s one word. They are two words to me. Gold is my monetary metal, love it, I have it because I think a monetary crisis is happening. If you have a short term horizon, I like gold better because I think we are having a monetary crisis first before we have a big industrial resurgence.

Silver, primarily Mike I love it as the industrial metal, as something who’s known ore grades are vanishing and deposits are depleting, and we know that it’s being used increasingly for more and more industrial applications. Silver is my Rip Van Winkle metal. I love it. If somebody said, “I need to pick one of these two, 20 years I want to be happy when I wake up.” Silver’s it. It’s a volatile metal that goes up and down, I think it could have a run down if we hit a capital “R” recession or depression across the world… if China blows up or something like that. But barring that, I love silver because of its actual supply and demand characteristics going forward. I think it’s heavily underpriced here.

Mike Gleason: Well as we begin to close here, Chris, what would you say are maybe the top three or four actions that people could be taking right now to become more self-reliant and generally more insulated from the chaos that’s on the horizon?

Chris Martenson: Well if I could just plug my own book here for a minute that I wrote with Adam Taggart called Prosper. What we do there is we specifically talk about steps people can take so that they will be more resilient given certain futures that might arrive. But every one of these steps we advise will make your life better today. So there’s really no way to lose in this story.

What we do is we have eight forms of capital that we like people to focus on. Financial capital, which commonly everybody focuses on only. But what we’ve found, and there’s a great quote, it says, “None are so poor as those who only have money.” If you only have financial capital you are not resilient. So there’s seven other forms of capital we talk about. I’ll just go through a couple.

One is social capital. Not just how many people you know, but how well you know them. Have you had experiences with them? Have you seen them operate under a variety of scenarios so you know really who they are at core? Building that social capital is going to be one of the most important things you can do to build you resilience. And guess what? You’ll know more people and connections are proven to make us happier, more fulfilled people.

Emotional capital, also in the mix. This is very important. It doesn’t do any good to be rich in all sorts of other areas if when a crisis comes you basically fold up your mental shop and shut down. Not good. We already see people doing this with increased rates of suicide, drinking, video game playing, other forms of numbing out because the reality is just not appealing. We think there’s lots of ways to rotate your thinking so that you can be positioned to not just be on the wave of change that’s coming, but the surf it.

There’s great opportunities coming here, but not for people who are going to be feeling the loss of the changes instead of the opportunities in the change. So those are just a couple of examples. Living capital is an example, knowledge capital, time (capital). Things like that. And so this book is our collection of stories and personal experiences with each of these forms of capital, from having worked with thousands of people in our seminars, at our website, Peak Prosperity. For people who are consciously and prudently as adults saying, “Hmm, different future coming, how can I be prepared? More importantly, how can I be resilient so I can increase my quality of life today and be more prepared for tomorrow?”

Mike Gleason: Yeah, it’s truly fantastic stuff. Obviously it was years in the making. You and Adam did a fantastic job, so many practical things in there. Now as we begin to close here Chris, why don’t you talk a little bit about the Peak Prosperity site and then also let people know how they can get their hands on that book if they haven’t already done that.

Chris Martenson: Thanks Mike. Yeah, the site is PeakProsperity.com. And we have a lot of free content there, we have a subscription newsletter for people who like to go a little deeper and maybe have more information. Our site is dedicated to two big things. One is educating, we want people to understand the context of what’s happening so they are not one of those rats getting shocked without an understanding of what the shocks are.

Once you know what the shocks are, then you have information that’s really important, that can help you move when other people are paralyzed or confused. So that’s half the site, the other half is about how we can become more prepared, more resilient… (there’s a) wonderful community of people there. They are very thoughtful. If I could identify us with one word, I would say we are all curious.

This is a life to be lived, it isn’t a dress rehearsal, we are not here hunkering down saying, “Woe is us, bad times coming.” We’re saying, “Big changes coming, now what do we do about it?” So it’s very positive while realistic, if I can put those two words together. And Prosper, the book, available on Amazon. You can come to the website and get that. It’s available pretty much everywhere.

Mike Gleason: Well again, excellent stuff. Thanks so much Chris, and I hope you have a great weekend, enjoy the rest of your summer, and we’ll catch up again soon.

Chris Martenson: Thanks Mike. You too, and to all your listeners, have a great weekend and summer.

Mike Gleason: Well that will do it for this week, thanks again to Dr. Chris Martenson of PeakProsperity.com and author of the book, Prosper: How to Prepare for the Future and Create a World Worth Inheriting. For more information, just go to PeakProsperity.com, check out the extensive site there and the great online community. Or check out the book, which is also available on Amazon. You definitely will not be disappointed.

Mike Gleason is a Director with Money Metals Exchange, a national precious metals dealer with over 50,000 customers. Gleason is a hard money advocate and a strong proponent of personal liberty, limited government and the Austrian School of Economics. A graduate of the University of Florida, Gleason has extensive experience in management, sales and logistics as well as precious metals investing. He also puts his longtime broadcasting background to good use, hosting a weekly precious metals podcast since 2011, a program listened to by tens of thousands each week.

Mike Gleason is a Director with Money Metals Exchange, a national precious metals dealer with over 50,000 customers. Gleason is a hard money advocate and a strong proponent of personal liberty, limited government and the Austrian School of Economics. A graduate of the University of Florida, Gleason has extensive experience in management, sales and logistics as well as precious metals investing. He also puts his longtime broadcasting background to good use, hosting a weekly precious metals podcast since 2011, a program listened to by tens of thousands each week.

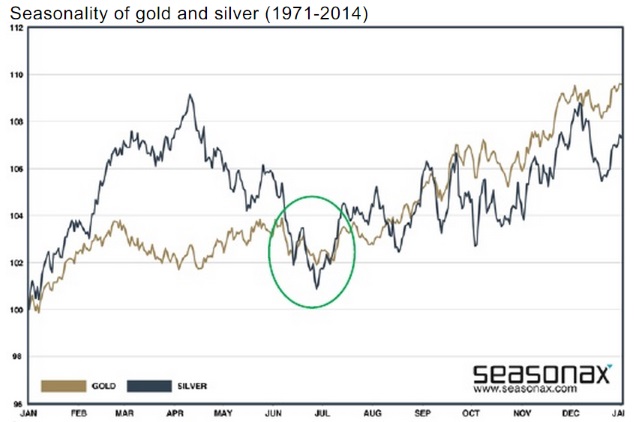

This chart “picture” has been in evidence for gold, silver, and the miners since January.

This chart “picture” has been in evidence for gold, silver, and the miners since January.

David Smith is Senior Analyst for

David Smith is Senior Analyst for

GPRO Stock Gaining Popularity Again?

GPRO Stock Gaining Popularity Again?

Mike Gleason: It is my privilege now to be joined by Dr. Chris Martenson of

Mike Gleason: It is my privilege now to be joined by Dr. Chris Martenson of  Mike Gleason is a Director with

Mike Gleason is a Director with  Technical Analysis: Silver Prices Could Soar

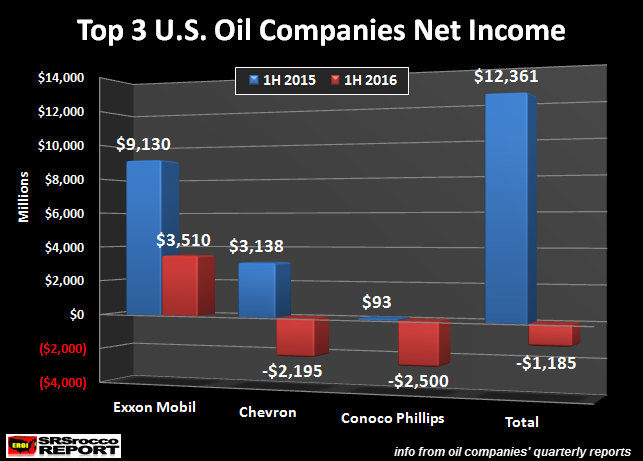

Technical Analysis: Silver Prices Could Soar 2016 YTD Relative Performance

2016 YTD Relative Performance While this partly explains the negative correlation between gold and silver versus the US dollar there is more to it. The key driver behind the value of the US dollar is the level of the US benchmark interest rate. This is because the more interest you are receiving for holding US dollars, the more people will exchange their money into US dollars. Hence, a rise in US benchmark interest rates, or an indication that an interest rate hike is near, will strengthen the currency.

While this partly explains the negative correlation between gold and silver versus the US dollar there is more to it. The key driver behind the value of the US dollar is the level of the US benchmark interest rate. This is because the more interest you are receiving for holding US dollars, the more people will exchange their money into US dollars. Hence, a rise in US benchmark interest rates, or an indication that an interest rate hike is near, will strengthen the currency.  During times when a country’s domestic currency is weakening aggressively, central banks tend to buy gold to compensate for that drop in value. We were able to witness this recently, when the Malaysian ringgit, the Indonesian rupee and the Thai baht weakened heavily against the U.S. dollar. Their central banks and many

During times when a country’s domestic currency is weakening aggressively, central banks tend to buy gold to compensate for that drop in value. We were able to witness this recently, when the Malaysian ringgit, the Indonesian rupee and the Thai baht weakened heavily against the U.S. dollar. Their central banks and many  Confidence is slippery, even when you are a metals investor sitting atop the best performing assets of 2016. It doesn’t help when 4 years of a miserable bear market remains fresh in our memories. Any weakness in prices and it can feel like markets are getting ready to plunge right back to $13 silver and $1,000 gold.

Confidence is slippery, even when you are a metals investor sitting atop the best performing assets of 2016. It doesn’t help when 4 years of a miserable bear market remains fresh in our memories. Any weakness in prices and it can feel like markets are getting ready to plunge right back to $13 silver and $1,000 gold. The year had opened with turmoil in the stock markets. The S&P 500 was plummeting in response to a December rate hike with the expectation of more hikes to come. Precious metals surged as investors sought refuge from crumbling stocks.

The year had opened with turmoil in the stock markets. The S&P 500 was plummeting in response to a December rate hike with the expectation of more hikes to come. Precious metals surged as investors sought refuge from crumbling stocks. Not only were interest rate hikes back off of the table, central bankers stood out front and did what they do best: they assured markets that no one need pay for their sins. They stood at the ready to provide “liquidity,” also known as unlimited cash to prop up overleveraged and mismanaged banks and hedge funds who lost bets they couldn’t afford on Brexit.

Not only were interest rate hikes back off of the table, central bankers stood out front and did what they do best: they assured markets that no one need pay for their sins. They stood at the ready to provide “liquidity,” also known as unlimited cash to prop up overleveraged and mismanaged banks and hedge funds who lost bets they couldn’t afford on Brexit. Clint Siegner is a Director at

Clint Siegner is a Director at