By the SRSrocco Report,

The top three U.S. oil companies released their financials today and the results were completely awful. Exxon Mobil was the only one of the three that still made a profit for the first half of the year, however it was down a stunning 62% compared to the same period last year.

Unfortunately, Chevron and ConocoPhillips results were much worse as they suffered a combined net income loss of $4.7 billion for the first half of 2016. We must remember, these are the major U.S. oil companies that are supposed to be highly profitable. I hear this all the time from politicians and folks who believe in lousy conspiracies.

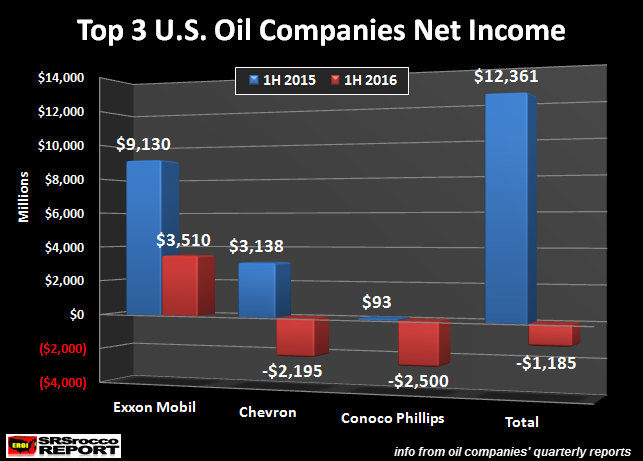

If we take a look at the chart below, we can see how much blood is flowing from the top three U.S. oil companies:

As I stated, Exxon Mobil still was able to show a profit of $3.5 billion, but this was down 62% compared to the $9.1 billion net income during the same period last year. Chevron actually enjoyed a positive net income of $3.1 billion during the first half of 2015, however this became a net loss of $2.2 billion 1H 2016. And then we have ConocoPhillips that suffered a $2.5 billion loss 1H 2016 versus a small profit of $93 million during the same period last year.

If we combine the total for these three major U.S. oil companies, they reported a $12.3 billion profit in the first half of 2015 compared to a net loss of $1.2 billion in the first six months this year.

So, individuals who don't believe in peak oil because the U.S. oil companies are making big profits, need to wake up and look at the data. The low oil price and the rising debt levels on these oil companies balance sheets are destroying them. While Exxon Mobil is still making a profit, it is nothing compared the BIG MONEY it was making a few years ago.

I don't have a chart for this, but look at these figures:

Top 3 U.S. Oil Companies Net Income (1H 2011 vs 1H 2016)

Exxon Mobil: (1H 2011) = $21.8 billion

Exxon Mobil: (1H 2016) = $3.5 billion

Chevron (1H 2011) = $13.9 billion

Chevron (1H 2016) = -$2.2 billion

ConocoPhillips (1H 2011) = $4.7 billion

ConocoPhillips (1H 2016) = -$2.5 billion

What a difference in five years... aye? These top three U.S. oil companies made a combined net income profit of $40.4 billion during the first half of 2011 versus a net loss of $1.2 billion 1H 2016. And... I believe the situation will become a lot worse for these companies going forward.

The U.S. Energy Sector is in serious trouble. I believe the United States and world will suffer a SENECA CLIFF collapse in the future. I discussed this in my interview on Finance & Liberty:

The Precious Metal Prices Continue To Rally

As the oil price continues to fall, gutting the entire U.S. oil industry, the precious metals continue to rally. Today, the price of gold is up $12.40 to $1,347, while silver is higher by $0.11 to $20.23.

This is a very interesting disconnect as U.S. economic indicators point to a contraction on top of deflating energy prices. Some analysts have been forecasting a huge deflation with falling gold and silver prices. I don't think this will happen. Gold and silver may have different plans, especially if we see more problems coming out of the European banks.

Investors need to prepare themselves for the coming collapse of most paper assets and real estate values. I don't see the oil price recovering anytime soon, so this will put severe pressure on the U.S. oil industry. Without rising energy production, ECONOMIC ACTIVITY GOES SOUTH... in a BIG WAY.

The idea that investors should only purchase 5-10% of their assets in gold or silver will become a HUGE MISTAKE going forward.

Lastly, if you haven't checked out our new PRECIOUS METALS INVESTING section or our new LOWEST COST PRECIOUS METALS STORAGE page, I highly recommend you do.

Check back for new articles and updates at the SRSrocco Report.

0 comments:

Post a Comment