Hold your real assets outside of the banking system in a private international facility --> http://www.321gold.com/info/053015_sprott.html

Economic Disaster

Posted with permission and written by Rory Hall of The Daily Coin (CLICK FOR ORIGINAL)

If we look at some of the dots that are beginning to line up, 2016 may not be a very good year for manufacturing, retail or the economy as a whole. The U.S. economy is 70% retail, which is an unsustainable economic base anyway you look at it. If the people that flip burgers next door to the big box store are one-anothers-customers and this is the majority of your economic base, how is that sustainable?

Caterpillar, which has been one of the “measuring sticks” for China’s growth, the mining industry and construction around the world, is in trouble. As the world’s largest manufacturer of heavy construction equipment one can get a sense of what will be happening in the coming months based on the sales of Caterpillar equipment. No sales, no construction and from there you have a massive whole in the economy. The number of other industries that are tied to construction and mining are immense. The situation is so bad Caterpillar announced they were cutting 10,000 jobs through 2018 and 5,000 of those would be in 2016. This does not bode well for global economic growth.

As we have reported for most of 2015 the Baltic Dry Index (BDI) has been bleeding-out all year. In the Spring the BDI was already falling off a cliff and people were crying that it was due to the Longshoreman’s strike in California that began in February 2015. This was simply not the case as the BDI has continued to slide and on two different occasions hit new record lows. The BDI represents the contact price for container ships that haul raw materials to China, India and the other manufacturing centers around the world, including the U.S. As these numbers tumble, this means no one needs this service. From my perspective, if manufacturing centers are not receiving raw materials there must be a slow down in manufacturing. This is one of the first steps in creating an economy. There must be products made in order for stores to have products on the shelves. No products, no business, no economy. You can see a plethora of articles, from a variety of sources, on this topic HERE. It is stunning how this index has tanked and doesn’t appear there will be a recovery anytime soon.

So far, nothing being built, no resources being extracted from the earth to create steel, cooper and the other materials to build homes, businesses and other structures. The shipping component of the raw materials has been in free fall for almost a year and the Federal Reserve, the Bureau of Labor Statistics and the other government agencies would have everyone believe all is well and the recovery is going great!! What a freakin’ lie.

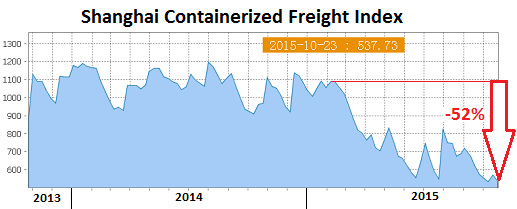

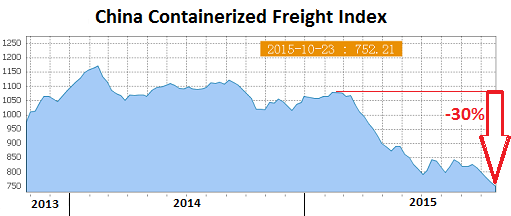

Another component that shows 2016 could be in for a very rough ride is the Shanghai Containerized Freight Index (SCFI). Wolf Richter has done a marvelous job of brining this index to light. Mr. Richter has written extensively about this index and has painted a picture that is as bleak as the previous two indicators. The SCFI is, basically, the third leg in the manufacturing cycle. Raw materials have been dug out of the ground (Caterpillar), shipped to the manufacturing centers (BDI) and made into a finished product to sell and the SCFI show us how much of the finished product is making it’s way to market. Needless to say, this too, has dropped like a stone for most of 2015. Once again, there is a plethora of articles from multiple sources on this topic HERE.

This is what Mr. Richter reported in October 2015. You would think that retailers, in the U.S. anyway, would be preparing for the “spending season” that begins in earnest in late November. That is not the case according to these numbers:

The latest weekly reading dropped another 1.7% from the prior week to 752.21, the worst level ever. The CCFI is now 30% below where it had been in February this year and 25% below where it had been 17 years ago at its inception.

The Shanghai Containerized Freight Index (SCFI), also operated by the Shanghai Shipping Exchange, tracks spot rates (not contractual rates) of shipping containers from Shanghai to 15 major destinations around the world. It’s even more volatile than the CCFI. But being based on spot rates, it’s a good indicator where the CCFI is headed.

For last week, the SCFI plunged 5.4% to a new record low of 537.73, down 46% from where it had been at its inception in 2009 when it was set at 1,000 – and down 52% from February:

Not that any of this matters for stocks. What matters are central banks. And they have once again spoken. They’re frazzled by these signs of “unexpected” deterioration. Even China’s official GDP growth rate, at 6.9%, inflated as it may be, is now down to the worst level since the Financial Crisis.

That leaves the “end user”, the retail market. What’s happening there? According to latest Bureau of Labor Statistics report the U.S. piled on 211,000 new jobs!! WoooHoooo we’re saved!!! Well, if you take a look at the reality of what these numbers actually represent you find some startling revelations. Like, over 300,000 part time jobs. You find a labor participation rate continuing to drop. Labor participation is the number of people of working age – 16-54 age group – and that number has fallen throughout 2015. It is now somewhere around the mid 1970’s level of participation. Has the population of the U.S. increased since the mid 1970’s? Well, why aren’t these people working? Why do they not have a job? How can an economy experience a “recovery” in 2015 when it continually loses it’s workforce?

What about retail sales? Is anyone selling products that aren’t being manufactured or shipped? Apparently not.

According to Dave Kranzler, Investment Research Dynamics, the biggest sales day of the year, Black Friday, fell by 10% year over year:

Total sales in the US on Black Friday fell 10% to $10.4bn this year, down from $11.6bn in 2014, according to research firm ShopperTrak. – The Guardian

Store-based sales dropped $1.2 billion, while online sales increased $150 million. The media is going to highlight the increase in online sales. But remember, online sales represent only 6% of total retail sales. The plunge in brick-and-mortar sales was nearly 10x greater in total dollars than was the increase in cyber sales.

Mr. Kranzler is not alone his analysis. ZeroHedge also discussed the year over year decline:

We can hear the mainstream media now – “Great News Everyone!! The American consumer is back” – online sales on Black Friday rose 10% to $1.7 billion which ComScore says shows “strong spending.” The only problem is – which we suspect will be oddly missing from the mainstream narrative, as ShopperTrak reports total sales on Black Friday crashed 10% to $10.4 billion. While blame has been placed on early opening on Thanksgiving, that is false too since spending on that day also plunged 10%. So, the sales news is unequivocally bad – which is hardly surprising given the collapse in consumer confidence.

So to clarify… (via The Guardian)

Total sales in the US on Black Friday fell 10% to $10.4bn this year, down from $11.6bn in 2014, according to research firm ShopperTrak.

The decline in sales on the traditional busiest shopping day of the year has been blamed on shops opening the day before. But this year, sales on Thanksgiving also dropped, and by the same percentage, to $1.8bn.

So, for those with difficulty with reading and math…

If you add all this together it can mean only one thing: the Federal Reserve knows exactly how to steer an economy and have done a helluva job since the 2008 financial crisis began! Quantative Easing (QE) and Zero Interest Rate Policy (ZIRP) have worked like a charm! The “recovery” is in full swing; with full employment, according the Bureau of Labor Statistics a mere 5.0% are unemployed. The Dow Jones Industrial Average is in great shape and the people are spending, spending, spending!! What a joyous time.

Now, slave, get back to work, if you have a job, and make sure you save some energy for your other part time employment as you will be going to those jobs later today. Full employment as defined by the Federal Reserve is two or more part time jobs for everyone. Generating enough income to pay taxes, insurance and maybe a mortgage/rent.

Please email with any questions about this article or precious metals HERE

Economic Disaster

Posted with permission and written by Rory Hall of The Daily Coin (CLICK FOR ORIGINAL)

Rory Hall, Editor-in-Chief of The Daily Coin, has written over 700 articles and produced more than 200 videos about the precious metals market, economic and monetary policies as well as geopolitical events since 1987. His articles have been published by Zerohedge, SHTFPlan, Sprott Money, GoldSilver and Silver Doctors, SGTReport, just to name a few. Rory has contributed daily to SGTReport since 2012. He has interviewed experts such as Dr. Paul Craig Roberts, Dr. Marc Faber, Eric Sprott, Gerald Celente and Peter Schiff, to name but a few. Visit The Daily Coin website and The Daily Coin YouTube channels to enjoy original and some of the best economic, precious metals, geopolitical and preparedness news from around the world.

0 comments:

Post a Comment