Hold your real assets outside of the banking system in a private international facility --> http://www.321gold.com/info/053015_sprott.html

Physical Silver Investment Demand Great Deal Higher Than Official Estimates

Posted with permission and written by: Steve St. Angelo of SRSrocco Report (CLICK FOR ORIGINAL)

Even though 2015 is estimated to be a record year for Official Silver Coin sales, total sales in this market is likely to be much higher. Why? It has to do with a portion of physical silver investment demand that is not included in the official data.

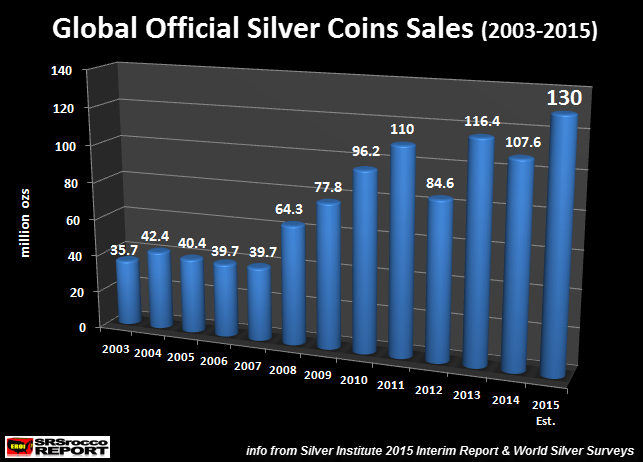

According to the Silver Institute 2015 Interim Report, total Official Silver Coin sales will reach an estimated 130 million oz (Moz), due to massive demand (June-Oct) stemming a Greek Exit contagion and the forecasted market crash in the fall. As we can see from the chart below, not only are Official Silver Coin sales for 2015 the highest ever, they are more than three times greater than they were in 2007… the year before the collapse of the U.S. Investment and Housing Market:

However, there is one important segment of this market that is not included in the figures above. Private silver round sales are not included in the physical silver investment figures due to the lack of available data. For new investors into the precious metal market, let me clarify the difference between Official Coins and Private Rounds.

Official Silver Coins = silver coins (mostly 1 oz) that are produced by Official Mints such as the U.S. & Royal Canadian Mints. These are labeled “coins” as they are legal tender.

Silver Rounds = silver rounds (mostly 1 oz) that are produced by several private mints such as the Sunshine and Highland Mint. These silver rounds have the same quality of silver as most Official Silver Coins, but cannot be called “coins” because they are not legal tender.

While silver rounds are not Official Coins, they still are highly sought after by investors and are easily purchased and sold back to most local and online dealers.

Sales of private rounds have increased significantly over the past several years, but their figures has not been included in the official statistics… again, due to the lack of reliable and accurate data. I have called many dealers and asked them for a general guideline of their private round sales. The private silver round figure I received from several dealers was approximately 10-15% of their Official Silver Coin sales.

After the release of the Silver Institute 2105 Silver Interim Report, I contacted the GFMS team at Thomson Reuters and asked several questions. One of the questions was in regard to the exclusion of silver round sales from their data. This was the GFMS team response:

You are correct in your observation that privately minted coins are not currently included in our silver coin demand statistics. This is something we have been working on, but it is taking time to develop back data. We have begun this work and it will be integrated into our statistics as soon as we feel they meet our reliability and accuracy standards.

I asked the GFMS team if they found that a 10-15% figure versus Official Coin sales was a good approximation. Thus, my estimate for private silver rounds was about 10+ Moz in 2015. The GFMS team responded by stating:

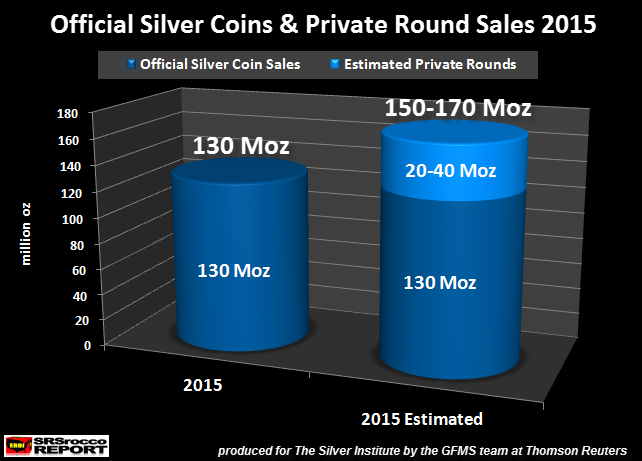

To give you a sense of the numbers we are currently working with, we would suggest your 10 mln estimate is conservative for 2015. 10% to 15% seems reasonable in normal years, but given the remarkable shortage of coins in North American in the third quarter and anecdotal information and data obtained from market players, we have estimated upwards of 20-40 mln ounces of privately minted coins sold in the region this year.As mentioned though, we are still working on these figures and they are by no means final.

So, according the GFMS team, they estimate that private silver round demand was 20-40 Moz in 2015.Thus, total Official Silver Coin and private round sales may actually be upwards of 30% higher than the official data. Folks, this is a big figure… much higher than I anticipated.

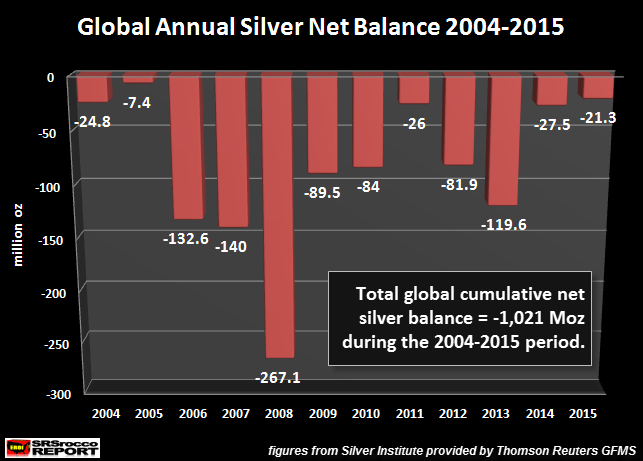

If we assume that private silver rounds were somewhere in the middle of their 20-40 Moz estimate, that would be an additional 30 Moz of physical silver investment demand for 2015.Thus, total Official Silver Coin and private rounds would equal 160 Moz in 2015, much higher than the 130 Moz figure. Thus, the forecasted net balance deficit of 21.3 Moz for 2015 will be more like 51.3 Moz… once we add in the additional 30 Moz private silver round demand.

Furthermore, once the GFMS team adds private silver round data to their World Silver Surveys, they will have to go back and update all previous figures for the past decade. This will certainly show that the cumulative net balance deficit shown below is actually much higher:

Please note, the GFMS Team was nice enough to share their approximate private silver round data with me, but it is still an estimate as they have not yet acquired enough reliable and accurate data to produce these figures officially. I would imagine we will likely see private silver round sales data included in their World Silver Surveys within the next year or so.

For those precious metal investors who think “All Official Data” is manipulated…. it isn’t. I have looked at a lot of data and can tell you, the folks at GFMS use information from many Government sources. For example, the GFMS team utilizes silver production figures from the U.S. Geological Survey (USGS) and Official Coin sales from the U.S. Mint. I have checked mining company silver production data for the United States and it does correspond with the figures put out by the USGS. This is also true for the U.S. Mint.

Now, I am not saying that all the official data is 100% accurate or that some may be over or under reported, but it is a good approximation of what is taking place as it pertains to supply and demand in the silver market.

That being said, physical silver investment demand has only one way to go in the future… AND THAT IS MUCH HIGHER. I will be putting out an article next week on Gold & Silver Prices To Surge Based On Fundamentals, Not Technical Analysis. Precious metals investors who have become disillusioned or frustrated by the low paper prices and negative articles by the so-called “Anti Gold-Silver Bugs”, have no idea just how bad the current economic and financial system have become.

One of the best ways to survive the coming collapse of the Greatest Financial Ponzi Scheme in history, is to own physical precious metals.

Please email with any questions about this article or precious metals HERE

Physical Silver Investment Demand Great Deal Higher Than Official Estimates

Posted with permission and written by: Steve St. Angelo of SRSrocco Report (CLICK FOR ORIGINAL)

0 comments:

Post a Comment