Silver Bullion Market - "Still The Most Bullish Story Ever Told?"

Interview with Ted Butler from SilverSeek.com

Cook: What’s happening in the silver market is hard to understand right now. Can you simplify it for us?

Butler: First you must understand the price of silver is set on the COMEX by two large opposing forces. On the short side are the big banks or traders led by JPMorgan. Four of these big traders are short 72% of the total commercial short position.

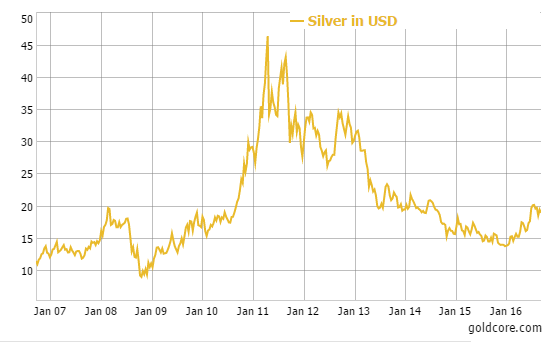

Silver in USD - 10 Years (GoldCore)

Silver in USD - 10 Years (GoldCore)

Cook: Isn’t that highly manipulative?

Butler: Of course, I think it’s grossly illegal, but the regulators sit on their hands.

Cook: Let’s leave that story for another day. Who is on the long side of the silver futures market?

Butler: The technical hedge funds known as the managed-money traders. They are pretty much computer-driven and react to technical trading signs.

Cook: Such as?

Butler: The most important are the 50-day and the 200-day moving averages. When the averages are penetrated by a price move to the upside, they buy. When they are penetrated to the downside, they sell.

Cook: Didn’t we just penetrate the 50-day to the downside?

Butler: Yes, and for the first time ever the tech funds didn’t sell as many contracts as they have sold in the past

Cook: Why not?

Butler: I don’t know, but if they are not going to sell, we are going to have a price explosion in silver.

Cook: They can still sell can’t they?

Butler: Yes, and they are likely to do so because the big short traders have always been able to snooker the tech funds into selling by driving the price down so it penetrates the moving averages and triggers their computerized sell programs.

Cook: Then what?

Butler: The big banks make a lot of money and buy back a lot of their shorts.

Cook: Rinse and repeat?

Butler: For the first time I don’t know. The numbers are just too big. The big shorts, not including JPMorgan, are out $2 billion in both gold and silver, the most ever. They aren’t going to go short that much ever again.

Cook: So are we at an inflection point where the nature of trading on the COMEX is altered significantly?

Butler: That’s possible. Bear in mind, those big traders are manipulating the market in order to reap massive profits. Miners and industrial users are supposed to set prices, not big short speculators. They’ve gotten so big in gold and silver futures they are a threat to their own solvency. It has to end and I think that will be soon.

Cook: What happens then?

Butler: The free market re-exerts itself. The low manipulated price of the past gives way to something much higher.

Cook: What happens if JPMorgan and the gang persist in their evil ways?

Butler: Bear in mind that JPMorgan has acquired at least 500 million ounces of physical silver. It’s in their interest to see the price go up.

Cook: Why aren’t they letting that happen?

Butler: They’ve been keeping the price low while they acquire more silver. They’ve loaded up at a cheap price.

Cook: Are they still adding physical silver?

Butler: Not currently that I can see. I think they are trying to get out of their big paper short position and are not having much luck. It seems like they are doing things to keep a silver shortage from happening. They don’t want the price to go up until they have driven the price of silver down to the point the technical-fund holders sell to them and as they buy from these tech funds their short position is reduced.

Cook: You make it sound like JPMorgan is the whole story.

Butler: They are, and the best part of that is that they want much higher prices for silver one of these days.

Cook: Is silver still the most bullish story ever told?

Butler: More than ever.

Interview with Ted Butler by Jim Cook here

Gold and Silver Bullion - News and Commentary

Gold holds losses as dollar gains versus yen (Reuters)

Gold extends losses on firm dollar, surge in Treasury yields (Reuters)

U.S. Stocks, Bonds Sell Off as Market Turmoil Resumes; Oil Drops (Bloomberg)

U.S. runs $107 billion budget deficit in August, Treasury says (Marketwatch )

Blockchain technology drives $100,000 Irish cheese and butter deal for Ornua (Reuters)

"Is Silver Still The Most Bullish Story Ever Told?" (Silverseek )

Paul Singer Warns It Is A “Very Dangerous Time” For Stocks, Prefers Gold (Zerohedge)

Who would be most painful for your portfolio? Clinton or Trump? (Moneyweek)

Dubai is buzzing but oil’s decline tempers the mood (Telegraph)

Gold Prices (LBMA AM)

14 Sep: USD 1,323.20, GBP 1,001.40 & EUR 1,177.91 per ounce

13 Sep: USD 1,328.50, GBP 1,000.36 & EUR 1,183.69 per ounce

12 Sep: USD 1,327.50, GBP 1,000.80 & EUR 1,182.54 per ounce

09 Sep: USD 1,335.65, GBP 1,004.68 & EUR 1,184.86 per ounce

08 Sep: USD 1,348.00, GBP 1,009.11 & EUR 1,195.81 per ounce

07 Sep: USD 1,348.75, GBP 1,008.60 & EUR 1,199.85 per ounce

06 Sep: USD 1,330.05, GBP 997.94 & EUR 1,191.46 per ounce

Silver Prices (LBMA)

14 Sep: USD 19.04, GBP 14.42 & EUR 16.96 per ounce

13 Sep: USD 19.16, GBP 14.44 & EUR 17.06 per ounce

12 Sep: USD 18.72, GBP 14.11 & EUR 16.68 per ounce

09 Sep: USD 19.41, GBP 14.58 & EUR 17.23 per ounce

08 Sep: USD 19.93, GBP 14.90 & EUR 17.65 per ounce

07 Sep: USD 19.92, GBP 14.89 & EUR 17.71 per ounce

06 Sep: USD 19.60, GBP 14.70 & EUR 17.55 per ounce

Recent Market Updates

- “Sorry, You Can’t Have Your Gold Bullion”

- Global Stocks, Bonds Fall Sharply – Gold Consolidates After Two Weeks Of Gains

- Gold, Silver, Blockchain and Fintech – Solutions To Negative Rates, Bail-ins, Cash Confiscations and Cashless Society

- Jan Skoyles Appointed Research Executive At GoldCore

- Silver Bullion Surges 3.5% To Over $20/oz

- Ireland “Especially Exposed” To “International Shocks” Warns Central Bank

- Deutsche Bank Tries To Explain Failure To Deliver Physical Gold

- Physical Gold Delivery Failure By German Banks

- Avoid Paper Gold – “Gold Delivery” Refused By Gold Exchange Traded Commodity

- Debt Bubble in Ireland and Globally Sees Wealthy Diversify Into Gold

- “Why Case Against Gold Is Wrong” – James Rickards

- Obama To Leave $20 Trillion Debt Crisis For Clinton Or Trump

- Gold Bullion Averages Biggest Seasonal Gains in September Over Past 20 Years

0 comments:

Post a Comment