IT was not an ideal way to mark a silver jubilee. The 25th anniversary of the signing of the Maastricht treaty, which gave life to the idea of a single European currency, fell on February 7th, the same day that the IMF published its annual health-check on the Greek economy. It said most (but not all) of its board favoured more debt relief to get Greece’s public finances in order—an idea quickly trashed by euro-zone officials.

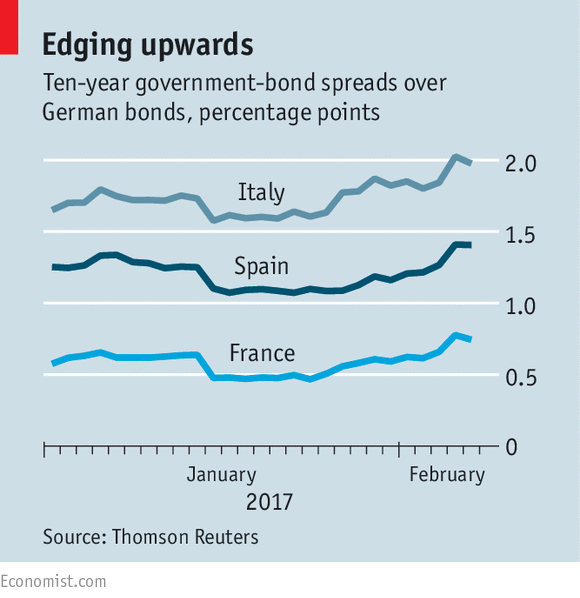

A day earlier the spread between ten-year government bonds in France and Germany had reached its widest level in four years. The proximate cause seemed to be a growing concern about political risks to the euro. François Fillon, once the front-runner in the race for the French presidency, is embroiled in a scandal and losing ground. A fear is that his fall from grace might boost support for Marine Le Pen, leader of the National Front, who wants France to leave the euro and the EU.

Shorter odds on a Le Pen victory would certainly justify a higher risk premium on French bonds. Yet there is more to the latest bout of euro-area bond jitters than a sharper focus on politics. After all, bond markets...Continue reading

0 comments:

Post a Comment