EU Crisis Becoming Existential… Dutch Vote Tomorrow and Why It Matters

The leader of the National Front in France, Marine Le Pen, has hailed Britain’s decision to leave the EU – and has called for France to hold a similar referendum

The leader of the National Front in France, Marine Le Pen, has hailed Britain’s decision to leave the EU – and has called for France to hold a similar referendum

The EU is facing an existential crisis and does not look like it will survive the massive political and financial challenges it is faced with. This has ramifications for investors in the EU itself and globally as the collapse of one of the world's largest trading blocs will badly impact already fragile global economic growth and increasingly "frothy" looking financial markets - particularly stock and bond markets.

The existential crisis facing the EU, the Dutch elections tomorrow and the coming elections in France and Germany and the risks increasingly likely EU contagion poses to Asian economies and the global economy is considered by True Wealth's Kim Iskyan today:

Tomorrow, parliamentary elections in the Netherlands mark the first of several important votes in EU member countries that will dictate the future of the continent.

After the Netherlands, France has a presidential election late next month (and likely in a run-off election in early May). Germany follows with presidential elections in September, followed by general elections in Italy in early 2018. All four countries are founding members of the EU. And in each case, there is a chance that an anti-EU party takes power, with potentially enormous consequences for the future of the EU.

Emboldened by the Brexit referendum and the election of U.S. President Donald Trump, right-wing parties have surged in popularity all across the continent. After years of déjà-vu episodes of debt crises, now much of the EU is in the midst of a populist backlash over concerns about immigration, refugees and terrorism. The prospect that anti-EU parties will assume power in countries that are the historical bedrock of the EU is a serious threat to the 28-member political and economic union – and also globalisation itself.

A functioning EU is important to Asia’s economic prosperity

As we’ve written before, a less globalised world hurts Asia. Many of the biggest Asian markets have been empowered by greater global integration. And for countries like China, Japan, South Korea, Singapore and Malaysia, trade is critical to economic growth.

Asia is easily the EU’s largest regional partner in trade. China is the EU’s second-biggest trade partner after the U.S. (the EU is China’s largest trading partner.) And Japan, South Korea and India are currently the EU’s 7th, 8th and 9th largest trading partners.

Together, the 10 countries that make up the Association of Southeast Asian Nations (ASEAN) are the EU’s third-largest trading partner, while the EU is ASEAN’s second largest partner. The EU is also the largest foreign investor into ASEAN. It accounts for 22 percent of the Southeast Asian region’s foreign direct investment (FDI) inflows.

“Euroexits” would affect trade and financial flows

Any country that leaves the EU would have to establish new bilateral (that is, between two countries) or multilateral (involving three or more countries) trade agreements with other countries. The UK is now starting to lay the foundations for such trade pacts with non-EU nations. On the positive side, around 60 countries already have special trading agreements with the EU in place, including South Korea. So should France vote to leave, for instance, it should (theoretically) be able to quickly replicate existing trading arrangements with these 60 countries.

But other countries, including China, Japan and the U.S. have no such free trade accords with the EU. These countries will likely need to use World Trade Organisation (WTO) framework to establish trade agreements with EU “exiters”. Meanwhile, all participating economies would probably see a dip in trade. And should another country leave the EU, heightened levels of uncertainty could further weigh on Asian economies.

A mixed outlook for the Netherlands

The Dutch Party for Freedom (PVV), which is headed by Geert Wilders – who requires 24-hour security in part due to his anti-Islam and anti-immigration views – could provide the next nail in the EU’s coffin. The far-right politician has promised to call for a referendum for a Dutch exit from the EU, and possibly a return to the country’s old currency, the guilder, if he wins.

In Wilders’ words, “The European Union is a political bureaucratic organisation that took away our identity and our national sovereignty. So, I would get rid of the European Union and be a nation-state again." Current polls suggest that PVV has a narrow lead.

If the PVV does get the most votes, it would have to form a coalition with another party. And it appears unlikely that any other major party would enter into such a coalition with Wilders. A “Nexit” is a possibility, but isn’t a certainty.

France is the EU’s biggest worry

More concerning for the health of the EU are the French elections. And at the moment, Marine Le Pen’s Front National party leads the first round of polls.

If she gains power, Le Pen has promised to seek parliamentary approval to hold a “Frexit” referendum within her first six months in charge. Similar to Wilders, she wants France to abandon the euro and adopt a new version of the country’s previous currency, the franc. And much like Trump’s “America First” campaign, Le Pen’s “Made in France” mantra seeks to push back against what she calls the “ultra-liberal economic model” of globalisation.

The leader of the National Front in France, Marine Le Pen, has hailed Britain's decision to leave the EU – and has called for France to hold a similar referendum.

A Frexit would mean that the EU would lose two of its three biggest economies (Germany, France and the U.K.) in the space of about one year. And while the EU may have survived the UK’s departure, the loss of France would “bring the project that has underpinned the European order for the past 60 years to a close”, according to The Economist.

Even if Le Pen does not win, discontent in France isn’t going away. Unemployment has been above 10 percent for the past four years. A poll by Pew Research also found that 45 percent of French citizens have a negative view of their country’s engagement in the global economy, as they believe that it lowers wages and costs jobs.

Other French presidential candidates also harbour protectionist views. Le Pen’s strongest rival at present, the centrist Emmanuel Macron, has previously voiced concern over China’s steel “dumping” on Europe (a practice we have previously highlighted). And the other major candidate François Fillon has said that he wants “a Europe able to defend its industries and jobs against China and the U.S.”

France may impose protectionist trade measures, similar to those that the U.S. is toying with. Whether that happens whilst remaining in the EU, or having exited, remains to be seen. Either way, the shift towards a more nationalist sentiment will be bad news for Asian exporters.

Germany: The EU’s (and Asia’s) biggest hope

From Asia’s standpoint, Germany’s election seems to be less of a concern at this stage. Neither of the front-runners is in favour of leaving the EU, although there is some mounting pressure from the right-wing anti-EU populist party Alternative for Germany.

In the bigger picture, Germany is one of the few rays of light for globalisation advocates. German Vice Chancellor Sigmar Gabriel recently said that the EU should pivot its economy towards Asia, should the Trump administration pursue protectionism.

Similarly, the head of Germany’s Federal Association of Wholesale, Foreign Trade and Services recently said that American protectionist plans should allow the trade ties between Germany and China to be “further strengthened.” China is already Germany's most important trading partner, with the two nations conducting US$180 billion worth of business in both imports and exports.

But if Brexit and Trump proved anything, it was that polls don’t mean much. The mood is clearly turning in Europe, away from globalisation and towards nationalism. Should even one more country leave the EU, it could trigger a domino effect that quickly leaves the regional bloc standing on shaky ground. And Asia could stand to lose from that.

The True Wealth Article Can Be Read Here

Interested in learning more about physical gold and silver?

Call GoldCore and speak with a gold and silver specialist today

Gold and Silver Bullion - News and Commentary

Gold prices steady ahead of Fed meeting (Reuters.com)

Treasuries Drop, Stocks Mixed as Fed Meeting Looms (Bloomberg.com)

Gold Prices Consolidate, Policy Uncertainties Curb Activity (EconomicCalendar.com)

Market Drift Suggests Some Investors May Be Trading on U.K. Economic Data Ahead of Release (WSJ.com)

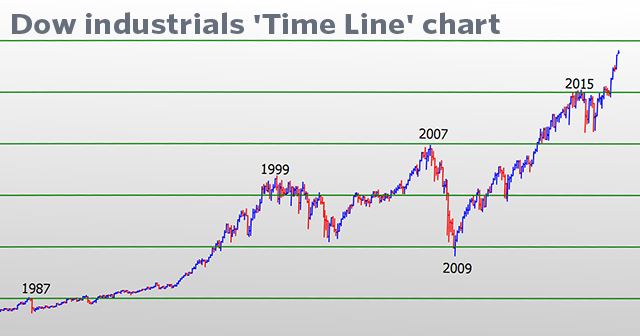

Crash guru warns the Dow could plunge to 14,800 (MarketWatch.com)

Gold a good hedge against falling stocks (ChronicleJournal.com)

Stagflation Stalking? The Answer Is Critical To Your Financial Health (GoldSeek.com)

How Will Gold React To The Next Rate Hike? - Holmes (Gold-Eagle.com)

Gold to jump $200 by end of the year - Bank of America (CNBC.com)

Gold Prices (LBMA AM)

14 Mar: USD 1,203.55, GBP 9,992.33 & EUR 1,130.86 per ounce

13 Mar: USD 1,207.80, GBP 989.79 & EUR 1,132.07 per ounce

10 Mar: USD 1,196.55, GBP 983.56 & EUR 1,127.15 per ounce

09 Mar: USD 1,204.60, GBP 991.39 & EUR 1,140.64 per ounce

08 Mar: USD 1,213.30, GBP 997.70 & EUR 1,149.00 per ounce

07 Mar: USD 1,223.70, GBP 1,003.56 & EUR 1,157.62 per ounce

06 Mar: USD 1,231.15, GBP 1,004.74 & EUR 1,162.82 per ounce

Silver Prices (LBMA)

14 Mar: USD 17.00, GBP 14.02 & EUR 15.99 per ounce

13 Mar: USD 17.02, GBP 13.92 & EUR 15.95 per ounce

10 Mar: USD 16.89, GBP 13.91 & EUR 15.92 per ounce

09 Mar: USD 17.14, GBP 14.10 & EUR 16.23 per ounce

08 Mar: USD 17.40, GBP 14.32 & EUR 16.48 per ounce

07 Mar: USD 17.70, GBP 14.52 & EUR 16.74 per ounce

06 Mar: USD 17.81, GBP 14.53 & EUR 16.83 per ounce

Recent Market Updates

- Digital Gold On Blockchain – For Now Caveat Emptor

- Gold $10,000 Coming – “Time To Prepare Is Now”

- Silver Very Undervalued from Historical Perpective of Ancient Greece

- Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II)

- Gold Investing 101 – Beware eBay, Collectibles and “Pure” Gold Coins that are Gold Plated

- “Think About and Prepare For” Euro Catastrophe

- Silver On Sale – 4% Fall On Massive $2 Billion of Futures Selling

- Trump Avoid Debt Crisis ? “Extremely Unlikely” – Rickards

- Art Market Bubble Bursting – Gauguin Priced At $85 Million Collapses 74%

- Gold’s Value – Weight, Beauty, Rarity, Peak Gold and Secure Storage – Interview

- Oscars Debacle – Movies More Costly As Dollar Devalued

- Gold Up 9% YTD – 4th Higher Weekly Close and Breaks Resistance At $1,250/oz

- The Oscars – Worth Their Weight in Gold?

0 comments:

Post a Comment