Stock Market Most Overvalued On Record — Worse Than 1929?

The US stock market today has never been more dangerous and overvalued, according to respected Wall Street market analyst John Hussman.

Indeed, Hussman goes as far as to say that "this is the most dangerous and overvalued stock market on record — worse than 2007, worse than 2000, even worse than 1929" as reported by Marketwatch.

For some months now, Hussman of Hussman Funds' has been warning in his research that investors are ignoring extremely high stock market valuations and are being lulled into a false sense of security by central bank liquidity, massive quantitative easing and zero percent and negative interest rates.

Hussman begins his latest research note by quoting the late, great Sir John Templeton:

“Bull markets are born on pessimism, grow on scepticism, mature on optimism, and die on euphoria.”

He then warns

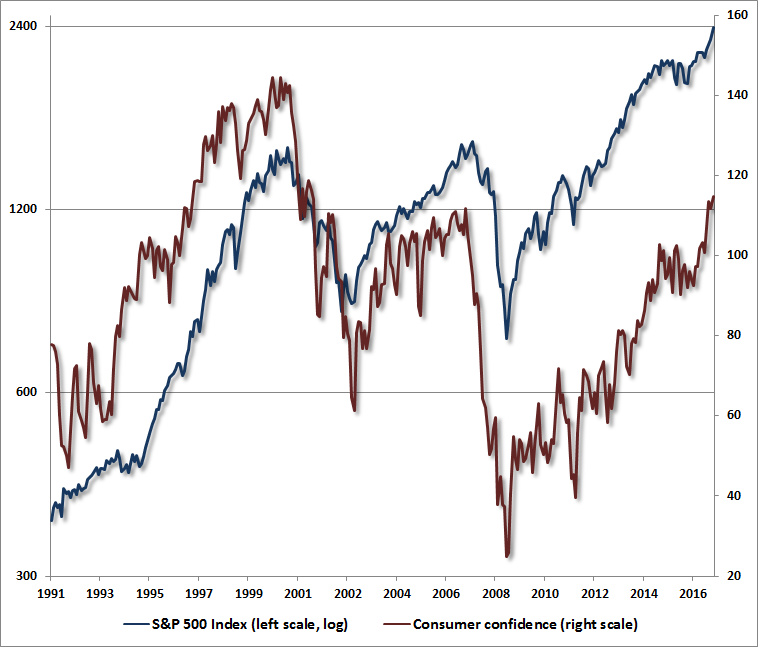

“A week ago, bullish sentiment among investment advisers soared to the highest level in 30 years (Investor’s Intelligence), joined last week by a 16-year high in consumer confidence. When one recognises that the prior peak in bullish sentiment corresponds to the 1987 market extreme, and the prior peak in consumer confidence corresponds to the 2000 bubble, Sir Templeton’s words take on both relevance and urgency.”

Hussman advises investors become more defensive, because the market could be about to enter a brutal bear market as seen throughout history.

Huge crowds gather in shock at the New York Stock Exchange after 1929 stock-market crash. Getty Images/Keystone/Staff

Huge crowds gather in shock at the New York Stock Exchange after 1929 stock-market crash. Getty Images/Keystone/Staff

Hussman Funds provide in-depth analytical research on the US stock market. They use long-term valuation models, reversion to the mean and mathematics to support their views.

Dr Hussman says what we’re currently seeing is worse than 2007 when the global financial crisis brought the world economy to its knees, worse than 2000 when the tech bubble popped and caused a market catastrophe, and even worse than the biblical Wall Street 1929 crash.

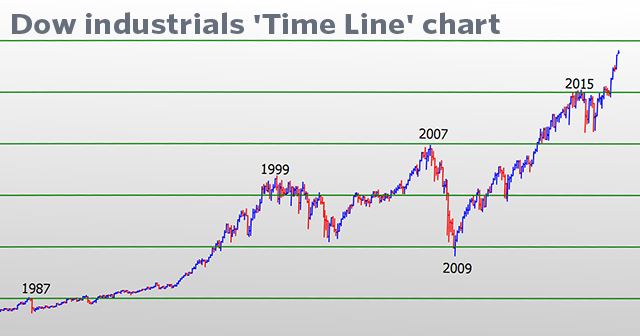

The Dow Jones Industrial Average recently breached the hugely important psychological level of 20,000 and has recently surged over 20,100 to 21,115.

Throughout history, the first breach of these important psychological resistance levels is usually the end of — rather than the beginning of — a stock market boom. After the initial breach of the barrier, it takes years for the market to make a permanent breach through these ‘barriers’ (see below).

Is this time different?

We do not know and no one has a crystal ball, however it is important to realise that the U.S. stock markets and bond markets are priced for perfection, despite a very uncertain outlook for the U.S. and the world.

Brexit, the risk of Frexit and EU contagion, uncertainty created by the Trump Presidency and considerable geopolitical risk from a myriad of unresolved conflicts - from North Korea to Russia to Iran and the geo-political mess that is the Middle East.

These over valued stock markets are also vulnerable given the scale of over valuation that is evident in bond markets and the real risk of a very significant sell off in global bond markets.

Bond markets have come under pressure in recent days with yields rising in many key markets. Italian debt looks particularly vulnerable with Italian 10 year yields rising and concerns that a break above 2.50% in the third largest bond market in the world (debt valued at €2.2 Trillion) has the potential to jettison Italy out of the European monetary union.

Bond guru Bill Gross is also warning that investors need to keep an watchful eye on the U.S. 10 year bond yield as a breach of 2.6% will mean that "a secular bear bond market has begun."

A massively indebted EU and U.S., which reaches the debt ceiling today, with indebted households and fragile economic recoveries will struggle when interest rates revert back to more normal levels.

Markets are priced for perfection and yet the political, financial, economic and monetary outlook is less than perfect. Euphoria and "irrational exuberance" will inevitably revert to "fear and loathing".

The question is when and by what one catalyst or combination of catalysts?

Given the scale of the risks facing investors and pension owners today, it is prudent to reduce allocations to stocks and bonds and increase allocations to physical gold.

Hussman's Research Comment Can Be Accessed Here

Access Daily and Weekly Updates Here

Gold and Silver Bullion - News and Commentary

Gold prices firm ahead of Fed announcement (Reuters.com)

Gold Prices Hold Support, Weaker Equities Underpin Investor Demand (EconomicCalendar.com)

Nobel Prize winner Sir Fraser Stoddart hopes to turn gold mines green (Telegraph.co.uk)

Most overvalued stock market on record — Worse than 1929 (MarketWatch.com)

These Charts Question Stocks for the Long Term Mantra (ZeroHedge.com)

The Mystery Of The Treasury's Disappearing Cash (ZeroHedge.com)

Beware the Ides of March (InternationalMan.com)

Only Way to Stop Indians Buying Gold? Take Away Their Cash (Bloomberg.com)

Gold Prices (LBMA AM)

15 Mar: USD 1,202.25, GBP 986.69 & EUR 1,132.04 per ounce

14 Mar: USD 1,203.55, GBP 992.33 & EUR 1,130.86 per ounce

13 Mar: USD 1,207.80, GBP 989.79 & EUR 1,132.07 per ounce

10 Mar: USD 1,196.55, GBP 983.56 & EUR 1,127.15 per ounce

09 Mar: USD 1,204.60, GBP 991.39 & EUR 1,140.64 per ounce

08 Mar: USD 1,213.30, GBP 997.70 & EUR 1,149.00 per ounce

07 Mar: USD 1,223.70, GBP 1,003.56 & EUR 1,157.62 per ounce

Silver Prices (LBMA)

15 Mar: USD 16.91, GBP 13.87 & EUR 15.92 per ounce

14 Mar: USD 17.00, GBP 14.02 & EUR 15.99 per ounce

13 Mar: USD 17.02, GBP 13.92 & EUR 15.95 per ounce

10 Mar: USD 16.89, GBP 13.91 & EUR 15.92 per ounce

09 Mar: USD 17.14, GBP 14.10 & EUR 16.23 per ounce

08 Mar: USD 17.40, GBP 14.32 & EUR 16.48 per ounce

07 Mar: USD 17.70, GBP 14.52 & EUR 16.74 per ounce

Recent Market Updates

- EU Crisis Is Existential – Importance of Tomorrow’s Vote

- Digital Gold On Blockchain – For Now Caveat Emptor

- Gold $10,000 Coming – “Time To Prepare Is Now”

- Silver Very Undervalued from Historical Perpective of Ancient Greece

- Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II)

- Gold Investing 101 – Beware eBay, Collectibles and “Pure” Gold Coins that are Gold Plated

- “Think About and Prepare For” Euro Catastrophe

- Silver On Sale – 4% Fall On Massive $2 Billion of Futures Selling

- Trump Avoid Debt Crisis ? “Extremely Unlikely” – Rickards

- Art Market Bubble Bursting – Gauguin Priced At $85 Million Collapses 74%

- Gold’s Value – Weight, Beauty, Rarity, Peak Gold and Secure Storage – Interview

- Oscars Debacle – Movies More Costly As Dollar Devalued

- Gold Up 9% YTD – 4th Higher Weekly Close and Breaks Resistance At $1,250/oz

Interested in learning more about physical gold and silver?

Call GoldCore and speak with a gold and silver specialist today

0 comments:

Post a Comment