Silver On Sale - 4% Fall On Massive $2 Billion of Futures Selling

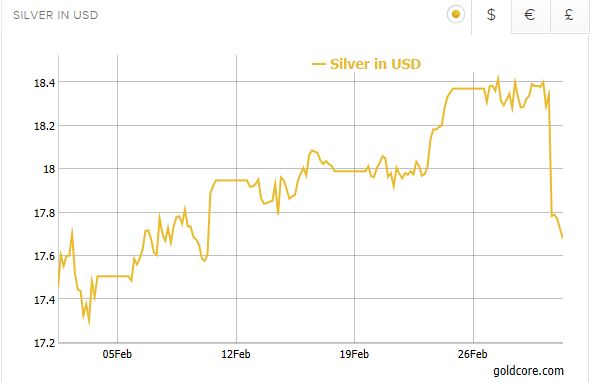

Silver fell a very sharp 85 cents from $18.40 per ounce to as low as $17.65 per ounce yesterday for a 4.25% price fall soon after the London bullion markets closed yesterday despite no market news or corresponding sharp moves in other markets.

Silver had surged 15% in the first two months and had seen ten consecutive weeks of gradual gains. It had made convincing closes above the psychological $18 an ounce level and the 200 day moving average (DMA) at 18.155 and made 3-month highs only yesterday.

Silver Prices (LBMA)

03 Mar: USD 17.66, GBP 14.44 & EUR 16.76 per ounce

02 Mar: USD 18.33, GBP 14.93 & EUR 17.42 per ounce

01 Mar: USD 18.33, GBP 14.89 & EUR 17.40 per ounce

28 Feb: USD 18.28, GBP 14.70 & EUR 17.24 per ounce

27 Feb: USD 18.34, GBP 14.77 & EUR 17.33 per ounce

24 Feb: USD 18.27, GBP 14.56 & EUR 17.23 per ounce

23 Feb: USD 18.00, GBP 14.42 & EUR 17.06 per ounce

Silver investors were gaining confidence and dealers were experiencing robust demand for silver coins and bars. Suddenly at almost exactly 1630 GMT yesterday as European markets were closing, some entity decided to dump $2 billion worth of silver contracts into the futures market in minutes. A huge 23,000 silver contracts which is the equivalent of 1.15 million ounces of silver was dumped on the market:

Source: Zero Hedge

"Over 23,000 Silver futures contracts suddenly puked into the market as soon as Europe closed..." as noted by Zero Hedge.

Silver quickly fell over 4% and gave up much of the gains of the last month. Gold fell $14.90 or 1.2% to $1235.00.

Rate hike expectations and the risks of a rate hike on March 15 are being attributed for the sharp silver price fall.

However, one would have thought that this was already priced into the market and therefore why the sudden 4% fall in minutes yesterday. It was unusual as there was no breaking news, no bearish silver or gold related news and indeed no important news or announcements from the Federal Reserve.

Indeed, most other markets were becalmed with no major moves in most markets except for gold and silver.

GATA Chairman Bill Murphy's "Midas" commentary at LeMetropoleCafe.com reviewed the smash in detail, as with commodity broker J.B. Slear's minute-by-minute tracking of the smash as contracts were dumped on the market in great bulk "starting at 11:25 a.m. for 40 minutes straight:"

1,071 contracts at 11:25.

5,648 at 11:30.

2,798 at 11:35.

1,175 at 11:40.

2,815 at 11:45.

3,319 at 11:50.

1,517 at 11:55.

2,357 at 12:00.

5,861 at 12:05.

4,702 at 12:10.

"That's a total of 30,192 contracts in 40 minutes."

Banks have been found guilty of manipulating most markets in recent years including the gold and silver markets. GATA has amassed a huge amount of evidence over the years and as recently as December came new revelations of silver fixing: Silver Fixing By Banks Proven In Traders Chats

Therefore, it stands to reason to suspect that the massive sell off may again have been by a bank or a proxy hedge fund or other institutional fund manipulating the silver market - either for private gain and trading profits or indeed on behalf of the official sector and central banks.

It could be a combination whereby banks realise that central banks are quietly pleased for gold and silver prices to be manipulated lower and banks can profitably manipulate markets believing that they are above the law.

Worst case scenario they get a slap on the wrist and a fine that is small in the light of their massive profits. Some poor patsy "lone wolf" kid trader is found to take the blame and the senior managers and executives get way with this criminal activity.

Golden Opportunity for Silver Buyers

The important point to remember here is that small retail bullion buyers and investors appear to be being defrauded by the largest players in the market – massive banks with massive liquidity provided to them by central banks.

It is also important to remember that this creates an opportunity. The suppression of gold and silver prices means that precious metals remain undervalued – especially versus the assets that banks and central banks favour – property, stocks and especially bonds.

Silver Coins VAT Free in Ireland, UK and EU

Silver Coins VAT Free in Ireland, UK and EU

Manipulation is an opportunity for investors as it allows them to accumulate physical gold and silver at artificially depressed prices.

The history of gold market 'fixing' and manipulation is of short term success followed by ultimate failure and much higher prices. This was seen after the 'London Gold Pool' failed spectacularly in the late 1960s. This was followed by gold and silver’s massive bull markets in the 1970s.

The gold and silver beach balls have been pushed near the bottom of the very small ‘precious metals pool.’ The lower they are pushed in the short term, the higher it will surge in the medium and long term.

Access breaking news and research here

Gold and Silver Bullion - News and Commentary

India's February gold imports surge 82% on pent-up demand (Reuters.com)

Global Stocks Retreat, Dollar Steady After Rally: Markets Wrap (Bloomberg.com)

Gold firm but heading for first weekly fall in five weeks (Reuters.com)

Bitcoin is now worth more than an ounce of gold for the first time ever (MarketWatch.com)

U.S. Libor surges by most in nearly 15 months (Reuters.com)

Gold Moves Higher Even if the Fed Raises Rates (DailyReckoning.com)

Silver Is Collapsing On Massive Volume (ZeroHedge.com)

Now that silver rig is as obvious the gold rig, will anyone else speak out? (GATA.org)

Why ‘Rich Dad’ author Robert Kiyosaki still thinks the market is about to crash (MarketWatch.com)

'Pure exuberance': Investor sentiment hasn't been this high since two bubbles ago (CNBC.com)

Gold Prices (LBMA AM)

03 Mar: USD 1,228.75, GBP 1,005.12 & EUR 1,168.05 per ounce

02 Mar: USD 1,243.30, GBP 1,013.17 & EUR 1,181.14 per ounce

01 Mar: USD 1,246.05, GBP 1,007.18 & EUR 1,182.50 per ounce

28 Feb: USD 1,251.90, GBP 1,006.90 & EUR 1,180.79 per ounce

27 Feb: USD 1,256.25, GBP 1,011.16 & EUR 1,187.41 per ounce

24 Feb: USD 1,255.35, GBP 1,000.89 & EUR 1,185.18 per ounce

23 Feb: USD 1,237.35, GBP 992.97 & EUR 1,173.13 per ounce

Silver Prices (LBMA)

03 Mar: USD 17.66, GBP 14.44 & EUR 16.76 per ounce

02 Mar: USD 18.33, GBP 14.93 & EUR 17.42 per ounce

01 Mar: USD 18.33, GBP 14.89 & EUR 17.40 per ounce

28 Feb: USD 18.28, GBP 14.70 & EUR 17.24 per ounce

27 Feb: USD 18.34, GBP 14.77 & EUR 17.33 per ounce

24 Feb: USD 18.27, GBP 14.56 & EUR 17.23 per ounce

23 Feb: USD 18.00, GBP 14.42 & EUR 17.06 per ounce

Recent Market Updates

- Trump Avoid Debt Crisis ? “Extremely Unlikely” – Rickards

- Art Market Bubble Bursting – Gauguin Priced At $85 Million Collapses 74%

- Gold’s Value – Weight, Beauty, Rarity, Peak Gold and Secure Storage – Interview

- Oscars Debacle – Movies More Costly As Dollar Devalued

- Gold Up 9% YTD – 4th Higher Weekly Close and Breaks Resistance At $1,250/oz

- The Oscars – Worth Their Weight in Gold?

- Gold To Benefit from Rising Inflation and Higher Than “Official” China Gold Demand

- Russia Gold Buying Is Back – Buys One Million Ounces In January

- Gold The “Ultimate Insurance Policy” as “Grave Concerns About Euro” – Greenspan

- Sharia Standard May See Gold Surge

- Gold Price To 2 Month High As Fiery Trump Declares World Order

- Gold’s Gains 15% In Inauguration Years Since 1974

- Turkey, ‘Axis of Gold’ and the End of US Dollar Hegemony

Interested in learning more about physical gold and silver?

Call GoldCore and speak with a Gold and Silver Specialist today!

0 comments:

Post a Comment