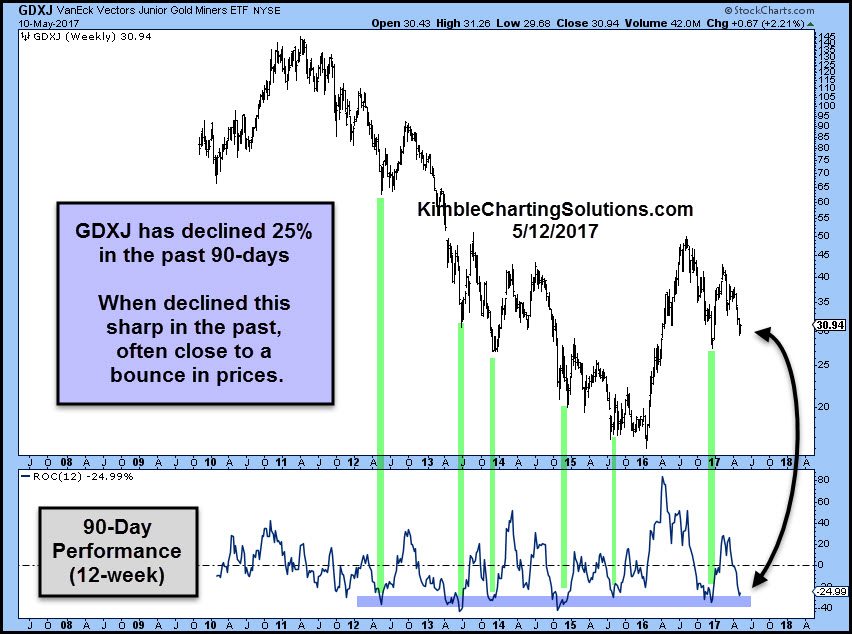

Junior Miner ETF has had a rough go of it the past 90- days. Could that large decline, present an opportunity? Below looks at the performance of GDXJ over 90-day windows since inception.

CLICK ON CHART TO ENLARGE

GDXJ has fallen nearly 25% over the past 90-days. When GDXJ has been down this hard in a 90-day window, in during a bear market, it was closer to a short-term low than a high. Below looks at the chart pattern of GDXJ and the GDXJ/GDX ratio.

CLICK ON CHART TO ENLARGE

Joe Friday Just The Facts- The large decline and the two charts directly above reflect that GDXJ was presenting a entry point, where a really should take place.

Both of these charts were shared on Wednesday with Premium and Metals members. We would be honored to have you as a member, if these type of patterns are of interest to you.

Send me an email to review a complimentary copy of my Weekly Metals Research that provides weekly pattern analysis and actionable ideas on Gold, Silver, Copper and the Miners

Website: KIMBLECHARTINGSOLUTIONS.COM

Blog: KIMBLECHARTINGSOLUTIONS.COM/BLOG

Questions: Email services@kimblechartingsolutions.com or call us toll free 877-721-7217 international 714-941-9381

0 comments:

Post a Comment