James Rickards via Daily Reckoning

Gold was down after the Fed's hike, but I expect it to start heading higher again. Too many powerful forces are driving it behind the scenes. Dwindling physical supply is a major one.

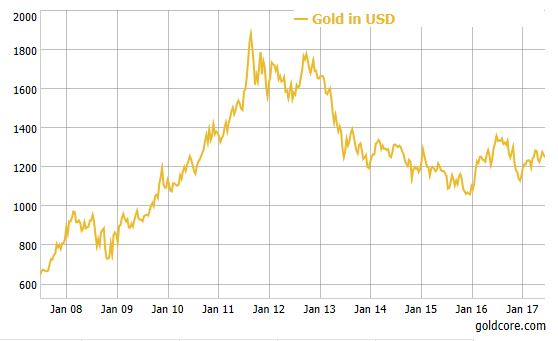

Gold in USD (5 Years)

On a recent visit to Switzerland, I was informed that secure logistics operators could not build new vaults fast enough and were taking over nuclear-bomb proof mountain bunkers from the Swiss Army to handle the demand for private storage.

Geopolitical fear is another. The crises in North Korea, Syria, Iran, the South China Sea, and Venezuela are not getting better. The headlines may fade in any given week, but geopolitical shocks will return when least expected and send gold soaring in a flight to safety.

Fed policy tightening is normally a headwind for gold. But, the last two times the Fed raised rates — December 14, 2016 and March 15, 2017 — gold rallied as if on cue.

Gold is the most forward-looking of any major market. It may be the case that the gold market sees the Fed is tightening into weakness and will eventually over-tighten and cause a recession.

At that point, the Fed will pivot back to easing through forward guidance. That will result in more inflation and a weaker dollar, which is the perfect environment for gold.

In short, all signs point to higher gold prices in the months ahead based on Fed ease, geopolitical tensions, and a weaker dollar.

The Fed’s Road Ahead is James Rickards latest piece for the Daily Reckoning. This is an excerpt & the full article can be read here

News and Commentary

Gold hits near four-week low as dollar firms (Reuters.com)

Bitcoin is suddenly on pace to have its worst week since 2015 (Marketwatch.com)

Iran fires missiles at ISIL positions in eastern Syria (Aljazeera.com)

Syrian warplane shot down by US jet (CNN.com)

Qatar Crisis Bashes Gulf Assets' Status as Middle East Haven (Bloomberg.com)

Gold down after Fed - Will start heading higher again on "dwindling supplies" (DailyReckoning.com)

Tug of war between the Fed and the markets (MoneyWeek.com)

"The Next Leg Is Clearly Lower" - Global Excess Liquidity Collapses (Zerohedge.com)

Qatar blockade, petro-yuan & coming war on Iran (RT.com)

Getting High on Cryptocurrencies (Bloomberg.com)

The new cryptocurrency gold rush: digital tokens that raise millions in minutes (Quartz Media)

Gold Prices (LBMA AM)

19 Jun: USD 1,251.10, GBP 976.86 & EUR 1,117.73 per ounce

16 Jun: USD 1,256.60, GBP 984.04 & EUR 1,124.03 per ounce

15 Jun: USD 1,260.25, GBP 992.57 & EUR 1,127.67 per ounce

14 Jun: USD 1,268.25, GBP 995.83 & EUR 1,131.41 per ounce

13 Jun: USD 1,261.30, GBP 992.26 & EUR 1,125.33 per ounce

12 Jun: USD 1,269.25, GBP 998.14 & EUR 1,131.28 per ounce

09 Jun: USD 1,274.25, GBP 1,001.31 & EUR 1,139.18 per ounce

Silver Prices (LBMA)

19 Jun: USD 16.67, GBP 13.02 & EUR 14.87 per ounce

16 Jun: USD 16.86, GBP 13.19 & EUR 15.10 per ounce

15 Jun: USD 16.86, GBP 13.19 & EUR 15.10 per ounce

14 Jun: USD 16.96, GBP 13.32 & EUR 15.14 per ounce

13 Jun: USD 16.82, GBP 13.21 & EUR 15.01 per ounce

12 Jun: USD 17.13, GBP 13.50 & EUR 15.27 per ounce

09 Jun: USD 17.35, GBP 13.60 & EUR 15.52 per ounce

Recent Market Updates

- Billionaires Invest In Gold

- Brexit and UK election impact UK housing

- In Gold we Trust: Must See Gold Charts and Research

- Pension Funds, Sovereign Wealth Funds, Central Banks “Stock Up” on Gold “Amid Uncertainty”

- 4 Charts Show Gold May Be Heading Much Higher

- Gold in Pounds Surges 1.5% To £1,001/oz – UK Political Turmoil Likely

- Gold Prices Steady On UK Election Risk; ECB Meeting and Geopolitical Risk

- Gold Breaks 6-Year Downtrend On Safe Haven and 50% Surge In Chinese Demand

- Deposit Bail In Risk as Spanish Bank’s Stocks Crash

- Terrorist attacks see Gold Stay Firm

- Trust in the Bigger Picture, Trust in Gold

- Trump, UK and the Middle East drive uncertainty

- Is China manipulating the gold market?

0 comments:

Post a Comment