In Gold we Trust Report: Bull Market Will Continue

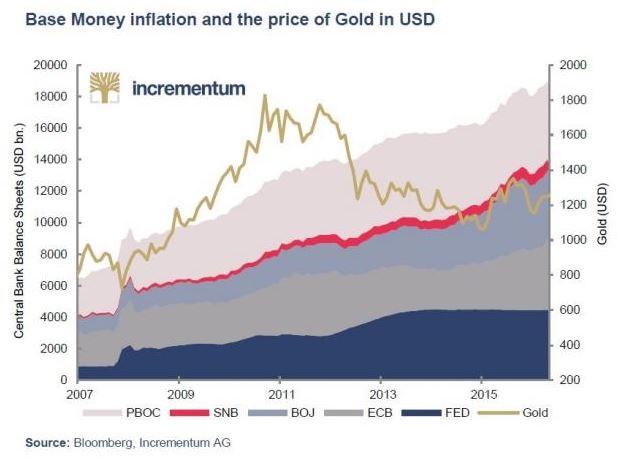

The 11th edition of the annual "In Gold we Trust" is another must read synopsis of the fundamentals of the gold market, replete with excellent charts by our friend Ronald-Peter Stoeferle and his colleague Mark Valek of Incrementum AG.

Key topics and takeaways of the report:

- "Sell economic ignorance, buy gold ..."

- Many signals suggest that we are about to face a big shift within the financial and monetary system

- 5 reasons why the gold bull market will continue

- Gold's gains in 2016 dampened due to high expectations of Trump's growth policy

- Gold still up 8.5% in 2016 and 10.2% since January 2017

- Attempt at normalization of U.S. monetary policy will be litmus test for US economy

- Bitcoin: Digital gold or fool's gold?

- White, Gray and Black Swans and consequences for gold price

- Exclusive Interview with Dr. Judy Shelton (Economic advisor to Donald Trump) about a possible remonetisation of gold

- Prudent investors should consider accumulating gold and gold stocks now due to excessive global debt, the “gradual reduction of the U.S. dollar’s importance as a global reserve currency” and the high probability that the U.S. is close to entering a recession

- "It is a case of better having insurance and not needing it, than one day realizing that one needs it but doesn't have it..."

- "We live in an age of advanced monetary surrealism...."

Research can be downloaded here:

In Gold we Trust – Extended version (169 pages)

In Gold we Trust – Compact version (29 pages)

News and Commentary

Gold tips lower, while palladium heads for highest finish since 2014 (MarketWatch.com)

Palladium near 16-year high, gold firm ahead of Fed meeting (Reuters.com)

China’s Shandong Gold Mining to seek loans to buy Barrick mine stake (Reuters.com)

Fed set to raise interest rates, give more detail on balance sheet winddown (Reuters.com)

Islamic State calls for attacks in West, Russia, Middle East, Asia during Ramadan (Reuters.com)

- Palladium's Constrained Supply. Source: Johnson Matthey & CPM Group via Macrotourist

Gold Is In A "Long Term Uptrend" Due To Political Turmoil - Cook (Bloomberg.com)

Gold could withstand rising interest rates, unwinding of Fed assets: TD Securities (Platts.com)

Palladium Pandemonium - Short Squeeze Sends Precious Metal Spreads (ZeroHedge.com)

Gold-Stock Inflection Nears - Hamilton (SeekingAlpha.com)

What, Me Worry? says Mauldin (MauldinEconomics.com)

| Avoid Digital & ETF Gold – Key Gold Storage Must Haves |

Gold Prices (LBMA AM)

13 Jun: USD 1,261.30, GBP 992.26 & EUR 1,125.33 per ounce

12 Jun: USD 1,269.25, GBP 998.14 & EUR 1,131.28 per ounce

09 Jun: USD 1,274.25, GBP 1,001.31 & EUR 1,139.18 per ounce

08 Jun: USD 1,284.80, GBP 992.12 & EUR 1,142.70 per ounce

07 Jun: USD 1,292.70, GBP 1,001.07 & EUR 1,146.62 per ounce

06 Jun: USD 1,287.85, GBP 997.31 & EUR 1,144.77 per ounce

05 Jun: USD 1,280.70, GBP 992.41 & EUR 1,136.88 per ounce

Silver Prices (LBMA)

13 Jun: USD 16.82, GBP 13.21 & EUR 15.01 per ounce

12 Jun: USD 17.13, GBP 13.50 & EUR 15.27 per ounce

09 Jun: USD 17.35, GBP 13.60 & EUR 15.52 per ounce

08 Jun: USD 17.60, GBP 13.60 & EUR 15.67 per ounce

07 Jun: USD 17.60, GBP 13.64 & EUR 15.71 per ounce

06 Jun: USD 17.56, GBP 13.61 & EUR 15.62 per ounce

05 Jun: USD 17.52, GBP 13.58 & EUR 15.59 per ounce

Recent Market Updates

- Pension Funds, Sovereign Wealth Funds, Central Banks “Stock Up” on Gold “Amid Uncertainty”

- 4 Charts Show Gold May Be Heading Much Higher

- Gold in Pounds Surges 1.5% To £1,001/oz – UK Political Turmoil Likely

- Gold Prices Steady On UK Election Risk; ECB Meeting and Geopolitical Risk

- Gold Breaks 6-Year Downtrend On Safe Haven and 50% Surge In Chinese Demand

- Deposit Bail In Risk as Spanish Bank’s Stocks Crash

- Terrorist attacks see Gold Stay Firm

- Trust in the Bigger Picture, Trust in Gold

- Trump, UK and the Middle East drive uncertainty

- Is China manipulating the gold market?

- Why Sharia Gold and Bitcoin Point to a Change in Views

- Bitcoin volatility and why it’s good for gold

- Silver Bullion In Secret Bull Market

0 comments:

Post a Comment