Last week, we said:

It is commonly accepted to say the dollar is “printed”, but we can see from this line of thinking it is really borrowed. There is a real borrower on the other side of the transaction, and that borrower has powerful motivations to keep paying to service the debt.

Bitcoin has no backing. Bitcoin is created out of thin air, the way people say of the dollar. The quantity of bitcoins created may be strictly limited by Satoshi’s design.

We referred to the dollar as being borrowed into existence, to make our point that the dollar’s value is pretty firm, due to the struggles of the debtors. By contrast, bitcoin is created ex nihilo (yes, yes, at a limited rate and subject to an ultimate cap on its quantity).

A reader took exception to the idea, and asserted that bitcoin is borrowed and lent all the time. We would like to address this, though first noting that this reader failed to address our point. A bitcoin is not, itself, a debt. It is not borrowed into existence. Now we will consider the reader’s point whether there is any real borrowing in bitcoin at all.

The problem with borrowing a currency which its proponents tell us will go up another 30 times (and which has gone up 6.6 times in the past year) is that your payment is going up. Would you buy a house with a monthly payment of $1,000 a month, knowing this payment would go up to $6,000 by the end of the year and to $180,000 in a few more years?

That reader dismisses such concern by noting that all transactions have risks. But this is not an ordinary risk. This is the risk of shorting a once-in-a-generation technology boom. Anyone who borrowed bitcoin a year ago at $585 would be bankrupt today at $3850. The last time we had such a craze was the dot com boom of the late 1990’s. Few would have shorted the NASDAQ. Perhaps nimble and aggressive traders, but certainly not ordinary businesses who were just trying to finance building a new retail store or buying a machine.

We say “shorting”, because that is the simplest and clearest way to understand borrowing in a foreign currency. If you borrow bitcoin (or Argentinian pesos) then you owe the return of that same quantity of bitcoin (or pesos) plus interest. If you borrow to finance a dollar expense in a dollar-generating business, then you have in fact established a short position in bitcoin. You are betting it will go down, or at least not go up. When it has gone up 660% so far and promises to go up another 3,000%, you suffer huge capital losses.

Any dollar-generating business should borrow in dollars. That way its short position is in the same currency as its long position. Its short position is its debt, and its long position is its revenue stream. When the currencies of liability and asset match, then the business has no net currency exposure. Its risk is purely entrepreneurial—will customers want its products at a price it can profitably sell them?

Thus we say that, in theory no one (except a bitcoin miner) should borrow in bitcoin. And in practice anyone who borrowed a year ago is now certainly bankrupt. Only a bitcoin miner has a primary bitcoin income. We say primary to distinguish from something that is common today. Many businesses, from Overstock to Expedia, accept bitcoin in transactions, but this is something else entirely.

They are businesses with dollar expenses, and set their prices in dollars. They just calculate a bitcoin amount, based on the dollar total in the shopping cart divided by the current price of bitcoin. When the customer pays, the bitcoin is immediately sold into the market, and the merchant gets the precise dollar amount that it wanted. Typically, a third party earns a small fee on the transaction.

The customer might swear that he paid in bitcoin. But that’s not accurate. What really happened is four-party transaction:

- Customer has bitcoin, wants Merchant’s goods

- New Bitcoin Speculator has dollars, wants bitcoins

- Merchant has goods, wants dollars

- Bitcoin payment processor enables parties #1 through #3 to transact by selling Customer’s bitcoins to New Bitcoin Speculator for dollars to pay to Merchant

The merchant who accepts bitcoin does not receive the bitcoin. The merchant receives the dollars. A bitcoin buyer out there in the world receives the bitcoin.

It is no different than if a money changer loitered near a merchant stall in a market bazaar in the ancient world. A foreigner wants to buy spices, but has the wrong kind of coins. The money changer figures out the exchange rate, takes the foreigner’s coins and pays the merchant in domestic coins.

Only, today on the Internet, this is done instantaneously and without the awareness of the customer.

We can think of only one kind of business with primary revenues in bitcoin. A miner. A miner could finance the purchase of more computer equipment by borrowing in bitcoin, as its income is in bitcoin. It has no currency risk (and indeed would have a currency risk if it borrowed in dollars).

Yet, this reader persisted. Bitcoin has a futures market now. Look at the term structure, he said. Now, we were really interested. A futures market and a forward curve! Hmmmm. ????

We did some looking around, and found some bitcoin futures exchanges. Each is different. Settlement on contract maturity is not clear to us at this point.

But one thing is clear. The purpose of these exchanges is to allow speculation on bitcoin with leverage. They are not warehousing markets as we see in commodities, coordinating seasonal production with year-round consumption.

According to our reader, there is a forward curve (in 30 minutes of Googling, we were not able to find a web page that showed prices of various contracts perhaps because we are looking on the weekend). He offered (on Monday, Aug 7) that when bitcoin was $3,370, the Sep 29 contract (53 days) was $3,435.2. This is a difference of $65.20. Contango.

It is important to note that this is a dollar profit, to be made on one’s dollars. If one had $3,370 one could use the bitcoin market to make more dollars. One would simultaneously buy 1 bitcoin and sell 1 bitcoin contract forward (about two months to maturity). One would end with the same dollars, plus pick up an additional 65 bucks, or about 12% annualized. This 12% is not based on any move in the price of bitcoin, and in fact one would have no exposure to change in price.

Regular readers will note that this is a carry trade, which occurs in the gold market all the time.

There is no way to start with 1 bitcoin, and end with 1.12 bitcoins. Try to work out how this could be done. If you sell the bitcoin and buy the future, that is a decarry. Decarrying would lose money (more than carrying could make).

The bitcoin futures market would seem (we are taking the reader’s price quotes at face value) to offer a rich interest rate on your dollars. We assume this is because of the risks of these fledgling bitcoin futures markets. Does anyone even know if they are calculating margin correctly, segregating it properly, and managing the clearinghouse with an appropriate level of financial controls?

If there were no risk, then anyone with access to borrow at LIBOR (about 1.25% for two month duration) could crush this spread. Instead of $3,435.20, a two-month contract should sell for $3,377 (based on $3,370 bitcoin). Instead of $62.20, one should be able to make around $7.

So as it stands, we see no real evidence of bitcoin lending and borrowing. We looked and found one open request to borrow bitcoin (this borrower says he will use the loan proceeds to buy machines to mine bitcoin).

We see that even if there is a working bitcoin futures exchange, it offers a dollar yield on dollars, not a bitcoin yield on bitcoin. Like with gold. The gold forward rate is not a gold yield. It’s a dollar yield to carry gold.

Gold offers an arbitrage that is not available in bitcoin. One can borrow dollars, buy gold, sell a future, and lend the gold out to a business that is using gold. As gold is a physical good, there are businesses that do things to transform its purity, shape, and location. For example, refiners and jewelers. It’s simpler and less expensive for them to finance their gold needs in gold directly from Monetary Metals, than it is to borrow dollars and hedge the price risk.

Thus, bullion banks perform the arbitrage described above all day long. In theory one could do similarly with bitcoin, but that would only make sense if there were bitcoin-generating businesses who borrowed in bitcoin.

And, back to our original point, the bitcoin itself is not borrowed into existence. It is printed (again, at a controlled rate with an ultimate cap on quantity). Therefore, bitcoin’s value is set purely by speculators only. So long as speculators expect the price to keep rising, they will keep buying and fulfill their own prophecy. When the chart begins to look ugly—all speculators are looking at the same chart—then the price action will turn.

Behind each bitcoin, there is not a debtor bidding up bitcoin with the products of his labor.

As of this writing, the price of bitcoin is now $4,150. This is a gain of $780 from the time of our discussion with the reader! If one had borrowed bitcoin at that time, as the reader insisted one could reasonably do, one already suffers a monthly payment 22% higher than it was earlier this week.

We believe principles of economics can be examined and validated this week. Find a concrete example, and see how the theory works out. If borrowing a rising currency is hazardous to your wealth, what does that say about bitcoin’s suitability for borrowing? When its price begins to fall again (it has happened before) then the destruction occurs on the other side. Borrowers’ gains will come from speculators’ pain (we insist it’s speculators, not savers—bitcoin is not a suitable vehicle for savings).

The prices of the metals was up sharply this week, especially on Wednesday. Was it manipulation? Yes, we know, we are not supposed to ask if price rises are manipulation. Only price dips can be manipulation, and rises are just nature taking its course. But we ask anyways?

Ok… no. No, it was not manipulation. We saw exactly the change in the gold and silver bases that we would expect in a rising market. We will show graphs of the basis, the true measure of the fundamentals.

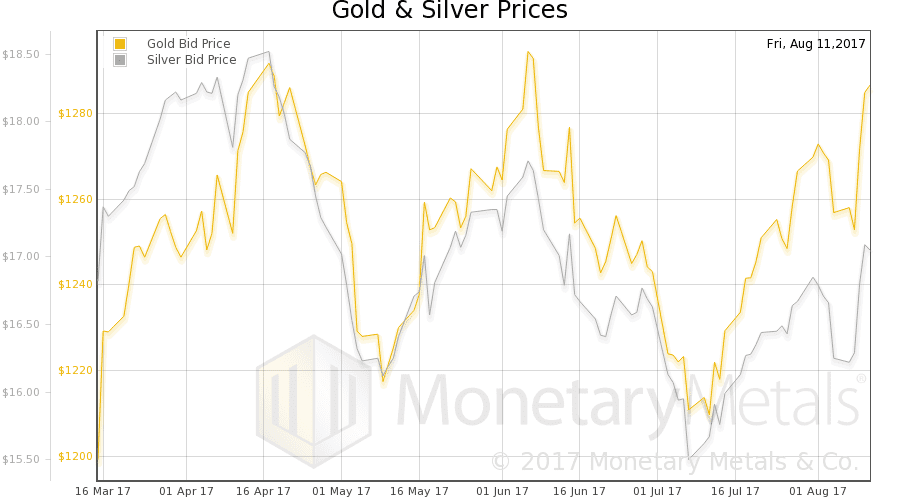

But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio moved down sharply this week.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

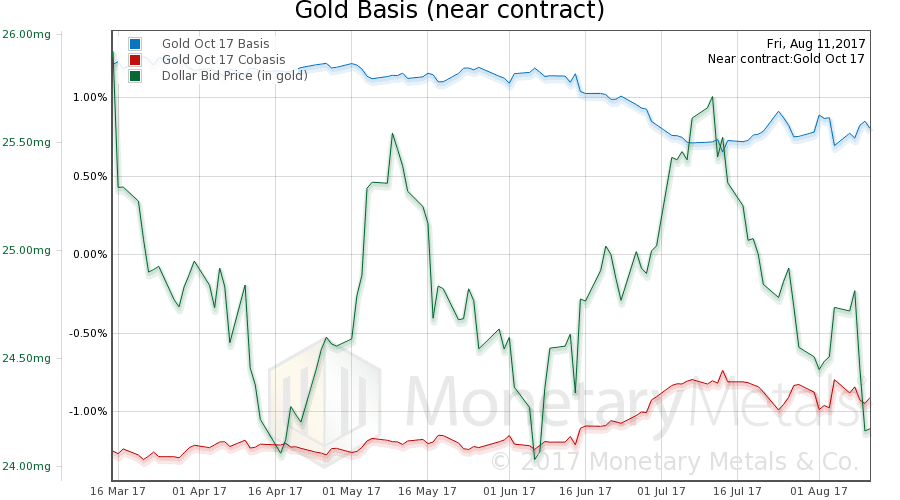

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The dollar fell this week (the mirror image of the rising price of gold), now down to not much over 24mg gold. And the basis rose a bit, 11bps. Gold became a little more abundant, but not a lot, at the higher price. About $28 higher.

Our calculated gold fundamental price rose about $15 (chart here). About half as much as the market price went up.

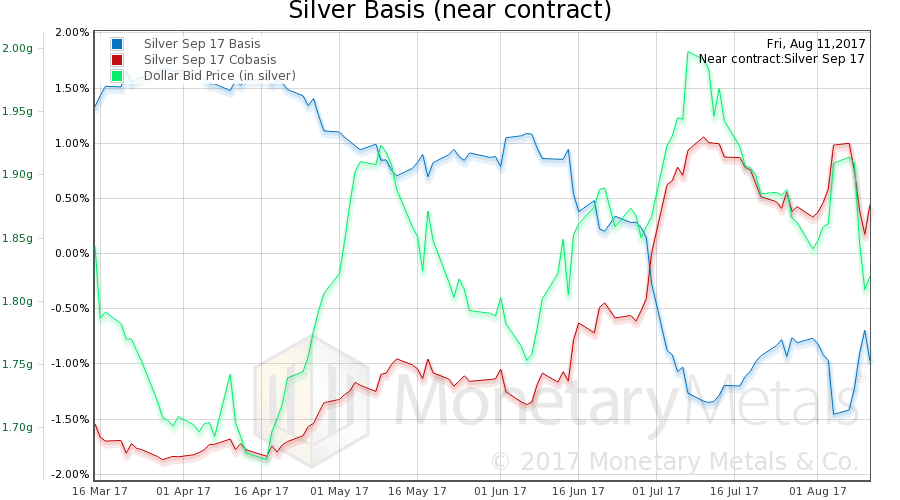

Now let’s look at silver.

In silver, the move up in the basis is greater. Keep in mind that we are approaching the expiry of the September silver contract, so a rising basis is a move against the pressures of the contract roll which is ongoing.

Our calculated silver fundamental rose $0.46 (chart here). Whereas the market price is up $0.80.

Speculators are pushing up the price a bit more than the firming fundamentals would justify. Are they manipulating the price of the metal? Of course not! All buying causes price to rise. And speculators are hoping to profit (as they reckon it, in dollars) from the rise. They don’t care (or mostly know) that the price is being driven more by speculators than by buyers of metal. They just want to sell at a higher price than they bought.

Last week, we asked rhetorically:

So is the silver selloff over? It’s hard to tell. The fundamentals were firming this week—the fundamental price did not move down much during the move. -$0.09 from Thursday to Friday. On the other hand, speculators may be putting in sell orders over the weekend and may decide to bail out on Monday. Momentum can be self-fulfilling.

Clearly the selloff was over. Fundamentals beat momentum. It happens every time, though the timing of the victory and the elasticity of the speculation is impossible to predict.

One thing is for sure. If the fundamentals don’t continue to firm up further, or at least hold at the present level, then this rally is doomed like all of the others in the last 6 years.

© 2017 Monetary Metals

0 comments:

Post a Comment