Gold Sees Safe Haven Gains On Trump “Fire and Fury” Threat

- Gold climbs amid rising risk on US and North Korea

- Trump threatened North Korea with ‘fire and fury like the world has never seen’

- North Korea says prepared to strike the US territory of Guam

- North Korea said US exercise 'proves that the U.S. imperialists are nuclear war maniacs'

- Heated rhetoric likely to support gold for rest of the week

- Russia and China poised to take advantage

- Situation adds to uncertainty in an already uncertain world

Gold provides certainty as US and North Korea go head-to-head

Just a few months ago President Trump offered an olive branch of sorts to North Korean dictator Kim Jong Un. In a series of interviews Trump referred to Kim as a ‘pretty smart cookie’ and one who he would be ‘honoured’ to meet.

Shortly after Kim Jong Un seemingly batted the olive branch away when he issued the following statement through state media, ‘… the most perfect weapon systems in the world will never become the eternal exclusive property of the U.S. … the U.S. should not … disregard or misjudge the reality that its mainland and Pacific operation region are in (North Korea’s) sighting range for strike.”

Now, less than two months later, we sit here with our morning coffees wondering if the world is on the brink of nuclear war.

Trump’s olive branch is now a massive red hot poker which continues to poke the proverbial bear.

"North Korea best not make any more threats to the United States. They will be met with fire and fury like the world has never seen."

"He has been very threatening beyond a normal statement. And, as I said, they will be met with fire, fury, and frankly power, the likes of which this world has never seen before."

Technologically advanced

The latest war of words comes on the back of a heated few days between the two countries.

On Saturday the UN announced fresh sanctions on North Korea. On Monday the US released pictures of a bilateral strategic exercise around Guam.

North Korea’s state media said North Korea would retaliate and make "the US pay a price" for drafting the new measures.

In the past the world has been reassured that North Korea’s bark is far worse than its bite due to the lack of technology which allowed the regime to build dangerous missiles.

This is unfortunately no longer the case.

A report by the Washington Post, which cited US intelligence officials, suggested North Korea is developing nuclear weapons capable of hitting the US at a much faster rate than expected.

North Korea seems keen to prove this as soon as possible:

‘The KPA Strategic Force is now carefully examining the operational plan for making an enveloping fire at the areas around Guam with medium-to-long-range strategic ballistic rocket Hwasong-12 in order to contain the U.S. major military bases on Guam including the Anderson Air Force Base in which the U.S. strategic bombers, which get on the nerves of the DPRK and threaten and blackmail it through their frequent visits to the sky above south Korea, are stationed and to send a serious warning signal to the U.S.

It should immediately stop its reckless military provocation against the state of the DPRK so that the latter would not be forced to make an unavoidable military choice.’

Time for Russia and China to step up?

In the run up to this situation all eyes have been on Russia and China who ultimately hold the most responsibility for handling relations with North Korea. Both countries are economically tied to the dictatorship and could have influence over Kim JI.

The problem here is that the United States does not want to be seen to be too reliant on the wannabe super-powers of the East, despite this being their only (peaceful) option. There are many things to be gained here by both Putin and Xi Jinping.

Both leaders have recently come together to call on both North Korea and the US to lay down their weapons and cool their rhetoric.

Whilst both have supported the latest round of sanctions, it seems at the moment their calls for calm are falling on deaf ears as all sides work to show off their strengths.

This is something worth paying attention to. Regardless of how North Korea vs Trump unfolds, the other side of this scenario will no doubt present a very different set of new world powers as countries set to take advantage of a distracted, divided and bankrupt United States.

See what’s important

This is unfortunately likely to be the beginning of yet another war of words, we expect this to affect gold prices positively as we move towards the end of the week.

Gold prices benefit from such situations partly because of the precious metal’s historical role during times such as these but also because it thrives when there is uncertainty. No one can argue there is no uncertainty when two countries are turning their nuclear weapons towards one another.

Unsurprisingly the heating up of the situation with North Korea has pushed ‘issues’ such as US labour data and inflation data to the bottom of the agenda.

This should serve as a timely reminder that it is the bigger picture which is important when it comes to economics and finance. Whilst economic data such as employment figures are important, it is what the global picture and geo-politics looks like over the long-term which will drive safe haven assets such as gold and silver.

Situations such as these can be game changers alas. Both Trump and Kim appear to be determined to keep escalating until the other gives in.

Unfortunately some form of military conflict looks increasingly inevitable and is unlikely to have a happy ending. Savers and investors should take note of this increasingly unstable situation and place their wealth into assets that perform well in times of uncertainty and indeed war, safe haven assets such as gold and silver.

News and Commentary

Gold up on rising U.S.-North Korea tensions (Reuters.com)

Gold, Yen Gain on North Korea Tension; Stocks Drop (Bloomberg.com)

Top Gold Producer Says Mining Needs More Activist Investors (Bloomberg.com)

BOE warns "stability threats" to financial system from ‘cliff-edge’ Brexit (FT.com)

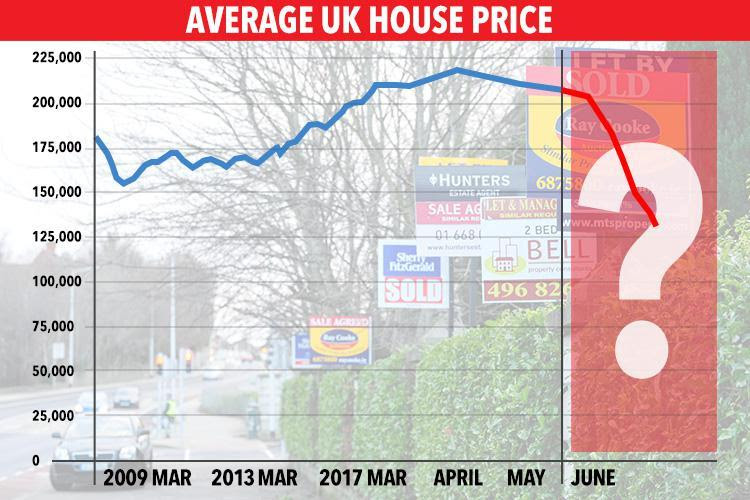

House prices fall for fourth quarter running (CityAM.com)

SWOT Analysis: What’s Next for the Yellow Metal? (GoldSeek.com)

Now, a Trade War — Is a Shooting War Next? (DailyReckoning.com)

Russia To Cut Dependence On U.S. Dollar, Payment Systems (ZeroHedge.com)

New research: the Great Recession is still with us (TrueEconomics)

The Debt-Ceiling Crisis Is Real (NYTimes.com)

Gold Prices (LBMA AM)

08 Aug: USD 1,261.45, GBP 967.78 & EUR 1,068.20 per ounce

07 Aug: USD 1,257.55, GBP 963.41 & EUR 1,065.90 per ounce

04 Aug: USD 1,269.30, GBP 964.92 & EUR 1,068.37 per ounce

03 Aug: USD 1,261.80, GBP 952.41 & EUR 1,064.96 per ounce

02 Aug: USD 1,266.65, GBP 956.83 & EUR 1,069.56 per ounce

01 Aug: USD 1,267.05, GBP 957.76 & EUR 1,072.30 per ounce

31 Jul: USD 1,266.35, GBP 965.59 & EUR 1,079.06 per ounce

Silver Prices (LBMA)

08 Aug: USD 16.39, GBP 12.57 & EUR 13.87 per ounce

07 Aug: USD 16.13, GBP 12.35 & EUR 13.67 per ounce

04 Aug: USD 16.70, GBP 12.71 & EUR 14.07 per ounce

03 Aug: USD 16.47, GBP 12.50 & EUR 13.91 per ounce

02 Aug: USD 16.67, GBP 12.60 & EUR 14.09 per ounce

01 Aug: USD 16.74, GBP 12.67 & EUR 14.17 per ounce

31 Jul: USD 16.76, GBP 12.77 & EUR 14.29 per ounce

Recent Market Updates

- Silver Mining Production Plummets 27% At Top Four Silver Miners

- Gold Consolidates On 2.5% Gain In July After Dollar Has 5th Monthly Decline

- Gold Coins and Bars See Demand Rise of 11% in H2, 2017

- Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

- What Investors Can Learn From the Japanese Art of Kintsukuroi

- Bitcoin, ICO Risk Versus Immutable Gold and Silver

- This Is Why Shrinkflation Is Making You Poor

- Gold A Good Store Of Value – Protect From $217 Trillion Global Debt Bubble

- Why Surging UK Household Debt Will Cause The Next Crisis

- Gold Seasonal Sweet Spot – August and September – Coming

- Commercial Property Market In Dublin Is Inflated and May Burst Again

- Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

- Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

0 comments:

Post a Comment