Gold Up 2.3%, Silver 5.3% In Week - Gundlach, Gartman and Dalio Positive On Gold

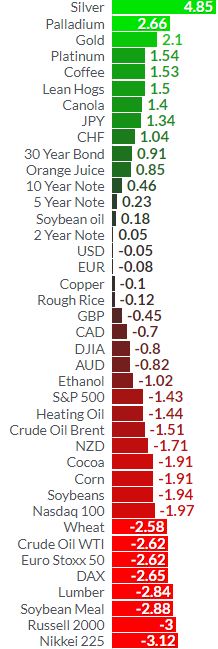

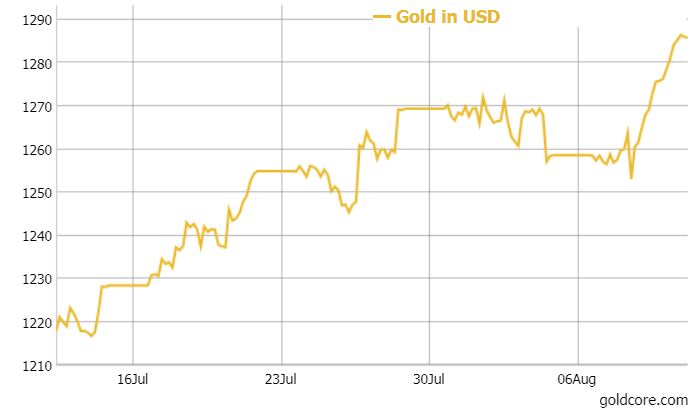

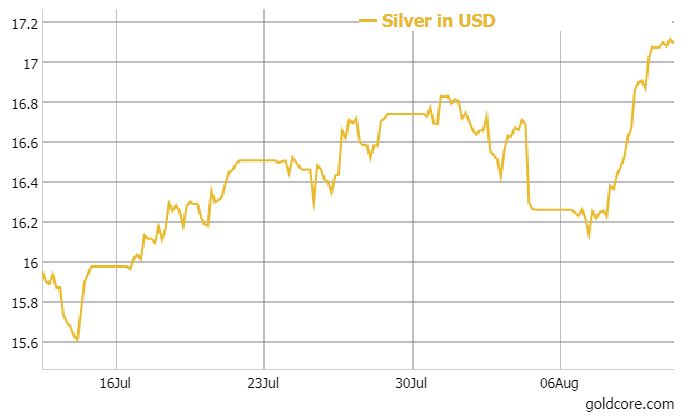

- Gold is up 2.3% this week and silver has surged nearly 5.3% as stocks sell off on geopolitical risk

- Billionaire fund managers and commodities experts increasingly positive on gold

- Risks are rising, and everybody should put 5% to 10% of their assets in gold - Dalio

- Dalio's Bridgewater, world's largest hedge fund, warned clients that geopolitical risks are rising

- 'Gold is about break out on the upside strongly' - commodities expert Gartman

- Gartman believes right now investors should have 10% to 15% allocation to gold

- "The stock market looks a little vulnerable. The geopolitical circumstances are getting worse and worse" - Gartman

- Run up in gold prices is far from over due to economic risks - Gartman

- Gold's chart has 'one of the most bullish' patterns - Billionaire bond guru Gundlach

- Gold up 6.3% and silver 8.2% in 30 days and look on verge of major move higher

Market Performance - One Week (Finviz)

See below for Business Insider UK article on Gundlach, CNBC article on Gartman and Business Insider on Dalio's views on gold

News and Commentary

Gold ends at 2-month high: Risk aversion is back on (MarketWatch.com)

Stocks Drop Most Since May, Bonds Rally on Tension (Bloomberg.com)

GUNDLACH: Gold's chart has 'one of the most bullish' patterns around (BusinessInsider.com)

Dalio Recommends Gold as Hedge Against Rising Political Risk (Bloomberg.com)

'Gold is about break out on the upside strongly,' Dennis Gartman says (CNBC.com)

Everybody Needs To Put 5% to 10% of Their Money In Gold (BusinessInsider.com)

These 7 billionaires are worried about a stock-market correction (MarketWatch.com)

Sanctions will destroy the dollar (TheStreet.com)

Bitcoin Debate between Keiser and Schiff (Youtube.com)

Decade after financial crisis, World is still hooked on debt that caused it (Telegraph.co.uk)

Related Content

“Do You Own Gold?” Ray Dalio at CFR: “Oh Yeah, I Do”

Gold Selling “Malevolent Force”? – Dennis Gartman

Gold Is Undervalued - Leading Money Managers

Gold Prices (LBMA AM)

11 Aug: USD 1,288.30, GBP 993.67 & EUR 1,096.47 per ounce

10 Aug: USD 1,278.90, GBP 985.39 & EUR 1,091.67 per ounce

09 Aug: USD 1,267.95, GBP 974.80 & EUR 1,079.79 per ounce

08 Aug: USD 1,261.45, GBP 967.78 & EUR 1,068.20 per ounce

07 Aug: USD 1,257.55, GBP 963.41 & EUR 1,065.90 per ounce

04 Aug: USD 1,269.30, GBP 964.92 & EUR 1,068.37 per ounce

03 Aug: USD 1,261.80, GBP 952.41 & EUR 1,064.96 per ounce

Silver Prices (LBMA)

10 Aug: USD 17.08, GBP 13.14 & EUR 14.57 per ounce

09 Aug: USD 16.59, GBP 12.76 & EUR 14.14 per ounce

08 Aug: USD 16.39, GBP 12.57 & EUR 13.87 per ounce

07 Aug: USD 16.13, GBP 12.35 & EUR 13.67 per ounce

04 Aug: USD 16.70, GBP 12.71 & EUR 14.07 per ounce

03 Aug: USD 16.47, GBP 12.50 & EUR 13.91 per ounce

02 Aug: USD 16.67, GBP 12.60 & EUR 14.09 per ounce

Recent Market Updates

- Great Disaster Looms as Technology Disrupts White Collar Workers

- Gold Sees Safe Haven Gains On Trump “Fire and Fury” Threat

- Silver Mining Production Plummets 27% At Top Four Silver Miners

- Gold Consolidates On 2.5% Gain In July After Dollar Has 5th Monthly Decline

- Gold Coins and Bars See Demand Rise of 11% in H2, 2017

- Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

- What Investors Can Learn From the Japanese Art of Kintsukuroi

- Bitcoin, ICO Risk Versus Immutable Gold and Silver

- This Is Why Shrinkflation Is Making You Poor

- Gold A Good Store Of Value – Protect From $217 Trillion Global Debt Bubble

- Why Surging UK Household Debt Will Cause The Next Crisis

- Gold Seasonal Sweet Spot – August and September – Coming

- Commercial Property Market In Dublin Is Inflated and May Burst Again

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

0 comments:

Post a Comment