We have noticed a proliferation of pundits, newsletter hawkers, and even mainstream market analysts focusing on one aspect of the bitcoin market. Big money, institutional money, public markets money, is soon to flood into bitcoin. Or so they say.

We will not offer our guess as to whether this is true. Instead, we want to point out something that should be self-evident. If big money is soon to come in, and presumably drive the price up to whatever new height—perhaps even the magic $1,000,000—what comes after?

In the restless churn that has overgrown our capital markets, investors speculators are always seeking to get into whatever asset is bubbling up. Big money leaving will follow big money entering, as surely as a rock thrown into the air will fall back down.

In last week’s Supply and Demand Report, we excerpted a quote from economist John Maynard Keynes. He cited Vladimir Lenin discussing how to destroy Western civilization. Here is the full quote (from The Economic Consequences of the Peace):

“Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some. The sight of this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth.

Those to whom the system brings windfalls, beyond their deserts and even beyond their expectations or desires, become “profiteers,” who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat. As the inflation proceeds and the real value of the currency fluctuates wildly from month to month, all permanent relations between debtors and creditors, which form the ultimate foundation of capitalism, become so utterly disordered as to be almost meaningless; and the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

Keynes is talking about printing currency, which causes rising prices. He went on to note that businesses who buy and sell goods get rich. There is always a price increase between when they buy and sell. And when they borrow to invest in property and plant, they profit again.

He is describing the American economy in the 1960’s and 1970’s (except the Fed does not print, it borrows). It does not describe the present environment (see also Keith’s article The Lazy 1970’s vs. the Frenetic 2000’s).

Today, prices are not rising, but falling. Crude oil, for example, has not merely fallen a little. It has been an epic collapse (which is likely not over). Commodities show monetary effects most clearly (and skyrocketing healthcare costs are not the effect of monetary policy, but regulatory and fiscal policy).

Yet, Lenin’s debauchery is still occurring. The hidden forces of economics are still in operation. The undermining of civilization is still the effect. And it’s still true that not one in a million can diagnose it.

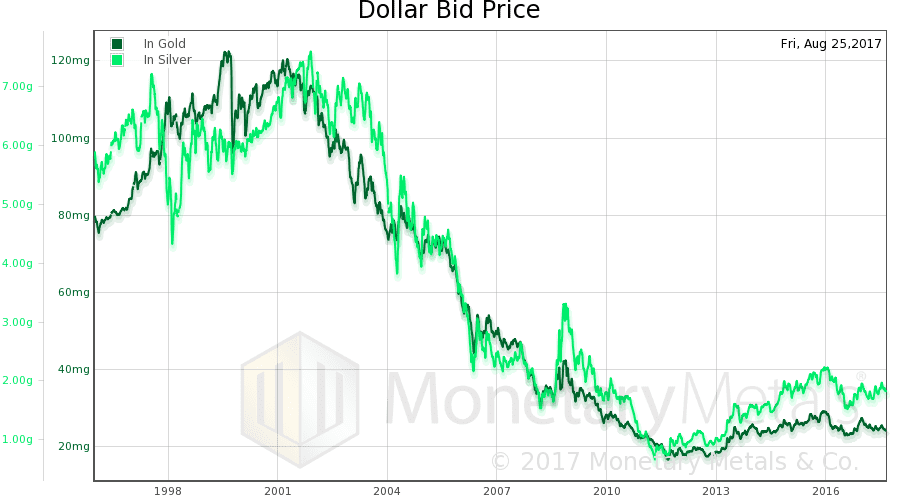

Let’s focus on something else Keynes said, that the value of the currency fluctuates wildly. That means in both directions (we don’t have a graph of the value of the German mark, but this page by University of California Santa Barbara Professor Harold Marcuse shows it in a table).

The US dollar certainly fluctuates wildly in both directions. Look at this graph of the price of the dollar. The dollar goes up from 80mg gold to 120mg, then down to 16mg then up to 29.27mg on Dec 3, 2015. Since then, it’s been choppy.

The price of the dollar is not the only thing that fluctuates wildly. The interest rate also fluctuates wildly. In the same period, the interest rate on the benchmark 10-year Treasury has fluctuated from 7% to 1.4%.

This is important because the net present value of a long-term loan or bond fluctuates (inversely) with the interest rate. As the rate falls, the net present value rises. This is an example of “permanent relations between debtors and creditors … becom[ing] so utterly disordered as to be almost meaningless”.

We refer to the capital gains that go to bond speculators, and corresponding capital losses that go to bond issuers (though conventional accounting does not recognize it). Keynes described this perfectly too, “this arbitrary rearrangement of riches strikes not only at security but [also] at confidence in the equity of the existing distribution of wealth”.

When bond prices rise and bond yields fall, then by a process of arbitrage stock prices rise and stock yields fall. And the same for real estate. When bonds, stocks, and real estate are rising then all assets experience upward pressure.

And how do most people feel about this? Keynes nailed this too. “Those to whom the system brings windfalls … are the object of the hatred of the bourgeoisie, … not less than of the proletariat.” On the one hand, wages are under downward pressure and jobs are being replaced with capital assets. On the other hand, a few get richer such asset owners and those whose income is tied to asset prices such as CEOs and brokers. This partly explains the rise of Trump.

And it brings us back to bitcoin. Bitcoin’s fluctuations are so wild, that by comparison the value of the dollar looks like a flatline. And its arbitrary enrichment of a few is correspondingly greater (the impoverishment of others will not be obvious until the price collapses).

We have seen some comments from readers and in bitcoin discussions elsewhere, that strike us as pugnacious. A chip-on-the-shoulder pseudo-pride, that practically sneers “I got mine, suckaaah!” Most bitcoin millionaires aren’t like this. And we do not begrudge anyone his trading gain. One should not hate the player, but the gamemaster who forces us to play. The Fed.

However, this is an important phenomenon. We bring it up as the flip side of the “hatred of the bourgeoisie and the proletariat”. Both sides know that something is screwy.

Everyone knows that money does not grow on trees. You do not normally get rich quick by betting on some Internet scheme. Yet, bitcoin seems to say, “Oh yes it does! Oh yes you do!”

We offer this insight: speculation converts one person’s wealth into another’s income. No one wants to spend his wealth. But they are happy to spend other people’s wealth—when it comes to them in the form of income.

Andy Appleton buys $10,000 worth of bitcoin. Later, he sells it for $20,000 to Bill Baker. Andy takes his original capital back plus 10%, or $11,000. That leaves him $9,000 of Bill’s wealth to spend, to consume. Bill of course bought it, hoping it would go up. And indeed it does. He sells it for $40,000 to Charlie Chilton. He reserves $22,000 of capital, leaving $18,000 of Charlie’s life savings to spend. Charlie forked it over to Bill, in the hopes of spending $36,000 of David Dalton’s wealth. And so on. Until the scheme hits the wall.

Bitcoin is a promoted as an alternative to fiat currency. However, it “engages all the hidden forces of economic law on the side of destruction” the same as the dollar. At an even faster rate. And this is promoted as a feature, not a bug.

The gold standard does not provide a mechanism to convert your wealth to someone else’s income. In our view, this is a feature, not a bug.

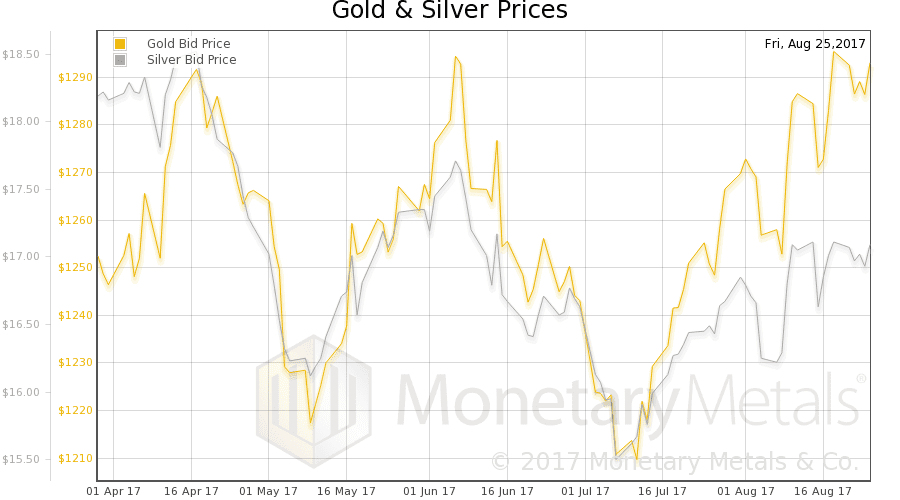

The price of gold dropped two bucks, and silver two cents. However, it was a pretty wild ride around the time when some information came out from our monetary masters at their annual boondoggle at Jackson Hole. We will show some charts of Friday’s intraday action, below.

As always, the question is which moves are driven by fundamentals, and which by speculation? We will show graphs of the basis, the true measure of the fundamentals.

But first, here are the charts of the prices of gold and silver, and the gold-silver ratio.

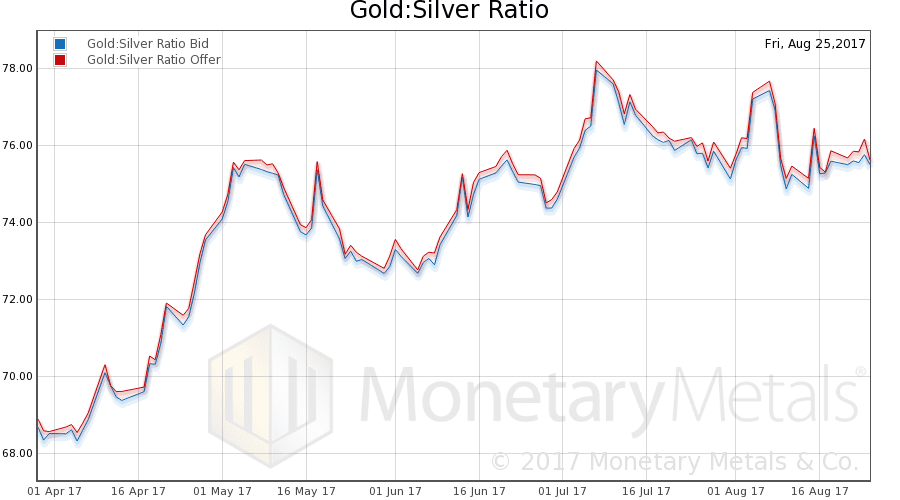

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio barely budged.

In this graph, we show both bid and offer prices for the gold-silver ratio. If you were to sell gold on the bid and buy silver at the ask, that is the lower bid price. Conversely, if you sold silver on the bid and bought gold at the offer, that is the higher offer price.

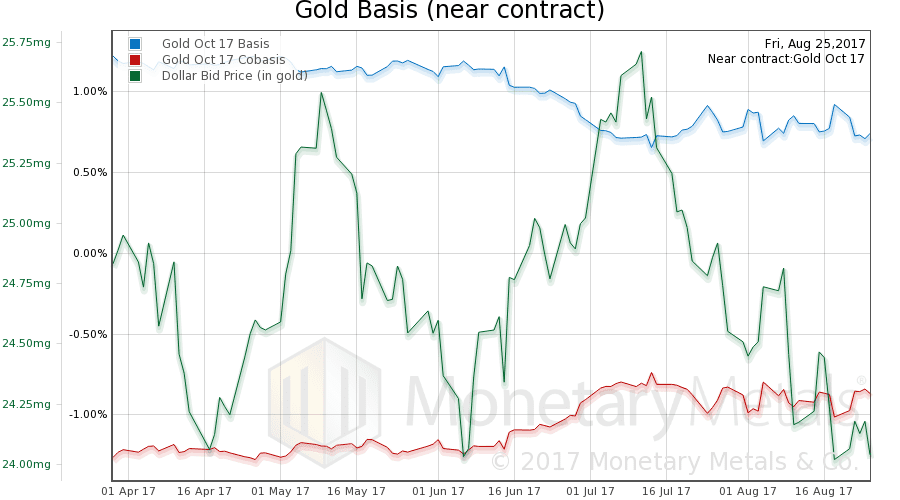

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The price didn’t move much, and neither did the basis.

So our calculated gold fundamental price was up $5, to $1,330.

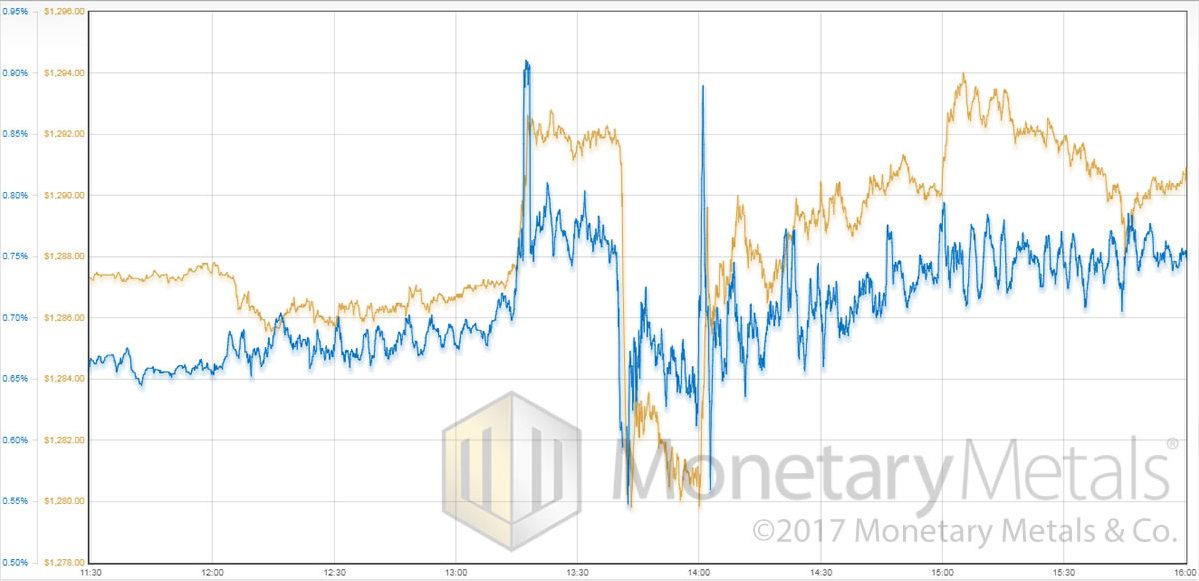

More interestingly, let’s look at the basis action when the price was gyrating on Friday.

The correlation between basis and price is uncanny, isn’t it? And it works in both directions. Manipulators speculators were buying paper gold from around 13:15 GMT (which is 14:15 BST or 9:15 NY time). Then these same manipulators speculators—or was it a different group, who overpowered the first, hm?—started selling at around 13:40. Then buying resumed at 14:00.

We are joking about the manipulation, of course. In our view, superstition thrives where people struggle to explain what they see without a scientific theory. Once upon a time, they saw thunder and lightning and thought the gods were having battle, or perhaps expressing anger at some sin of man. Such mythology could not survive the advent of the field meteorology (if even that long).

The manipulation myth similarly does belong in a world where there is an arbitrage theory of markets, and daily pictures of the basis and cobasis.

Note also the rise in price at 15:00, without a rise in basis. That is likely some buying of physical metal.

Now let’s look at silver.

The basis fell and the coabsis rose. Not a lot, but it did lift our calculated silver fundamental price $0.20 to $17.18.

Here is the intraday price and basis graph for silver during Friday’s rollercoaster.

As with gold, the basis tracks the price. The moves in both directions were speculative.

© 2017 Monetary Metals

0 comments:

Post a Comment