U.S. Treasury Secretary: I Assume Fort Knox Gold Is Still There

- US Treasury Secretary Steve Mnuchin visits Fort Knox Gold

- Later tweeted ‘Glad gold is safe!’

- Only the third Treasury Secretary to visit the fortified vault, last visit was 1948

- Last Congressional visit was 1974

- Speculation over existence of gold in Fort Knox is rife

- Concerns over Federal Reserves lack of interest in carrying to an audit on gold

- Gold was last counted in 1953, nine years before Mnuchin was born

- Mnuchin may be looking to prevent countries and states from worrying about and repatriating their gold

US Treasury Secretary 'assumes' the gold is still in Fort Knox, 64 years after it was audited.

81 years after it was built Fort Knox received its third visit from a US Treasury Secretary yesterday, Steven Mnuchin.

The fortified facility is reportedly surrounded by 30,000 soldiers, tanks, armored personnel carriers, attack helicopters, and artillery. Despite this, there is still concern as to whether the gold is there.

As he headed in, Mnuchin told an audience “I assume the gold is still there…It would really be quite a movie if we walked in and there was no gold.”

With a background in Hollywood it was unsurprising that Mnuchin’s imagination appeared to be getting carried away with tales of finding the $200 billion of gold missing.

Missing gold: fact or fiction?

An empty Fort Knox is an issue far removed from the hills of Hollywood and has far more basis in reality than many give it credit for.

For many decades campaigns have been led for the US Treasury and government to audit the gold and to testify to its existence.

The gold has not been ‘counted’ since 1953. This was less than 20 years after Fort Knox was built. Since then there has been no official count or audit.

The facility (purportedly) holds 147 million ounces of gold, worth around $186 billion. This is small compared to the amount purportedly held at the Liberty Street facility, in New York.

As with Fort Knox, the New York gold is yet to be audited.

At the moment, a tweet from a US Treasury Secretary is all we have when it comes to assurance over the gold’s existence.

Thanks to @usmint staff for hosting at #FortKnox #USBD. First @USTreasury Secretary to visit since John Snyder in 1948. Glad gold is safe!

— Steven Mnuchin (@stevenmnuchin1) August 21, 2017

Lack of Fort Knox gold audit to prevent damage, will cause damage

Congressman Ron Paul has argued previously that the US government ask Americans to trust that the Fort Knox gold is there plus gold stored elsewhere. They refuse to allow any checks and audits (whether independent or carried out by the government).

Paul stated back in 2010, "if there was no question about the gold being there, you think they would be anxious to prove gold is there.”

Mnuchin is no doubt aware of the damage that would be done to the US economy should it come to light that the gold is no longer where it's supposed to be.

He has likely taken note of Goldfinger’s dastardly plan in the infamous Bond film. In Goldfinger the villain plans to contaminate the US gold holdings in order to boost the value of his and the Chinese’s own bullion.

Whilst the gold in Fort Knox is unlikely to have been contaminated there is a strong argument that it isn’t there at all. Instead, it has been leased out many times over.

Who has the gold?

As GATA found out between 2008 and 2009 the Fed keeps a secret of its gold-swap arrangements with foreign banks.

Unsurprisingly gold-swap arrangements potentially lead to the eventual problem that no-one’s sure whose gold is whose anymore. It can be a high-end, expensive game of pass-the-parcel.

It’s worth remembering that the gold held by the US Government is not just owned by America, they hold gold for many countries, including Germany.

There is an argument to be made over whether or not Germany, or anyone else storing gold in a central bank abroad, owns allocated gold or is merely a ‘creditor’ on a metal statement, given gold swap arrangements.

Concerns have been so great over the United State’s lack of interest in auditing the gold bullion that countries have begun to repatriate the gold and demand statements.

Venezuela and Germany are the two most high profile countries to have recently repatriated their gold. Both went to big efforts to publicise the existence of the gold as it was repatriated. Germany even published bar numbers.

Missing gold has the states in a state

The US has its own trust issues though when it comes to gold, thanks to the lack of checks in place. Two years ago the state of Texas were given the go ahead to build its own Bullion Depository, into which the state would repatriate over $1 billion worth of gold.

The move by Texas highlighted mistrust in the Federal Government’s ability to not only keep the physical gold but also to not confiscate it should the monetary system run into problems.

Gold going missing in the US is not a recent issue.

Back in the 1920s Herr Hjalmar Schacht, then head of the German Central Bank, went to New York to see Germany’s gold. Despite the importance of the visit, Fed officials could not find the palette of Germany’s gold bullion.

One would have thought this would have triggered an early start to the Second World War but instead Herr Schacht turned to the Federal Reserve Chairman, Benjamin Strong, and said ‘Never mind, I believe you when you when you say the gold is there. Even if it weren’t you are good for its replacement.’

All of this serves as a timely reminder that we should learn from the mistakes of governments and central banks. Rather than offer up a blind trust to counterparties storing gold we should ensure that we have as much control as possible over our gold bullion.

We believe that allocated and segregated gold bullion, stored in secure locations such as Singapore, Hong Kong and Zurich is the best way to store gold. When you do this with GoldCore you have control and a audit of your gold holdings so you know they are right where you want them, when you want them.

News and Commentary

Gold slips amid steady dollar; investors wary ahead of Jackson Hole meet (Reuters.com)

Metals shine as stocks struggle near 5-1/2-week low (Reuters.com)

A Cosmic Theory and 2-Inch Lump of Gold Drive Novo’s 500% Surge (Bloomberg.com)

UK Rightmove house prices down in August (Telegraph.co.uk)

Dalio Says the U.S. Is the Most Divided Since 1937 (Bloomberg.com)

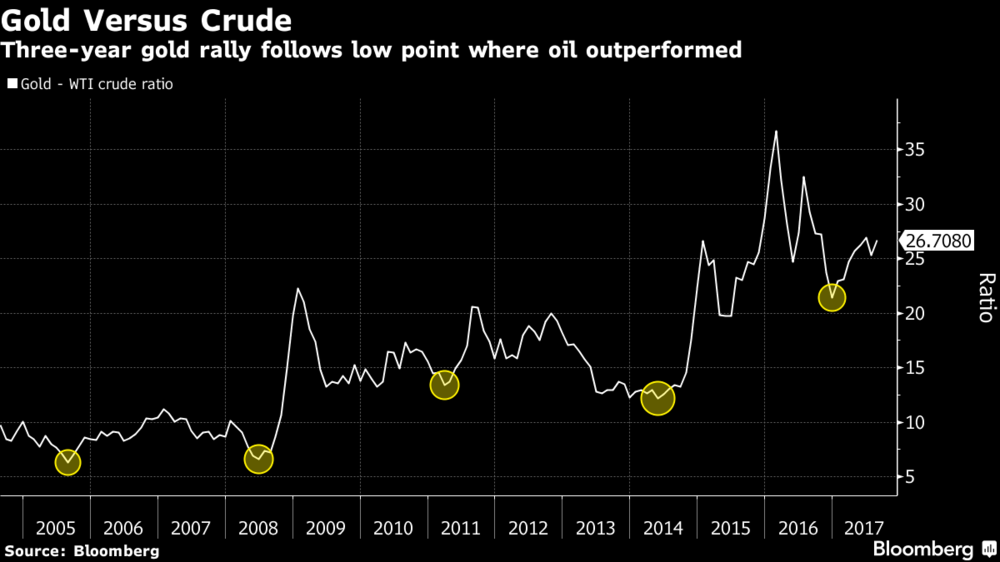

Gold's Rally Against Oil Is Just Beginning (Bloomberg.com)

Stars Are Aligning for Gold Bugs (WSJEmail.com)

US stocks may be more overvalued than they've ever been before (MoneyWeek.com)

Stunning Photos Capture the Solar Eclipse Across America (Smithsonian.com)

Gold Prices (LBMA AM)

22 Aug: USD 1,285.10, GBP 1,000.71 & EUR 1,091.95 per ounce

21 Aug: USD 1,287.60, GBP 999.82 & EUR 1,096.52 per ounce

18 Aug: USD 1,295.25, GBP 1,004.34 & EUR 1,102.65 per ounce

17 Aug: USD 1,285.90, GBP 998.12 & EUR 1,096.74 per ounce

16 Aug: USD 1,270.15, GBP 985.13 & EUR 1,082.29 per ounce

15 Aug: USD 1,274.60, GBP 986.92 & EUR 1,084.05 per ounce

14 Aug: USD 1,281.10, GBP 987.34 & EUR 1,085.48 per ounce

Silver Prices (LBMA)

22 Aug: USD 17.02, GBP 13.27 & EUR 14.48 per ounce

21 Aug: USD 17.02, GBP 13.20 & EUR 14.48 per ounce

18 Aug: USD 17.15, GBP 13.30 & EUR 14.60 per ounce

17 Aug: USD 17.02, GBP 13.23 & EUR 14.55 per ounce

16 Aug: USD 16.68, GBP 12.96 & EUR 14.25 per ounce

15 Aug: USD 16.89, GBP 13.12 & EUR 14.38 per ounce

14 Aug: USD 16.97, GBP 13.09 & EUR 14.39 per ounce

Recent Market Updates

- Buffett Sees Market Crash Coming? His Cash Speaks Louder Than Words

- Gold, Silver Consolidate On Last Weeks Gains, Palladium Surges 36% YTD To 16 Year High

- Must See Charts – Gold Hedges USD Devaluation, Rise in Oil, Food and Cost of Living Since Nixon Ended Gold Standard

- World’s Largest Hedge Fund Bridgewater Buys $68 Million of Gold ETF In Q2

- Diversify Into Gold Urges Dalio on Linkedin – “Militaristic Leaders Playing Chicken Risks Hellacious War”

- Gold Has Yet Another Purpose – Help Fight Cancer

- Gold Up 2%, Silver 5% In Week – Gundlach, Gartman and Dalio Positive On Gold

- Great Disaster Looms as Technology Disrupts White Collar Workers

- Gold Sees Safe Haven Gains On Trump “Fire and Fury” Threat

- Silver Mining Production Plummets 27% At Top Four Silver Miners

- Gold Consolidates On 2.5% Gain In July After Dollar Has 5th Monthly Decline

- Gold Coins and Bars See Demand Rise of 11% in H2, 2017

- Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

0 comments:

Post a Comment