Gold Up 9% YTD - 4th Higher Weekly Close and Breaks Resistance At $1,250/oz

- Gold up 1.5% in euros and dollars this week

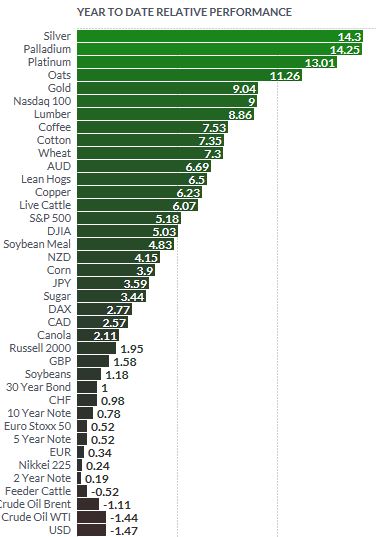

- Silver up 1.4% this week and now up 14.3% and is the best performing market YTD

- Gold up 9% year to date - fourth consecutive higher weekly close and breaks resistance at $1,250/oz

- Gold up 9.4% in euros year to date as Le Pen's lead in polls widened

- Gold up another 6.4% in sterling pounds year to date as 'Hard Brexit' looms

- French and Dutch elections pose risks to Eurozone itself and the entire European Union project

- Euro contagion risk on renewed concerns this week about new debt crisis due to extremely high public debt and very fragile banks in Greece, Italy and Portugal

Gold pushed to near a four month high amid heightened political uncertainty in the U.S. and the EU this morning.

Gold rose another $6.40, or 0.5%, to $1,258 an ounce and is currently set for a 1.5% gain this week. It is higher for a second day today and looks set for a fourth consecutive week of gains which is positive from a technical and momentum perspective.

All precious metals have made gains, gold, silver, platinum and palladium, as both the euro and the dollar weakened.

Silver jumped another 1% to $18.25 an ounce. Silver was set for a weekly gain of 1.3%, a ninth straight week of advances and is now 14.3% higher year to date. The best performing market in the world.

Geo-political worries and political concerns in the EU continue which is leading a flight to safety bid in gold futures market and gold exchange traded funds (ETFs) and demand for safe haven gold bullion.

The dollar looks vulnerable due to the uncertainty about US President Donald Trump and the new U.S. administration's policies. Overnight Trump attacked China and accused the Chinese of being ‘grand champions’ of currency manipulation (see gold news below).

This alone is quite bullish for gold. It does not create confidence about trade relations between the world's two biggest economies and it suggests that we may be about to embark on the next phase of the global currency wars.

Reduced expectations of a US rate hike in March following the release of the minutes from the US Federal Reserve's last meeting are also helping gold.

Gold is up 9.4% in euros year to date as Le Pen's lead in polls has widened. Gold is 6.4% higher in sterling pounds year to date as the feared 'Hard Brexit' looms.

The French and Dutch elections pose serious risks to the Eurozone itself and indeed the entire European Union project. There is a real risk of contagion and renewed concerns this week about new debt crises due to extremely high public debt and very fragile banks in Greece, Italy and Portugal - See GoldCore News

Gold and Silver Bullion - News and Commentary

London Metal Exchange cuts deal with banks to propel gold futures (Reuters.com)

Gold steady near 3-1/2 month high, focus on Trump economic policy (Reuters.com)

Dow Hits 10th Straight Daily High as Dollar Slips (Bloomberg.com)

Bitcoin hits 3-year peak, nears record high on U.S. ETF approval talk (Reuters.com)

Exclusive: Trump calls Chinese 'grand champions' of currency manipulation (Reuters.com)

Einhorn Shorts Sovereigns, Affirms Gold on Trump Uncertainty (Bloomberg.com)

Cobalt Surges As Hedge Funds Stockpile Metal (IrishTimes.com)

Are 100-year Treasuries On the Way? (Barrons.com)

Trump - The Great Disrupter Strikes Again (DailyReckoning.com)

10 reasons to be nervous about the all-time high stock market (Yahoo.com)

Gold Prices (LBMA AM)

24 Feb: USD 1,255.35, GBP 1,000.89 & EUR 1,185.18 per ounce

23 Feb: USD 1,237.35, GBP 992.97 & EUR 1,173.13 per ounce

22 Feb: USD 1,237.50, GBP 994.21 & EUR 1,178.22 per ounce

21 Feb: USD 1,228.70, GBP 988.86 & EUR 1,166.16 per ounce

20 Feb: USD 1,235.35, GBP 991.49 & EUR 1,163.21 per ounce

17 Feb: USD 1,241.40, GBP 1,000.57 & EUR 1,165.55 per ounce

16 Feb: USD 1,236.75, GBP 988.41 & EUR 1,163.29 per ounce

Silver Prices (LBMA)

24 Feb: USD 18.27, GBP 14.56 & EUR 17.23 per ounce

23 Feb: USD 18.00, GBP 14.42 & EUR 17.06 per ounce

22 Feb: USD 18.00, GBP 14.47 & EUR 17.14 per ounce

21 Feb: USD 17.89, GBP 14.41 & EUR 16.97 per ounce

20 Feb: USD 17.98, GBP 14.42 & EUR 16.92 per ounce

17 Feb: USD 18.01, GBP 14.50 & EUR 16.91 per ounce

16 Feb: USD 18.10, GBP 14.49 & EUR 17.02 per ounce

Recent Market Updates

- The Oscars – Worth Their Weight in Gold?

- Gold To Benefit from Rising Inflation and Higher Than “Official” China Gold Demand

- Russia Gold Buying Is Back – Buys One Million Ounces In January

- Gold The “Ultimate Insurance Policy” as “Grave Concerns About Euro” – Greenspan

- Sharia Standard May See Gold Surge

- Gold Price To 2 Month High As Fiery Trump Declares World Order

- Gold’s Gains 15% In Inauguration Years Since 1974

- Turkey, ‘Axis of Gold’ and the End of US Dollar Hegemony

- Gold Up 5.5% YTD – Hard Brexit Cometh and Weaker Dollar Under Trump

- Bitcoin and Gold – Outlook and Safe Haven?

- Physical Gold Will ‘Trump’ Paper Gold

- Gold Lower Before Trump Presidency – Strong Gains Akin To After Obama Inauguration

- Gold Rallies To $1,207 After Trump Press Conference Shambles

Interested in learning more about physical gold and silver?

Call GoldCore and speak with a Gold and Silver Specialist today!

0 comments:

Post a Comment