The Banks Will Not Be Denied Franchises and are Buying Into Exchanges

written by Soren K. for MarketSlant

The US Government has essentially declared war on the OTC markets. This is the banking industry life blood. Banks are not going to go down easily. We have said so here in the past. Since the US government has essentially declared it wants exchanges to be the depositories for risk instead of Banks, the Banks are going to start buying exchanges. What ICE, (originally formed by Goldman and other banks) did for oil, EOS intends to do for Gold. That is ensure that if banks are disintermediated, at least they will own their replacement. ICE is the second largest oil exchange behind the CME now. And ICE is no longer bank owned. Hence the banks are creating a new vehicle to capture lost business, this one is in Gold. And its goal is to get in the middle of every Gold deal being bought in the East. And they are smart to do it.From a previous post, the problem for banks can be easily seen. Banks know this and are not going down without a fight.

TBTF = Too Big to Exist

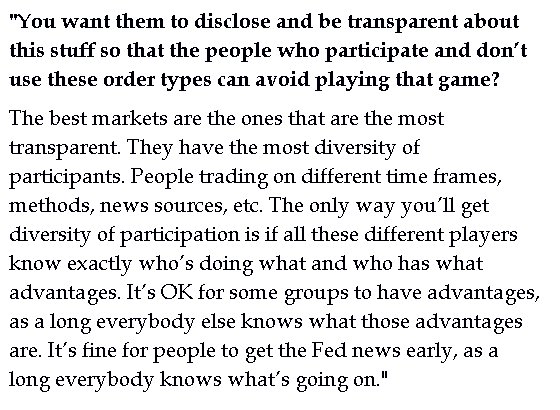

The Federal Government's policies post the 2007 crash have done nothing to reduce the concentration of systemic risk in our markets. They have in fact concentrated power in a smaller number of counterparties' hands. Price discovery is less reliable. Transparency of price is better, but less reliable. We like this statement made today on transparency, diversity in market participants and our growing systemic risk.

Exchanges Are the Answer

One positive we see is the vested interest the Federal Government has take in the US Exchanges. By encouraging trades on the exchanges, the gov't at least has a fair shot of seeing systemic risk now. The opacity of banking's OTC markets are a big problem. Maybe it is bad to have all your eggs in one basket. But if you really watch that basket closely, then at least you can see trouble coming rather than waiting for a bank to blow up and start a cascade of OTC defaults. And as long as all the data "eggs" are transparent, then another 2007 event can be avoided. Manipulation in Metals

They will preserve their FX franchises as long as they can. But they see the writing on the wall with the Gold OTC market. Therefore they will join what they cannot beat. Here are the talking points on the deal the Banks cut with the LME in summary:

- Banks take stakes in LME gold contracts through new company

- They promise to supply liquidity in return for revenue share

- Built-in liquidity may give LME edge over U.S. rivals

- LME gold, silver contracts to launch on June 5

For Example:

At the moment, London's gold trade is dominated by over-the-counter (OTC) business conducted bilaterally among networks of brokers, producers and consumers. Gold futures trading takes place chiefly on the CME's New York market and the Tokyo Commodity Exchange. However, the LME and its rivals see an opportunity as regulation of the market tightens, hoping this will force the trade onto transparent, centrally-cleared exchanges. Bigger banks, which rely on their wide range of business relationships, stand to lose market share from such a shift because exchange trading would make it easier for smaller players to compete.

Gold dealers keep their volumes secret and no precise figures are available, but analysts and traders estimate the EOS shareholders may control up to 50 percent of OTC bullion trading in London.

The secular trend is Gold demand moves eastward. And it is a fact that exchanges do best in regions of demand, not regions of supply. Hence Comex vaults are emptied while SGE are getting filled.

The LME is paying banks with revenues and guaranteed order flow in return for "liquidity provision". Does this seem like captive flow in which a bank's prop desk in the US can somehow front run?

Here are the revenue streams a designated marketmaker/ specialist type market structure affords:

-

revenue sharing from volumes traded

-

rebates

-

guaranteed order flow minimums

-

implicit fees in bid/ask trading like a bookie

-

information in which "non-affiliated" divisions can trade in front of or against the flow

Here is how the marketmaker/specialist manages risk

-

hedging and carrying risk on his book when he has to

-

"stopping" or declaring order imbalances that remove its obligation to provide liquidity

-

simply not making markets because the risk is too big compared to the revenues if he's unethical

Small Players Will Be Shut Out

The Specialist/DMM/PMM type liquidity provider with no real risk has a license to print money. And he can walk away is he doesnt like the deal. His risk is limited to the extent he participates. The LME has all the risk here. Do they even know how to police their liquidity providers beyond the "moral" obligation? It is not easy to quantify when a sub-contractor is shirking his responsibility in this business.

From Reuters: The London Metal Exchange has reached a 50:50 revenue-sharing deal with a company founded by a group of banks to promote trade in its new gold futures contracts, sources said, aiming to overcome market skepticism surrounding their launch in June. Usually, exchanges merely consult potential users about their needs when planning new financial and commodity contracts. But in this case, the LME has opted for a radical departure from normal practice as it tries to grab a piece of London's $5 trillion-a-year gold market. Sources close to the matter told Reuters that the five banks and a proprietary trader which are shareholders in the new company have undertaken to bring guaranteed minimum levels of trade in the gold futures. Should they meet these levels, the project partners will receive a half share of the revenue under an incentive scheme designed to ensure the contracts have turnover, viability and credibility from the outset.

"We're all committed to market-making and will at least bring our own trading book," said a source at one of the banks involved in the project. "It'll come with some built-in volume." The sources gave few details of the arrangement. However, one at a different bank backing the contracts said: "Do we have incentives for it to work? Yes." The LME, which is owned by Hong Kong Exchanges and Clearing Ltd, hopes the arrangement will give its contracts enough business to take off from June 5 despite doubts among many brokers and gold producers.

The Key to the Gold Market's Eastern Success Lies in Market Structure

Essentially, the contracted specialist has a free "put" to not do what he is morally obligated to do. This is not a new model. But it is now full circle where banks as liquidity providers ( the guys who rigged and or passively played a role in rigging the Gold and Silver Fix) are now at the hub of the Gold flow. Yet in much bigger markets like FX, the banks wont participate in this way. This is because the FX market is still largely OTC and a good profit center franchise still. That is not to say the Specialist/ DMM type market-structure cannot work. It is necessary in many cases where the marketmaker is the gold dust that gets the virtuously reinforced cycle of liquidty going. That is a paraphrase from the Goldman sponsored book "B2B exchanges"

More: It also wants to shoulder aside U.S. exchanges CME Group and ICE which launched London gold contracts last month, although they have yet to attract any business.The LME's partners from the banking sector are Goldman Sachs, ICBC Standard Bank, Morgan Stanley, Natixis and Societe Generale. They have founded a company called EOS Precious Metals along with commodity trader OSTC and The World Gold Council, an industry market development body.

And demand is moving East. Incumbent exchanges in precious metals should consider getting the gang back together to augment their currently homogeneous and hedged (conflicted?) liquidity pool and make a stronger play in China. Traders who invest their competitive ego and heart as well as financially vested interest into making London contracts work are out there.

Even More:

"If the LME can provide liquidity, then that's where people will go and so will we," said a source at one gold producer.The LME plans to offer a much wider range of contracts than its competitors do at the moment in London.The CME is offering gold and silver contracts to connect London with its established New York market. ICE runs the London gold auction, which sets a global benchmark price for bullion, and has a daily gold contract that will enable participants, which include most of London's largest bullion banks, to clear their trades.Neither set of contracts has traded since launching in January. The CME said it was working with major banks to synchronize their systems to start trading.

While the regulators are patting themselves on the back for catching the Gold and Silver scandals after 20 years, the players have moved on to greener pastures.

-VBL

0 comments:

Post a Comment