There is a often-promoted plan to grow your wealth. Here’s the background. The dollar is going to be worthless. Soon! The reason is because [their peeps in high places tell them / the Chinese / end of the petrodollar / historical fiat currencies / Rothschild Jekyll Island Master Plan Private Fed / Fed printing] will cause the dollar to collapse and gold will rocket to $50,000. In fact, it’s a miracle that the price is a mere $1,253 and it hasn’t already. It will, once people discover this One Weird Secret that They Don’t Want You to Know that we have been reiterating every day for decades.

(By the way, Monetary Metals is about to publish the data to finally shine the full sunlight of disinfectant on this—stay tuned)

The plan has three phases.

Phase 1: You gotta buy gold. Now. In fact, call 1-800-BUY-GOLD now! That number, again, is one eight hundred bee yoo wye gee oh ell dee.

Phase 2: Price goes up

Phase 3: Profit!

This is a bit reminiscent of the underpants business model on South Park. South Park of course showed phase 2 as “???” but the analogy holds.

Pay particular attention to the context switch. The story switches midway from the-dollar-will-collapse to gold-will-go-up.

In fact, these are the same thing. It is important to realize because a higher price of gold does not make you richer. Sure, you have more dollars but each of them is worth proportionally less. And why would you want to exchange your gold for collapsing Rothschild private bank petrodollar printing press Monopoly money? On top of this, the tax man will take a big chunk of any price appreciation. So, if you sell you have less wealth.

Aside from being wrong as a matter of fact, it is an example of dollar thinking. It comes from the belief that gold is to be sold. That is not historically how people thought about it. Gold is money and those who have it should seek to earn a return on it, not sell it.

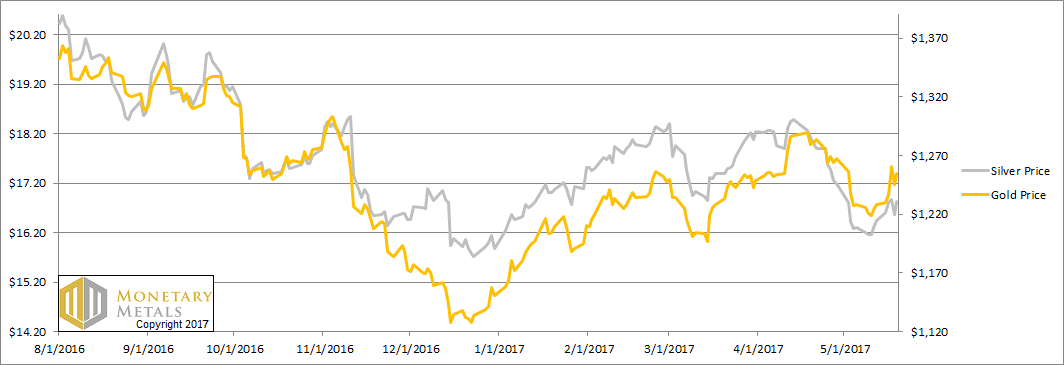

This week, the prices of the metals went up. Perhaps that rubber stopper under the silver elevator is durable.

However, as always we are interested in the supply and demand fundamental of the metals. We will show graphs, but first, the price and ratio charts.

The Prices of Gold and Silver

Next, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It moved lower this week.

The Ratio of the Gold Price to the Silver Price

For each metal, we will look at a graph of the basis and cobasis overlaid with the price of the dollar in terms of the respective metal. It will make it easier to provide brief commentary. The dollar will be represented in green, the basis in blue and cobasis in red.

Here is the gold graph.

The Gold Basis and Cobasis and the Dollar Price

We changed to the August contract.

August is far from expiration, and we see no sign of temporary backwardation (another phenomenon that disproves the naked short manipulation theory). And we see something clear and revealing. There is a steadily rising scarcity (i.e. the cobasis, the red line) and falling abundance (the basis, the blue line). The trend has been ongoing for many months, with not a lot of jitter. The scarcity of gold, as indicated by the August gold spreads, has been on the rise.

For somewhat less time, the price of gold has been rising.

Our calculated fundamental closed the week up another $21, to $1,275. That’s hardly “call 1-800-BUY-GOLD now before it hits $10,000” territory, but noteworthy nonetheless.

Now let’s look at silver.

The Silver Basis and Cobasis and the Dollar Price

Last week, we said that “silver does not yet show any backwardation, though it’s close at -0.03%.” This week, it’s +0.1%. However, this is definitely temporary backwardation. The near contract in silver tends to fall earlier than the near contract in gold.

Obviously, past a certain date, speculators looking to bet on silver would not buy the July contract but instead the September. Everyone may have his own boundary, in part depending on how long they want to hold the position. But clearly, for the marginal silver speculator, we are past that point in the July contract.

So there is an imbalance, less and less buying. The selling (to roll July) may not be urgent yet, but silver is less liquid than gold. So a small imbalance will show up as a change in basis.

Our calculated fundamental price of silver was down a few pennies.

We will end on an amusing note. The previous week, we said:

"We saw a technical analysis trader write a note this weekend. He said he plans to short silver on Monday. When the technicals and then fundamentals align, that can make for an interesting week."

Assuming he shorted it early on Monday morning, he might have top-ticked it at $16.40. On Tuesday, he could have closed at $16.05, for a gain of 2.1%. There has to be an easier way to earn a few bucks (and we never recommend naked-shorting gold or silver).

Well, as of Friday silver is $16.84. Depending on how much leverage he used, that could be a big owwie.

Keith will be speaking at the Mining Investment Europe event in Frankfurt in mid-June. He will be in London the week of June 19, and in New York the week of June 26. If you’re interested in attending a Monetary Metals seminar on GOFO and transparency in the gold market in either city, or to meet with Keith to discuss gold investment, please click here.

© 2017 Monetary Metals

0 comments:

Post a Comment