Gold Has “Decisive Turn Around” – “Next Stop Is $1,300 Or Higher”

James Rickards via Daily Reckoning

But the most important development this week may be the one you never heard about on the news or the internet.

On May 10, gold launched a decisive turnaround from its most recent decline.

This kept intact the pattern I’ve been writing about for weeks of “higher highs, and higher lows” as every retreat finds a footing higher than the one before and each new high reaches new, higher ground.

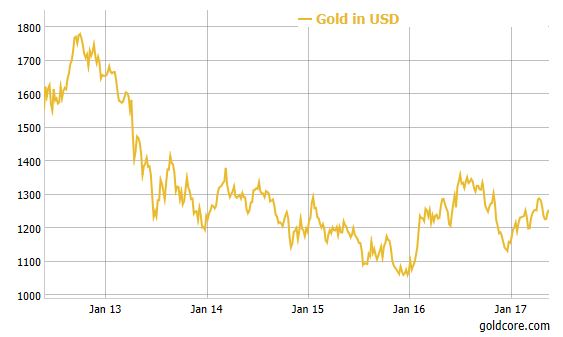

This pattern began on Dec. 15, 2016, at an interim low of $1,128/oz. Since then gold has hit new highs of:

- $1,216/oz on Jan. 17

- $1,256/oz on Feb. 24

- $1,289/oz on April 18.

Each time gold retreated from those highs, it found a new bottom at a higher price than the time before. The recent low was $1,218/oz on May 10. In this new spike, gold has now rallied to $1,251 as of early Friday.

If this pattern holds, the next stop is $1,300 or higher.

A Fed rate hike on June 14 could be a catalyst for a move even higher, just as the last two rate hikes on Dec. 14, 2016, and March 15, 2017, were turning points for gold.

No market moves up in a straight line, and gold won’t either. But what we’re seeing right now is very encouraging.

While everyone is focused on the Washington circus this week, they’re missing what could be the real news — gold.

'The Perils of Complacency' is James Rickards latest piece for the Daily Reckoning. Full article can be read here

News and Commentary

Gold heads for biggest gain in 5 weeks (News.com)

Gold holds gains as Trump concerns support (Reuters.com)

Russia probe reaches current White House official (WashingtonPost.com)

Paulson holds SPDR Gold holdings steady as bullion rallies (Reuters.com)

New platinum bullion coins unveiled during London Platinum Week} (CoinUpdate.com)

- Gold in USD (5 Years)

Most important development this week not on the news or the internet - Rickards (DailyReckoning.com)

Get Ready for Quantitative Tightening , Then QE4 - Rickards (DailyReckoning.com)

How China plans to send the price of gold soaring (KingWorldNews.com)

Venezuela: Forty Years of Economic Decline (Mises.org)

Do this one simple thing to get richer every day (StansBerryChurcHouse.com)

| Avoid Digital & ETF Gold – Key Gold Storage Must Haves |

Gold Prices (LBMA AM)

22 May: USD 1,255.25, GBP 967.17 & EUR 1,123.07 per ounce

19 May: USD 1,251.85, GBP 962.17 & EUR 1,122.03 per ounce

18 May: USD 1,261.35, GBP 968.21 & EUR 1,133.95 per ounce

17 May: USD 1,244.60, GBP 961.70 & EUR 1,122.13 per ounce

16 May: USD 1,234.05, GBP 958.98 & EUR 1,117.93 per ounce

15 May: USD 1,231.50, GBP 952.32 & EUR 1,124.61 per ounce

12 May: USD 1,227.90, GBP 955.06 & EUR 1,129.55 per ounce

Silver Prices (LBMA)

22 May: USD 16.95, GBP 13.04 & EUR 15.10 per ounce

19 May: USD 16.77, GBP 12.90 & EUR 15.02 per ounce

18 May: USD 16.81, GBP 12.90 & EUR 15.10 per ounce

17 May: USD 16.90, GBP 13.03 & EUR 15.22 per ounce

16 May: USD 16.72, GBP 12.97 & EUR 15.13 per ounce

15 May: USD 16.59, GBP 12.83 & EUR 15.12 per ounce

12 May: USD 16.30, GBP 12.68 & EUR 14.99 per ounce

Recent Market Updates

- Gold and Silver Bullion Coins See Sales “Explosion” In UK On “Wave Of Political Turmoil”

- Gold Investment Is the Ultimate Guide for Tech Investors In 500 Words

- Gold Spikes On Heavy Volume On Trump, U.S. Political “Mess”

- Cyber Wars Could Crash Markets and Threat To Humanity – Rickards and Buffett

- Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies

- History of Gold – Interesting Facts and Changes Over 50 Years

- U.S. Gold Exports To China and India Surge In 2017

- The Dream of the Central Banker

- Silver Investment Case Remains Extremely Compelling

- Gold Coins, Bars In Demand – +9% In Q1, 2017

- Irish Property Bubble – 38pc Believe Housing Market Will Crash

- Silver Bullion On Sale After 10.6% Fall In Two Weeks

- London Property Bubble Vulnerable To Crash

0 comments:

Post a Comment