Manchester Attack Sees Asian Stocks Fall, Gold Firm

The appalling attack in Manchester overnight in which over 22 people have been killed has led to a slight uptick in risk aversion in markets.

Investors are cautious after police said they were treating a bombing at a concert in the Manchester Arena as a “terrorist incident”.

Asian stocks gave up gains after the attacks and European indices had a subdued start.

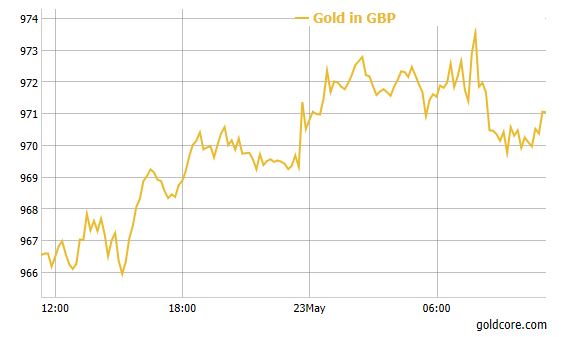

Gold rose in the aftermath of the attacks to three week highs prior to giving up some of the gains by mid morning trading.

Sterling fell marginally and gold in sterling terms rose as high as £973.55 prior to consolidating near £970. Sterling was down 0.2 percent against the dollar to $1.2978 after falling 0.3 percent on Monday.

If the blast is confirmed as a terrorist incident, it would be the deadliest attack in Britain by militants since four British Muslims killed 52 people in suicide bombings on London's transport system in July 2005.

The attack has come just two-and-a-half weeks before an election that British Prime Minister Theresa May is expected to win easily.

Polls showing that the contest was tightening had added to sterling's woes recently. A terrorist attack will likely benefit the Tory Party and Theresa May as they are perceived to be tougher on terrorism than the Labour Party.

Terrorist events have not impacted markets globally in recent months and years. However, the concern is that with consumers indebted and consumer sentiment vulnerable, a spate of terrorist attacks or worse a terrorist 'spectacular' akin to 'September 11' could badly impact already fragile economies and increasingly frothy financial markets.

The UK's counter-terrorism chief has said that terrorists want to inflict an “enormous and spectacular” terrorist atrocity on the UK.

The uncertain political climate in the UK and the United States is weighing on the dollar and sterling. Concerns over U.S. political turmoil and the complete mess that is the current U.S. political situation will lead to continuing demand for safe haven gold.

This has led to gold's recent gains and should contribute to gold eking out further gains in the coming weeks.

News and Commentary

Gold edges higher in Asia after deadly Manchester concert venue blast (Investing.com)

Gold prices tally highest settlement in 3 weeks (MarketWatch.com)

Gold prices steady despite Manchester blast, US political woes support (Reuters.com)

Trump Concern, Manchester Blast Spur Risk-Off Tone (Bloomberg.co)

Trump trouble and euro surge extend gold’s gains (Reuters.com)

Market crash that makes 2008 look like a picnic - Paul Interviews Taleb (YouTube.com)

Dungeons of gold: Sex, booze and braais in underground mine cities (TimesLive.co.za)

Gold and silver futures shorts seem washed out (TFMetalsReport.com)

Gold's golden cross: Metal just formed a chart pattern that can signal a breakout (CNBC.com)

| Avoid Digital & ETF Gold – Key Gold Storage Must Haves |

Gold Prices (LBMA AM)

23 May: USD 1,259.90, GBP 969.62 & EUR 1,119.17 per ounce

22 May: USD 1,255.25, GBP 967.17 & EUR 1,123.07 per ounce

19 May: USD 1,251.85, GBP 962.17 & EUR 1,122.03 per ounce

18 May: USD 1,261.35, GBP 968.21 & EUR 1,133.95 per ounce

17 May: USD 1,244.60, GBP 961.70 & EUR 1,122.13 per ounce

16 May: USD 1,234.05, GBP 958.98 & EUR 1,117.93 per ounce

15 May: USD 1,231.50, GBP 952.32 & EUR 1,124.61 per ounce

Silver Prices (LBMA)

23 May: USD 17.14, GBP 13.22 & EUR 15.25 per ounce

22 May: USD 16.95, GBP 13.04 & EUR 15.10 per ounce

19 May: USD 16.77, GBP 12.90 & EUR 15.02 per ounce

18 May: USD 16.81, GBP 12.90 & EUR 15.10 per ounce

17 May: USD 16.90, GBP 13.03 & EUR 15.22 per ounce

16 May: USD 16.72, GBP 12.97 & EUR 15.13 per ounce

15 May: USD 16.59, GBP 12.83 & EUR 15.12 per ounce

Recent Market Updates

- James Rickards: Gold’s “Decisive Turn Around” – “Next Stop Is $1,300 Or Higher”

- Gold and Silver Bullion Coins See Sales “Explosion” In UK On “Wave Of Political Turmoil”

- Gold Investment Is the Ultimate Guide for Tech Investors In 500 Words

- Gold Spikes On Heavy Volume On Trump, U.S. Political “Mess”

- Cyber Wars Could Crash Markets and Threat To Humanity – Rickards and Buffett

- Cyber Attacks Show Vulnerability of Digital Systems and Digital Currencies

- History of Gold – Interesting Facts and Changes Over 50 Years

- U.S. Gold Exports To China and India Surge In 2017

- The Dream of the Central Banker

- Silver Investment Case Remains Extremely Compelling

- Gold Coins, Bars In Demand – +9% In Q1, 2017

- Irish Property Bubble – 38pc Believe Housing Market Will Crash

- Silver Bullion On Sale After 10.6% Fall In Two Weeks

0 comments:

Post a Comment