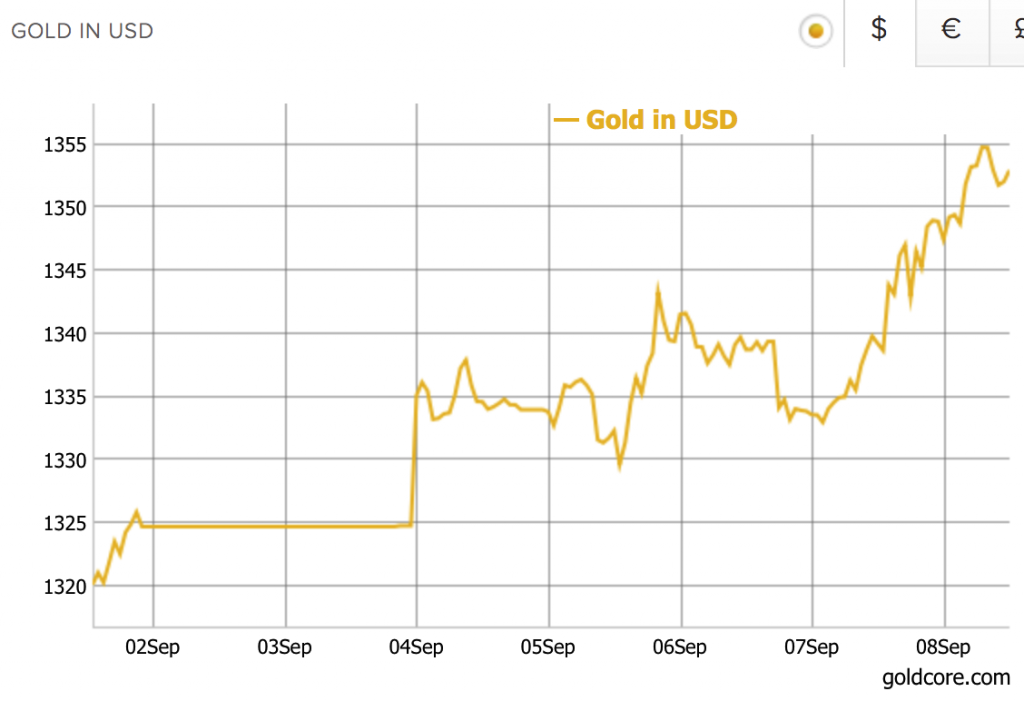

Gold Has 2% Weekly Gain,18% Higher YTD - Trump's Debt Ceiling Deal Hurts Dollar

- Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy

- Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower

- Euro Stoxx flat for week - S&P 500, Nikkei down 0.65% and 2.2%

- Geo-political concerns including North Korea, falling USD push gold 2.1% in week

- Gold prices reach $1,355 this morning following Mexico earthquake

- Safe haven demand sees gold over one year high, highest since August 2016

- Silver touches $18.24 - highest level since April 2017

- Goldman, BoAML and Deutsche Bank all warn re markets this week

Editor: Mark O'Byrne

This morning the earthquake in Mexico likely contributed to gold eking out further gains to $1,355/oz, its highest since August 2016. The gold price is now up 2.1% for the week.

Sadly some of the short-term performance in both gold and silver is because of devastating events around the globe. From hurricanes and earthquakes to potential nuclear wars.

However, as explained earlier this week, while gold is reacting to geopolitical events in the short term, the real driver of gold will be the impact of these events which is government money printing and debasement of the currency. Only this week, Trump extended the debt ceiling - with the devastation of the floods in Texas and Hurricane Irma the latest reason to increase the US national debt.

Is the Euro too strong?

Yesterday the ECB decided to leave interest rates unchanged. On the back of the decision, the euro rose to $1.20 pushing the US dollar to a 32-month low. Draghi did not express concern over the currency’s strength.

Some indication was given as to the when the ECB would taper asset purchases - October is expected.

Relative to gold and silver in the last week, the euro has underperformed.

No increase in the US rates or the dollar

Meanwhile in the US weak economic data and events in Texas and Florida have likely pushed any chance of further rate hikes back. Data yesterday showed weekly jobless claims rose this week to their highest since 2015. Hurricane Harvey likely contributed to this and it is likely the start of a trend and will likely get worse.

Odds of the increase happening this year have slipped from 40% to 29%. For many a rate hike would be bad news for gold and silver prices. However so far this year this has not proven to be as damaging as some bears expected. Indeed, as we have shown with data and charts many times, rising interest rates generally corresponds with rising gold prices - as seen in the 1970s and from 2003 to 2006.

Trump’s deal-making and money printing

This week President Trump struck a short-term deal with the Democrats in order to avoid a showdown over the US debt ceiling. Many had been worried that the issue would be dragged out by both parties. Republicans were reportedly furious at Trump’s decision.

As a result gold fell back somewhat after a stellar start to the week. Many market participants had expected the debt ceiling issue to be a far greater issue than it turned out to be. Of course, it still is a big issue as Trump and the Democrats have merely pushed the can down the road, but for now this is something they (and markets) will likely not worry about too much.

There are concerns over the discontent and discord in the White House which has still not passed any meaningful legislation since Trump’s inauguration. This is providing greater support for gold which appears to be gaining strength due to issues in Washington.

Is it about geopolitical risks?

Short-term hikes in the gold and silver price are thanks to expected increases in safe haven demand considering events such as North Korea, potential genocide in Myanmar, Venezuelan economic crisis and of course, extreme weather events and now a massive earthquake.

However these are not necessarily the long-term drivers of the gold and silver price. As we explained earlier this week. It is most likely down to concerns over governments and their monetary policies.

Trump and his government are of course creating geopolitical risks, however it is the fact that his policis are (and will continue) to result in currency debasement that will provide longer-term support for gold.

Goldman Sachs’ analysts suggested this week that gold’s rise to one-year highs is thanks to perceived pro-growth promise from Trump which are currently floundering but will result in more money creation. His to-do (and expense) list has also grown as a result of hurricanes in the country.

Conclusion

We should rightly pay attention to events happening around the world. They are devastating the lives of so many people.

However, when it comes to our portfolios we should not look to the pattern of a hurricane or the sabre-rattling of a dictator to justify our decisions to hold certain assets.

Instead we need to switch off the 23-hour rolling news and ask ourselves what this means for the long-term.

All of it whether war, recovery from an environmental disaster or peacekeeping operations in Myanmar means spending. Money does not grow on trees and no Western government has any money left ... just debt and lots of it.

Currency debasement continues on a massive scale globally. This in time will have devastating consequences for our economies and our digital and paper savings and investments. Investors should prepare their portfolios in the same way one would for an environmental disaster or war - with good, solid insurance.

News and Commentary

Gold climbs to 1-year high as U.S. dollar sees fresh weakness (MarketWatch.com)

Gold rises to one-year high amid sluggish dollar (Reuters.com)

Dollar Tumbles as Yen, Euro Rally on Irma, ECB (Bloomberg.com)

ECB keeps door open to even more stimulus (Reuters.com)

Hurricane Harvey lifts U.S. jobless claims to more than two-year high (Reuters.com)

Yen Losing its Haven Sheen to Gold on North Korea (Bloomberg.com)

Gold to reach $1400 on dollar weakness and North Korea (CNBC.com)

Flight to quality may see further gains for gold bullion (CNBC.com)

Gold prices boom as fears grow over North Korea nuclear crisis (Independent.co.uk)

Own Gold for Long Term as Fiat Money is Doomed - Frisby (MoneyWeek.com)

Gold Prices (LBMA AM)

08 Sep: USD 1,350.90, GBP 1,026.82 & EUR 1,120.71 per ounce

07 Sep: USD 1,340.45, GBP 1,026.52 & EUR 1,119.54 per ounce

06 Sep: USD 1,340.15, GBP 1,028.03 & EUR 1,122.11 per ounce

05 Sep: USD 1,331.15, GBP 1,029.51 & EUR 1,120.43 per ounce

04 Sep: USD 1,334.60, GBP 1,030.98 & EUR 1,120.53 per ounce

01 Sep: USD 1,318.40, GBP 1,020.18 & EUR 1,107.98 per ounce

31 Aug: USD 1,305.80, GBP 1,013.17 & EUR 1,098.31 per ounce

Silver Prices (LBMA)

08 Sep: USD 18.21, GBP 13.80 & EUR 15.09 per ounce

07 Sep: USD 17.79, GBP 13.59 & EUR 14.85 per ounce

06 Sep: USD 17.77, GBP 13.62 & EUR 14.90 per ounce

05 Sep: USD 17.88, GBP 13.80 & EUR 15.03 per ounce

04 Sep: USD 17.80, GBP 13.75 & EUR 14.95 per ounce

01 Sep: USD 17.50, GBP 13.53 & EUR 14.69 per ounce

31 Aug: USD 17.34, GBP 13.47 & EUR 14.62 per ounce

Recent Market Updates

- ‘Things Have Been Going Up For Too Long’ – Goldman CEO

- Physical Gold In Vault Is “True Hedge of Last Resort” – Goldman Sachs

- Bitcoin Falls 20% as Mobius and Chinese Regulators Warn

- Gold Surges To $1338 as U.S. Warns of ‘Massive’ Military Response

- Precious Metals Outperform Markets In August – Gold +4%, Silver +5%

- 4 Reasons Why “Gold Has Entered A New Bull Market” – Schroders

- Gold Reset To $10,000/oz Coming “By January 1, 2018” – Rickards

- Gold Surges 2.6% After Jackson Hole and N. Korean Missile

- Diversify Into Gold On U.S. “Political Instability” Advise Blackrock

- Trump Presidency Is Over – Bannon Is Right

- The Truth About Bundesbank Repatriation of Gold From U.S.

- Cyberwar Risk – Was U.S. Navy Victim Of Hacking?

- Global Financial Crisis 10 Years On: Gold Rises 100% from $650 to $1,300

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

0 comments:

Post a Comment